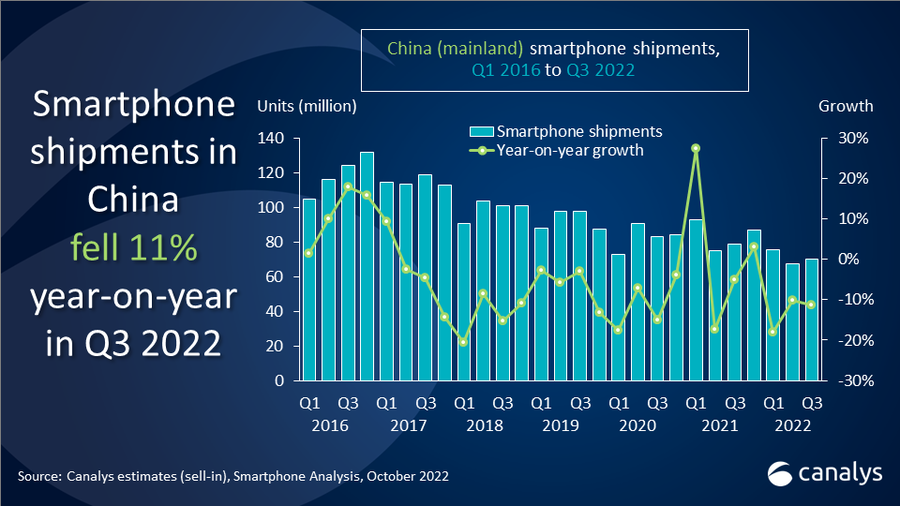

Mainland China’s smartphone market declined 11% in Q3 2022 despite strong iPhone momentum

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 27 October 2022

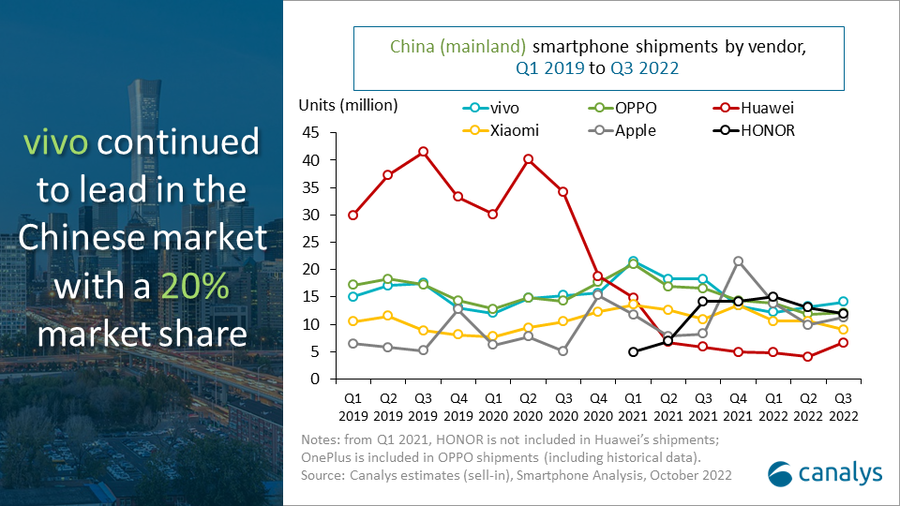

The latest smartphone estimates from Canalys show that Mainland China’s Q3 2022 smartphone market improved marginally over Q2 with 70.0 million units shipped. However, the market is still struggling and declined 11% year-on-year as low shipment levels continued. vivo and OPPO revived sequentially after optimizing inventory levels in H1 2022. vivo maintained its lead in the market with 14.1 million units in Q3 2022; while OPPO (including OnePlus), shipping 12.1 million units, rose to second place. HONOR lost its H1 2022 growth momentum and slipped to third with 12.0 million units due to a lack of new launches. Apple came fourth with 11.3 million units, while Xiaomi completed the top five with 9.0 million units shipped in Q3 2022.

“Apple saw remarkable growth in Mainland China in Q3,” said Canalys Analyst Amber Liu. “Its annual launch is highly anticipated by consumers and channels and strong demand for the iPhone 14 Pro series contributed to Apple’s overall performance. However, lackluster demand of the iPhone 14 series sent a strong signal that even Apple is not completely isolated from weak Mainland China consumer demand. Under an onslaught of Android vendor competition, Apple had to concede to adopt aggressive promotions of its entry-level editions and previous generation devices, especially in the RMB5000-6000 (US$700-800) price band.”

“Amid this overall decline in the market, Chinese vendors want to break through in the high-end segment” commented Canalys Analyst Toby Zhu. “vivo is continuously investing in camera and imaging capabilities for its flagship X series, while OPPO is investing in building its cross-device ecosystem solution. To achieve sustainable growth in the high-end, profitability is the most important metric for both product planning and channel operations for vendors. Moreover, it is critical when planning new products for high-end consumers that leading Chinese players start to shift away from only focusing on specification to a successful product definition. Huawei is still lurking, ready to strike, as the biggest threat to other vendors which hope to break into the high-end. Outside the top five, Huawei grew in the market with the 4G-only Mate series, showcasing considerable legacy demand from consumers and channel partners.”

“The Mainland China market will maintain flat or see a small growth in 2023 which is still a much lower level than 2021 or pre-pandemic as demand is not likely to improve until late next year. The coming Q4 performance will be driven by Apple with bulk shipments of new iPhones and the e-commerce shopping festival,” said Toby Zhu. “Android vendors will push out new launches of high-end devices as well as foldable phones, although production planning should be much more cautious. Vendors have been suffering from rapidly declining demand and high inventory over the past quarters which has severely damaged confidence in the overall supply chain. Vendors must face market reality and put effort into optimizing operations and profitability while building relationships with their existing user base.”

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2022 |

||||||

|

Vendor |

Q3 2022 shipments (million) |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

|

vivo |

14.1 |

20% |

18.3 |

23% |

-23% |

|

|

OPPO |

12.1 |

17% |

16.5 |

21% |

-27% |

|

|

HONOR |

12.0 |

17% |

14.2 |

18% |

-16% |

|

|

Apple |

11.3 |

16% |

8.3 |

11% |

36% |

|

|

Xiaomi |

9.0 |

13% |

10.9 |

14% |

-17% |

|

|

Others |

11.5 |

16% |

10.7 |

14% |

7% |

|

|

Total |

70.0 |

100% |

78.9 |

100% |

-11% |

|

|

|

|

|

||||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments; |

|

|||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com +86 150 2674 3017

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.