vivo retains top spot as Mainland China's smartphone market grows 4% in Q3 2024

Friday, 25 October 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

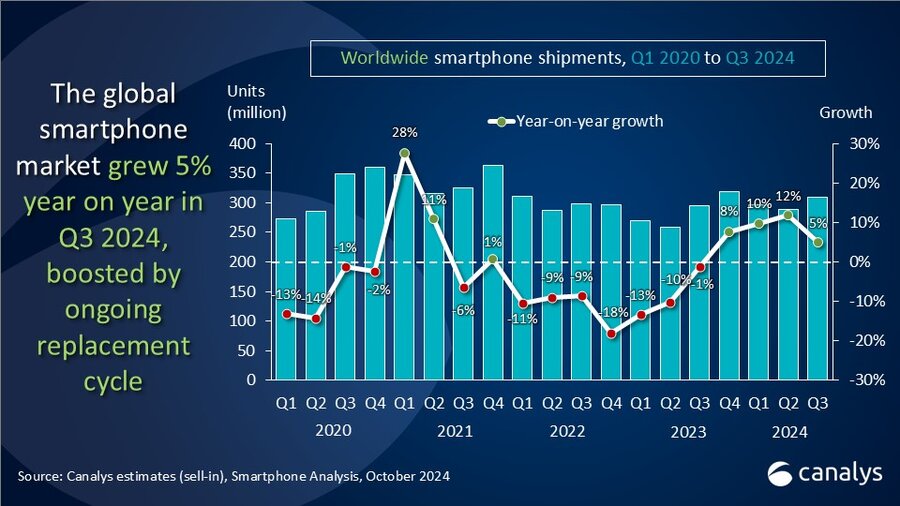

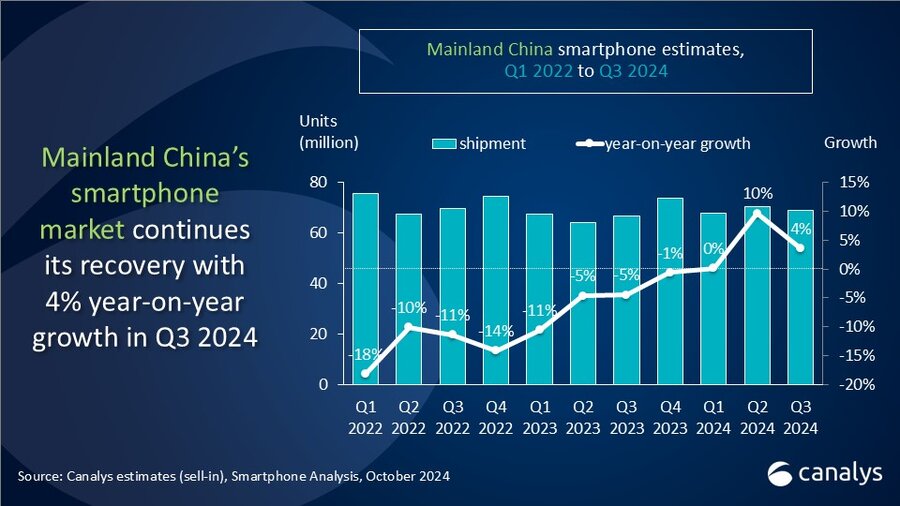

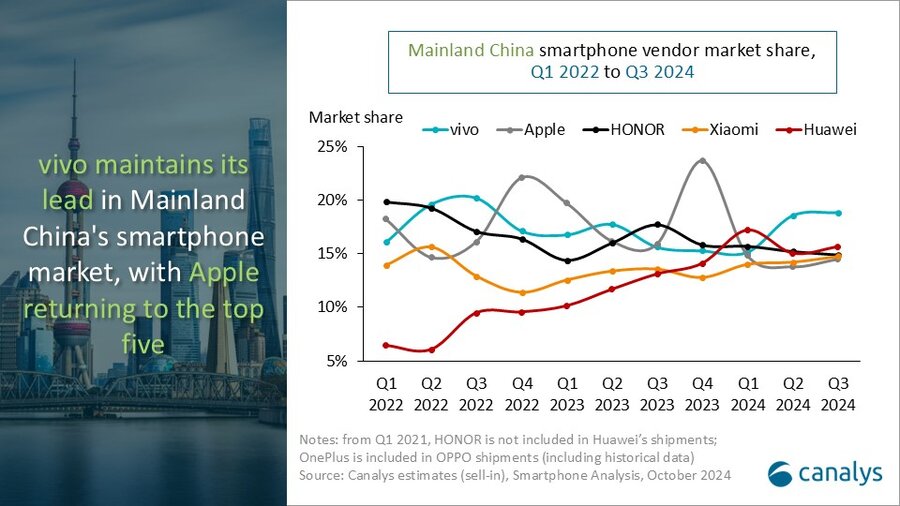

According to Canalys research, Mainland China's smartphone market continued to rebound in Q3 2024, driven by the summer and back-to-school shopping seasons. Q3 shipments rose 4% year on year to 69.1 million units. vivo maintained its lead with a 19% market share, thanks to new mid-range product launches that boosted offline sales and expanded its online presence. Overall, vivo's shipments surged 25% year on year to 13.0 million units. Huawei ranked second with 10.8 million shipped units, capturing a 16% market share and growing 24%, driven by an active channel strategy to support its flagship products. HONOR came in third with 10.3 million units shipped, though its overall shipments fell 13% year on year as it faced challenges despite the popularity of its new foldable phones. Xiaomi advanced to fourth place with a 15% market share, shipping 10.2 million units and growing 13%. Driven by its ecosystem strategy “Human x Car x Home”, Xiaomi has identified a broader and more stable consumer group. Despite a 6% drop in shipments, Apple reclaimed fifth place, with demand for the iPhone 16 series expected to remain resilient, even in the absence of Apple Intelligence services.

“The Mainland China smartphone market has entered its most active period of the year, with consumer demand continuing from last quarter’s e-commerce sales into the summer,” said Canalys Research Manager Amber Liu. “Vendors are optimizing inventories and launching new products in preparation for the upcoming shopping season. In Q3, they are focusing on the mid-range and affordable 5G segments, leveraging features like durability, battery life, and various promotions to stimulate mass-market upgrades. These provide more options for students, the workforce, and average-income consumers. To revive the mass market demand, vendors are not only intensifying their online sales efforts but also increasing cooperation with operators and helping offline partners improve profitability.”

“The flagship segment is also about to peak for the year,” added Canalys Research Analyst Lucas Zhong. “Huawei’s Mate XT Ultimate, released in September, sparked discussions about trifold, driving attention to its coming Mate series. Foldable phones in Mainland China continue to demonstrate a strong pull in pricing and traffic, rapidly becoming a strategic approach for vendors to strengthen their brand's innovative image. Mainland China remains the fastest-growing and largest market for this new form factor. Meanwhile, brands like Huawei, vivo, HONOR and OPPO have entered a new phase of AI integration. AI-powered operating systems and AI assistants are designed to enhance the user experience and drive upgrade demand. A broader AI ecosystem is also taking shape. Before Apple Intelligence enters Mainland China, domestic AI-enabled smartphones are expected to gain momentum, intensifying competition in the flagship segment for the fourth quarter.”

“Canalys expects Mainland China’s smartphone market to see moderate recovery, continuing into next year,” concluded Canalys Senior Analyst Toby Zhu. “The government is implementing accommodative monetary policies and consumer stimulus measures to boost the economy and retail industry. Vendors are innovating aggressively in both mass-market and flagship segments, particularly in software development for operating systems and AI, driving product competitiveness and technological advancements in key components. On the channel side, vendors are exploring new collaboration models with leading operators and e-commerce channels, such as exclusive devices and streaming, to enhance cross-channel and ecosystem competitiveness. However, vendors still face significant challenges, including rising prices caused by components’ costs, rapid changes in retail landscapes and geopolitical impacts on supply chain continuity.”

|

People's Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2024 |

|||||

|

Vendor |

Q3 2024 shipments (million) |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

vivo |

13.0 |

19% |

10.4 |

16% |

25% |

|

Huawei |

10.8 |

16% |

8.7 |

13% |

24% |

|

HONOR |

10.3 |

15% |

11.8 |

18% |

-13% |

|

Xiaomi |

10.2 |

15% |

9.1 |

14% |

13% |

|

Apple |

10.0 |

14% |

10.6 |

16% |

-6% |

|

Others |

14.8 |

21% |

16.0 |

24% |

-8% |

|

Total |

69.1 |

100% |

66.7 |

100% |

4% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei's shipments; OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.