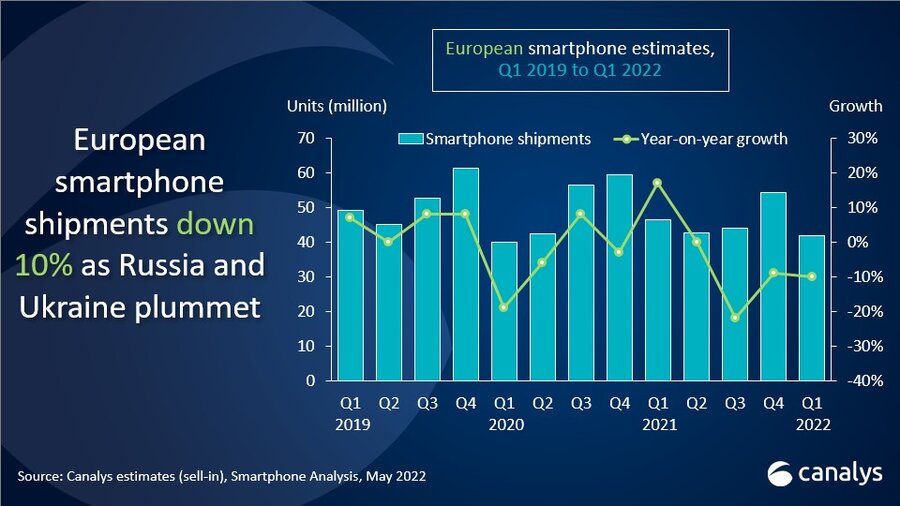

Room for optimism despite 10% fall in European smartphone shipments in Q1 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 24 May 2022

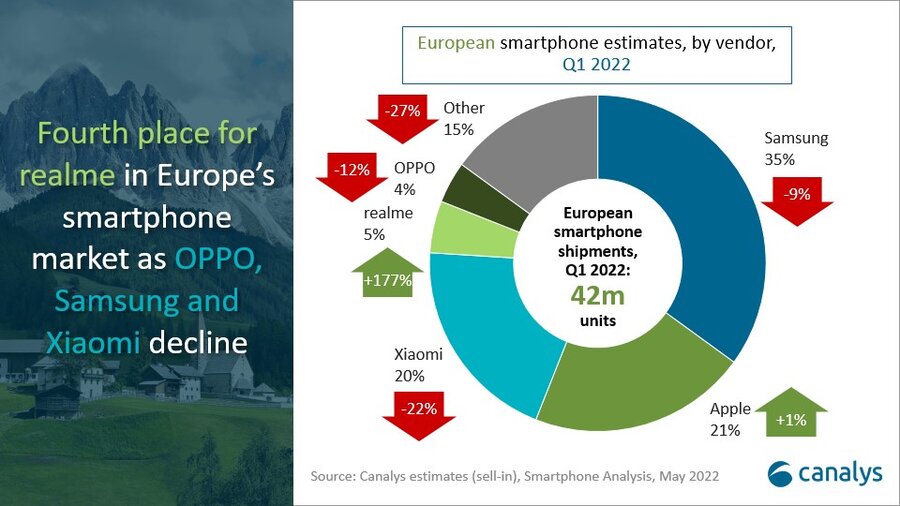

European smartphone shipments fell 10% year on year in Q1 2022, coming in at 41.7 million units. Samsung kicked off 2022 in first place, with a 35% market share as supply started to recover for its low- and mid-range models. Apple came second, driven by strong iPhone 13 demand. Xiaomi took third place, thanks to its new Redmi Note 11 series, while realme and OPPO completed the top five, achieving 5% and 4% market shares.

“Most of the decline in Europe was due to Russia and Ukraine being hit hard. Shipments in the countries fell 31% and 51% respectively compared with Q1 2021,” said Canalys Research Analyst Runar Bjørhovde. “Shipments in the rest of Europe only declined 3.5% year on year, showing that demand remains intact. But the ongoing war has driven inflation to a record level and consumer confidence is falling. The real test for the smartphone market will come in the next two quarters, when the economic impact of the war truly starts to be felt.”

“Emerging vendors are accelerating despite the uncertainty,” said Canalys Research Analyst Ayush Shastry. “Supply limitations and varying demand from market to market have provided opportunities for new names to break in and take share. The focus of realme and vivo on indirect retail and ecommerce channels has borne fruit. As the industry faces many risks, on both the supply and demand sides, improving specific channel partnerships will be key for vendors in the upcoming quarters. Competition within the channel is high, and vendors have a unique opportunity to help differentiate their channel partners’ offerings and build stronger long-term relationships.”

|

European smartphone shipments, market share and annual growth Canalys Smartphone Market Pulse: Q1 2022 |

|||||

|

Vendor |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

Samsung |

14.6 |

35% |

16.1 |

35% |

-9% |

|

Apple |

8.9 |

21% |

8.8 |

19% |

1% |

|

Xiaomi |

8.2 |

20% |

10.5 |

23% |

-22% |

|

realme |

2.1 |

5% |

0.8 |

2% |

177% |

|

OPPO |

1.8 |

4% |

2.0 |

4% |

-12% |

|

Others |

6.1 |

15% |

8.3 |

18% |

-27% |

|

Total |

41.7 |

100% |

46.4 |

100% |

-10% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys Smartphone Analysis (sell-in shipments), May 2022 |

|

||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com +44 7787 290 115

Ayush Shastry: ayush_shastry@canalys.com +44 7979 862 409

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.