The smartphone user experience is vital for drivers in the battle for the cockpit

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 19 July 2022

Car makers are implementing digital cockpit strategies with huge investments planned to enhance the in-vehicle user experience (UX) and create software-defined vehicles. Digital cockpits are multi-screen, software-based, voice-enabled, upgradeable, in-vehicle infotainment (IVI) and control systems. But results from a recent Canalys survey of drivers showed that smartphone mirroring (extending app and content use from the smartphone to the vehicle) is a regular occurrence, with 65% of respondents in the US and 58% in Europe relying on the solutions for most of their drives. The aim of both the car makers and technology vendors is to control the UX. Car makers need to differentiate and aim to create new revenue streams; technology vendors want to increase loyalty to their ecosystems.

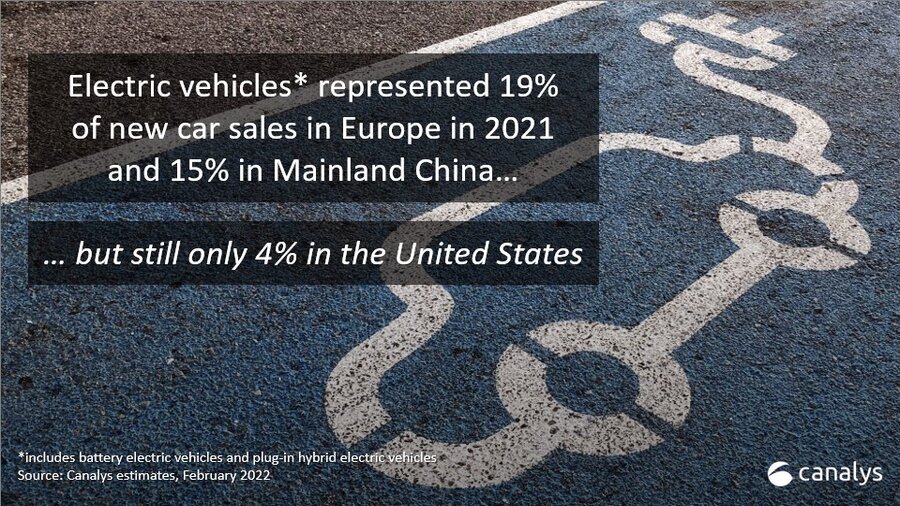

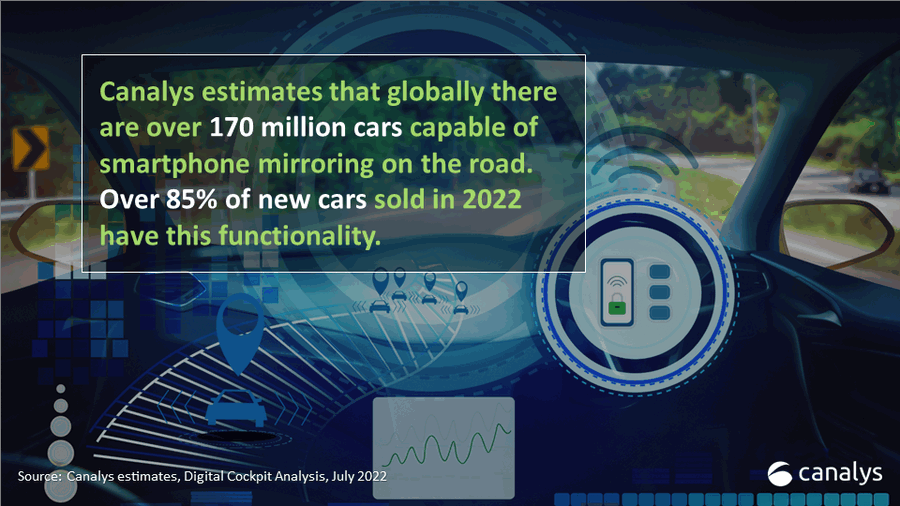

Vendors launched smartphone mirroring solutions in 2015, including Android Auto from Google, Apple CarPlay and CarLife from Baidu in China. Canalys estimates there are now more than 170 million cars capable of smartphone mirroring on the road worldwide, and over 85% of new cars sold in 2022 offer the capability. Canalys also estimates that over 60% of cars on the road with smartphone mirroring capabilities were bought in 2019 or later. This means that, with cars having an average lifespan of 12 years, most cars with smartphone mirroring, assuming they are still supported, will be in use for the next decade. It also means that millions of drivers have used the solutions for more than five years already.

Canalys research of 2,000 people asked drivers in France, Germany, the UK and the US how they connect their smartphones and use apps and voice assistants in their vehicles today. Highlights from the survey results show how important it is for users to be able to connect and access apps and content from their smartphones as they drive.

Vendors have improved smartphone mirroring solutions over the years in the battle to provide better usability, enhance platform loyalty and maintain a hold over the user experience. Google has also embedded Android Automotive OS in several car models, with Google built-in services available, and Apple has recently announced next-generation CarPlay, which is customizable, with deep IVI integration across multiple displays.

The digital cockpit is typically part of a bigger shift to new technology platforms by car makers, and most are planning to launch systems by 2025. Many car makers have set out their own software and OS strategies and partnerships to create software-defined vehicles and digital cockpits and are hiring thousands of software engineers to develop solutions. Long-term investments in software development from the likes of Ford, GM and Stellantis will run into billions of dollars. New potential revenue streams from subscriptions, fleet services, insurance and on-demand features, such as driver assistance, separate from option packs, will be launched. BMW’s ConnectedDrive Store offers digital services and features via subscriptions or microtransactions for items, including heated seats, high beam assistant, driver assistance and CarPlay. Stellantis is targeting revenue of US$20 billion in 2030 from software services.

Automotive OEMs must decide what to do. Those that continue to support smartphone mirroring in future vehicles will provide continuity of service and a familiar UX for existing users who will maintain their emotional connection to the smartphone and ecosystem, but it will be a generic solution and OEMs will miss their chance to differentiate and create new revenue streams. Those that only offer their new digital cockpit solution will aim to differentiate with their own user experience, personality, environment and potentially revenue-generating services, which are unique to their brand, while some will give the driver the choice of their own interface or the mirrored solution. The battle in the coming years is whether drivers stay emotionally connected to their smartphone experience or embrace the digital cockpit car experience.

Canalys’ Digital Cockpit Analysis service provides qualitative and quantitative insights into the digital cockpit and automotive operating systems. The continuous information service includes company profile and strategy reports, market trend reports and consumer surveys. Planned follow-up surveys will uncover:

For more information, please contact:

Jason Low (China): jason_low@canalys.com +86 159 2128 2971

Chris Jones (UK): chris_jones@canalys.com +44 7867 389 727

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.