Apple and Samsung drive record-high ASPs in North American smartphone market amid 11% decline

Monday, 5 June 2023

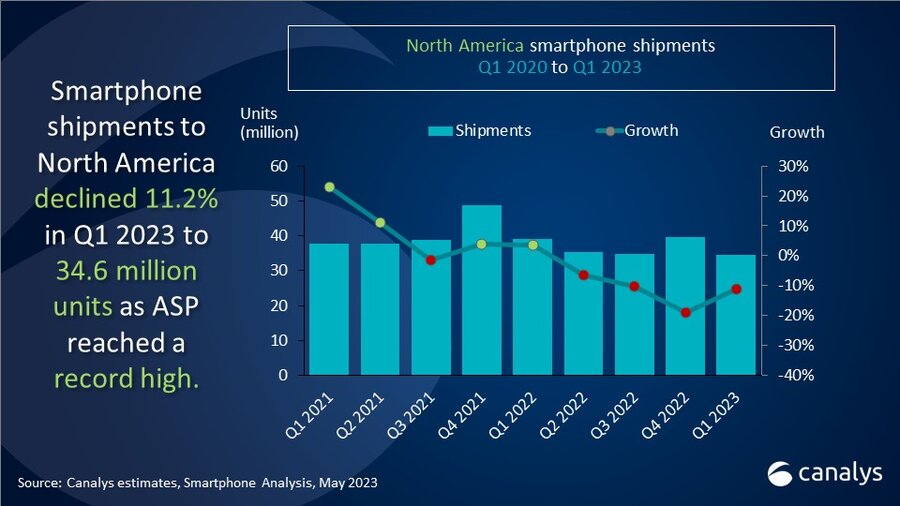

North America's smartphone market experienced its fourth quarter of shipment decline, dropping 11.2% year-on-year to 34.6 million units in Q1 2023. Challenging economic conditions and inflation in the US market drove lower consumer demand, particularly in the low-end mass market (below US$200). Despite robust growth in the premium segment (US$800) failing to save the market from decline, the ASP of the North American smartphone market reached its historic Q1 record high of US$790 this year, up from US$671 in Q1 2022.

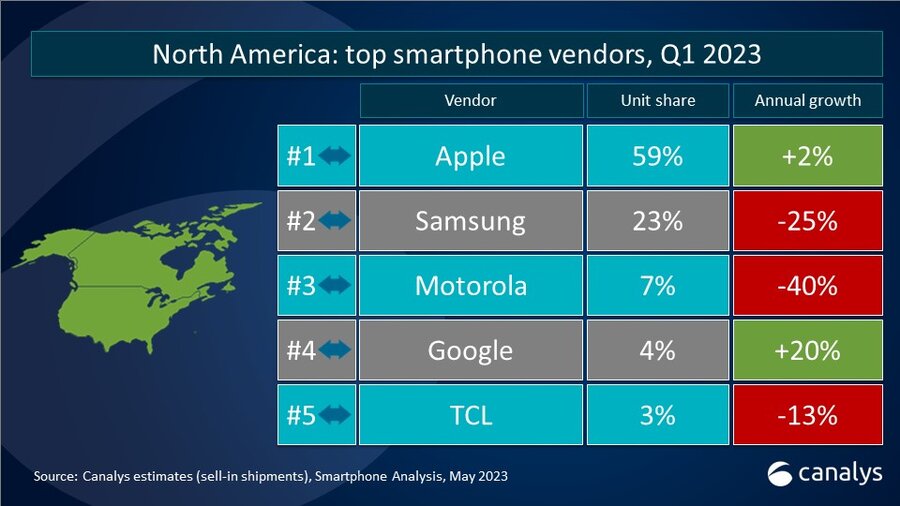

Apple claimed the top spot in North America in Q1 2023 with a 59% market share, its best Q1 record, up 8% from Q1 2022. Samsung, on the other hand, reported the worst Q1 decline in its top market, with its shipments dropping 25% compared to Q1 2022 when the vendor recovered from supply shortage with strong sell-in. Competition is tough behind the top two vendors, with Motorola (7%), Google Pixel (4%) and TCL (3%) having competitive numbers. OnePlus (1%) and Nokia (1%) took the sixth and seventh places respectively in Q1 2023, having ambitious plans to move closer to the top five this year.

“Apple strengthened its position even further with its premium Pro series, thanks to normalized supply and relatively intact high-end spending in the region. Seven iPhone models entered the market's top 10 where the iPhone Pro and Pro Max contributed to 45% of shipments,” said Lindsey Upton, Analyst at Canalys. “Driven by Apple and Samsung, the US$800 and above market segment grew by 32.9% year-on-year, a sharp contrast to the otherwise gloomy market. Despite the duopoly in the premium market, competitors still seek to break into this segment with premium devices, specifically motivated to differentiate through additional characteristics such as ecosystem integration, interconnectivity, brand reliability and improved security. However, success in this segment is contingent upon strong carrier relations while carriers still concentrate on few brands to provide the devices to consumers."

“The competition beyond the top two vendors is a show worth watching as Google Pixel shakes up the scene,” commented Runar Bjørhovde, Analyst at Canalys. "Google has moved close to the top three, following the Pixel 7 series launch. With only three devices in the market, Google has taken a 4% market share with a 20% year-on-year growth, the fastest-growing among the top five vendors. The Pixel portfolio's strong ecosystem message has been well received by the market, together with significantly increased interest for Google following the recent announcements at the Google I/O on Generative AI and hardware. Going forward, the expansion of the Pixel portfolio is critical to maintaining the momentum, especially leveraging its mid-range Pixel 7a. The Pixel Fold launch also affirms Google's premium ambitions, seeking to challenge iOS and its commitment to strengthening Android's capability in different form factors.”

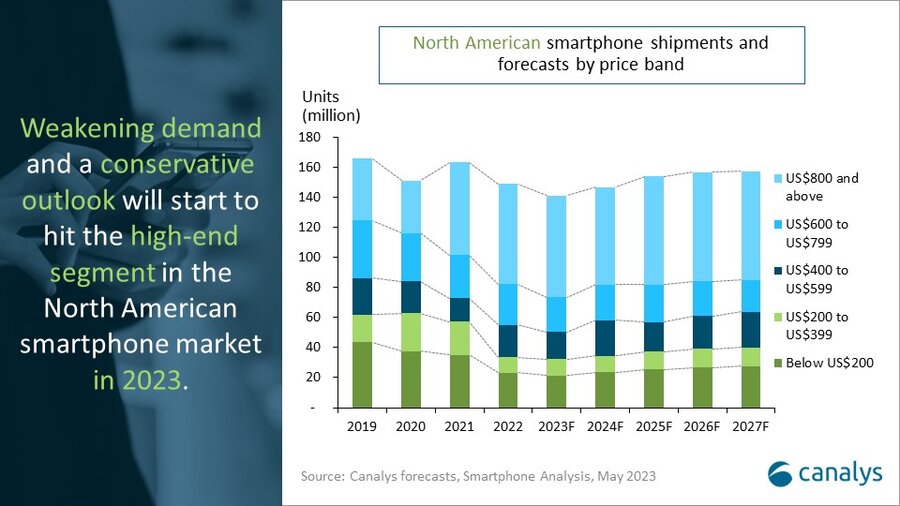

“North America is the most important region for Apple and Samsung in both volume and sales value, but the year ahead will be challenging as even Apple and Samsung cannot be immune from the weakening demand in all segments,” added Upton. According to Canalys' latest forecast published in May 2023, the North American market will decline by 5.4% this year. While the low-end market segment ($200 and below) continues to face pressure given the economic outlook, the high-end segment of US$600+ (including premium brands) is likely to decline for the first time since 2020 at 3.5% year-on-year.

“Carriers remain cautious with their portfolio planning and hardware subsidies, leading to a pessimistic outlook in the smartphone category. Meanwhile, they are counting on more partnerships hitting each segment of the smartphone ecosystem to drive consumer and enterprise strategy. Competitive price points and attractive bundles will continue to be the theme across the carriers and retail channels. For smartphone vendors, the opportunity lies in differentiation in new products and marketing messages, focusing resources on one or two target segments. Meanwhile, vendors should always manage financial risks, especially components and channel inventory for devices built exclusively for the North American markets, to cushion themselves from severe market downside risk,” added Upton.

|

North American smartphone shipments and annual growth

|

|||||

|

Vendor |

Q1 2023 shipments (million) |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Apple |

20.3 |

59% |

19.9 |

51% |

2% |

|

Samsung |

7.9 |

23% |

10.5 |

27% |

-25% |

|

Motorola |

2.4 |

7% |

4.0 |

10% |

-40% |

|

|

1.4 |

4% |

1.2 |

3% |

20% |

|

TCL |

1.2 |

3% |

1.4 |

4% |

-13% |

|

Others |

1.4 |

4% |

2.1 |

5% |

-32% |

|

Total |

34.6 |

100% |

39.1 |

100% |

-11% |

|

|

|

|

|||

|

Note: Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Lindsey Upton: lindsey_upton@canalys.com

Runar Bjørhovde: runar_bjorhovde@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.