Southeast Asia’s smartphone shipments fell 4% in Q3 due to demand headwinds

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 30 November 2022

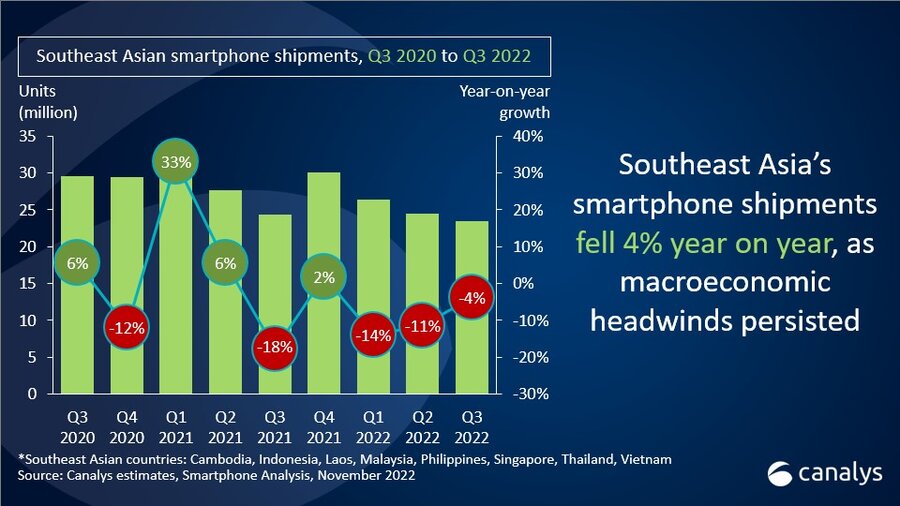

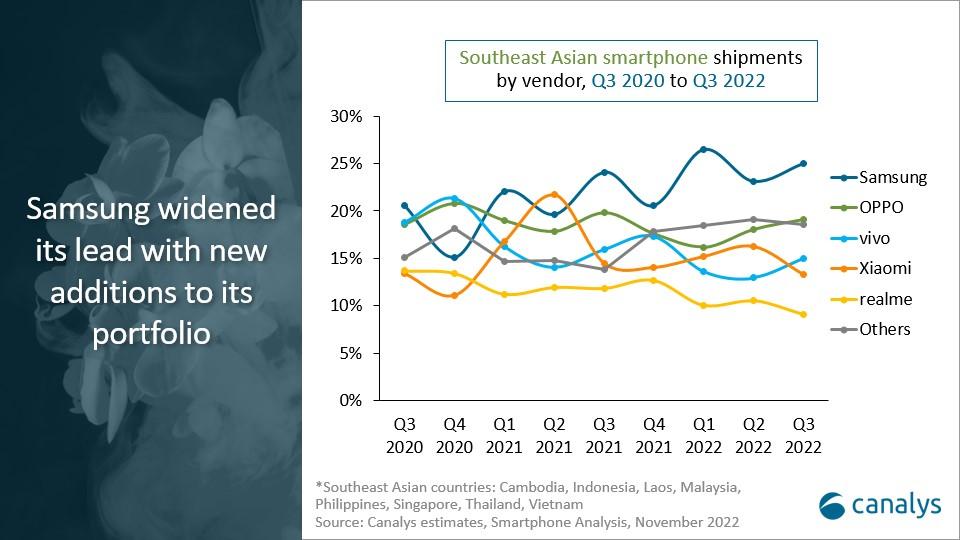

The ongoing deterioration of consumer demand caused smartphone shipments in Southeast Asia to fall 4% year on year in Q3 2022 to 23.5 million units, the lowest level in the region since Q1 2020. Samsung widened its lead, shipping 5.9 million units for a 25% share. OPPO remained second with 4.5 million units, accounting for 19% of the market. vivo came third with 3.5 million shipments. Xiaomi fell to fourth place with 3.1 million units, while realme finished fifth with 2.1 million shipments.

“Post-pandemic inflation is likely to linger for the rest of 2022,” said Canalys Research Analyst Chiew Le Xuan. “Global macroeconomic headwinds pose a significant risk to Southeast Asian countries, negatively affecting consumers’ confidence and smartphone vendors’ operating costs. Furthermore, inventory, inflation and interest rate hikes have led to smartphone spending returning to the ultra-low end.” Smartphone vendors launched various new low-end products in Q3, a defensive strategy to protect their shares as the market suffers from demand headwinds. OPPO has remained consistent in its strategy of moving away from the ultra-low end, focusing its investments on growing channel confidence and upgrading its brand. In the premium sector, Samsung used its extensive resources in above-the-line marketing and bespoke pop-ups to market its new foldable line-up and effectively maneuver as the retail channel returned to pre-pandemic levels. Apple’s iPhone 14 launch in Singapore and Thailand, with solid demand for its Pro series, reiterates that the high-end segment remains unimpeded by inflation.

“Despite short-term macroeconomic headwinds and consumers’ price sensitivity, Southeast Asia remains a bright investment spot and is increasingly strategic to vendors such as Apple and Samsung. In the short term, eyes are on the region’s capability to navigate macroeconomic challenges and maintain the stability of its financial systems and its ability to control political and economic risks. Southeast Asia has remained steadfast and has proven its ability to control currency and inflation risks relative to other developing regions. Market leaders will look to leverage the region’s geopolitical advantage in production and trading while building relationships with local governments and telcos to secure opportunities in digital transformation. As a result, they create a strategic growth path to reach new consumers and build on brand trust. Smartphone vendors will see a return on their investments in the long term, capitalizing on the trend of investors and tech supply chains diversifying out of mainland China.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2022 |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

Samsung |

5.9 |

25% |

5.9 |

24% |

0% |

|

OPPO |

4.5 |

19% |

4.8 |

20% |

-7% |

|

vivo |

3.5 |

15% |

3.9 |

16% |

-9% |

|

Xiaomi |

3.1 |

13% |

3.5 |

14% |

-11% |

|

realme |

2.1 |

9% |

2.9 |

12% |

-27% |

|

Others |

4.4 |

19% |

3.4 |

14% |

29% |

|

Total |

23.5 |

100% |

24.4 |

100% |

-4% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Chiew Le Xuan: lexuan_chiew@canalys.com +65 9655 6264

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.