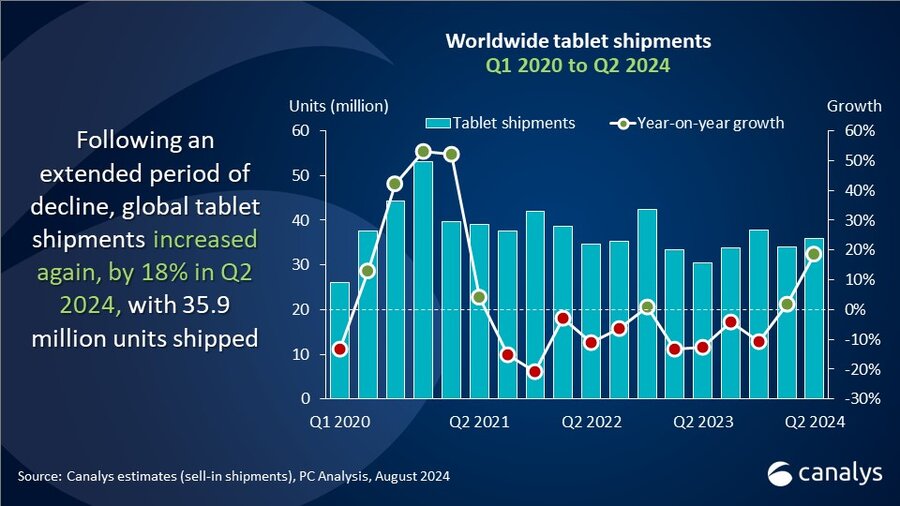

Worldwide tablet shipments up 18% in Q2 2024

Monday, 5 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

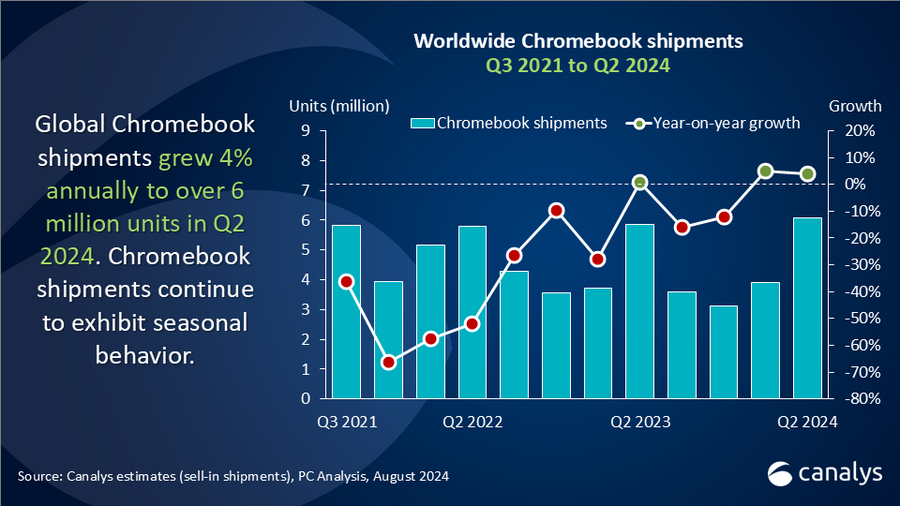

According to the latest Canalys data, worldwide tablet shipments increased by 18% year on year in the second quarter of 2024, reaching 35.9 million units. At the same time, Chromebook shipments grew by 4%, reaching 6.0 million units, as the education market returned to typical seasonal spending patterns.

“The tablet industry has had a positive first half of 2024, and the rest of the year should bring further relief after a difficult 2023,” said Canalys Analyst Kieren Jessop. “New product launches have coincided with an uptick in cyclical refresh demand following the surge in tablet sales that occurred during the pandemic. Additional innovation in areas such as display technology and integrated AI functionality are set to draw further consumer interest, particularly for premium tablets. The Chinese tablet market has shown tremendous growth due to domestic vendors’ aggressive promotional strategies, which has increased tablet penetration in the country. With these vendors targeting international expansion, regions such as the Middle East, and Central and Eastern Europe are also seeing a rise in shipments. In India, government education tenders have boosted demand, with future growth anticipated due to guidelines that favor local device manufacturing.”

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Apple |

13,908 |

38.7% |

11,736 |

38.7% |

18.5% |

|

Samsung |

6,776 |

18.9% |

6,010 |

19.8% |

12.7% |

|

Huawei |

2,501 |

7.0% |

1,658 |

5.5% |

50.8% |

|

Lenovo |

2,485 |

6.9% |

2,136 |

7.0% |

16.3% |

|

Xiaomi |

2,144 |

6.0% |

1,039 |

3.4% |

106.4% |

|

Others |

8,122 |

22.6% |

7,783 |

25.6% |

4.4% |

|

Total |

35,937 |

100.0% |

30,362 |

100.0% |

18.4% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), August 2024 |

|

||||

In Q2 2024, Apple maintained its lead in the global tablet market, shipping 13.9 million iPads and securing a 39% market share. Samsung had a 13% year-on-year increase, shipping 6.8 million units, driven by strong sales of its flagship models and growing demand in emerging markets across the Asia Pacific region. Huawei held onto its third-place position, shipping 2.5 million units and achieving robust 51% annual growth, primarily fueled by demand in China and EMEA. Lenovo came fourth, with 2.5 million units shipped and 16% annual growth, as it strengthened its presence in most global markets. Xiaomi rounded out the top five, surpassing Amazon with significant 106% year-on-year growth and 2.1 million units shipped.

“Chromebook shipments experienced the typical seasonal surge in the second quarter, with 4% growth and just over 6 million devices shipped,” said Canalys Analyst Greg Davis. “Chromebook shipments were bolstered this quarter by regionally specific education funding packages, such as the Emergency Connectivity Fund (ECF) in the United States, which required spending to conclude in Q2 2024. Discounting in the retail channel also helped support consumer demand for Chromebooks, particularly for bring-your-own-device use in education settings. While we anticipate shipment numbers to drop sequentially in Q3, the overall trend for the category remains positive, with its foothold in the education space and the increased integration of on-device AI capabilities into Chromebooks.”

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

HP |

1,673 |

27.6% |

1,567 |

26.8% |

6.7% |

|

Lenovo |

1,455 |

24.0% |

1,340 |

22.9% |

8.5% |

|

Acer |

1,232 |

20.3% |

1,055 |

18.0% |

16.8% |

|

Dell |

1,155 |

19.0% |

1,291 |

22.1% |

-10.5% |

|

Asus |

347 |

5.7% |

372 |

6.4% |

-6.7% |

|

Others |

206 |

3.4% |

223 |

3.8% |

-7.4% |

|

Total |

6,068 |

100.0% |

5,848 |

100.0% |

3.8% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), August 2024 |

|

||||

In the Chromebook market, HP retained first place as it shipped 1.7 million units in Q2 2024 for a 28% market share. With a 9% year-on-year increase, Lenovo came second, shipping 1.5 million Chromebooks worldwide. Acer, which grew the most this quarter, claimed third place with 1.2 million units shipped, bolstered by its success in government tenders across the Asia Pacific region. Dell and Asus ranked fourth and fifth, respectively, both suffering from year-on-year declines in shipments.

For more information, please contact:

Kieren Jessop: kieren_jessop@canalys.com

Greg Davis: greg_davis@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, and additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.