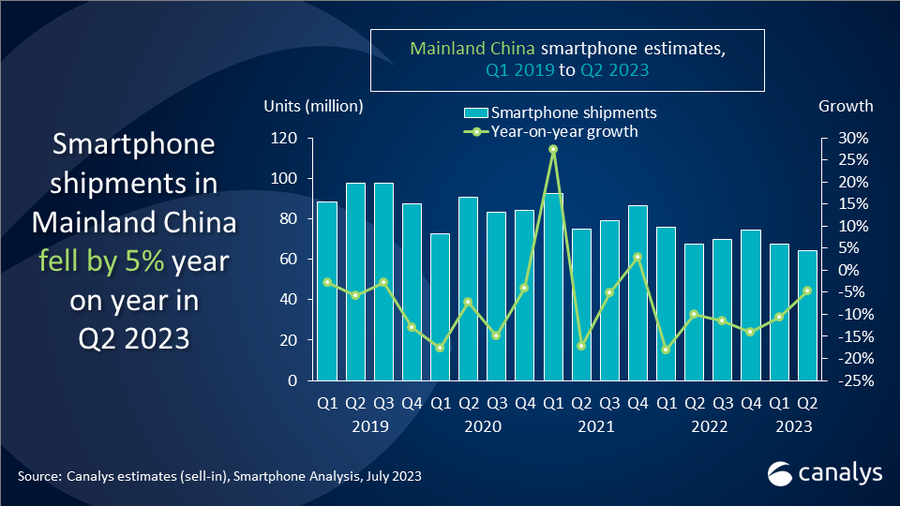

A 5% drop sees Mainland China’s smartphone shipment decline easing in Q2 2023

Friday, 28 July 2023

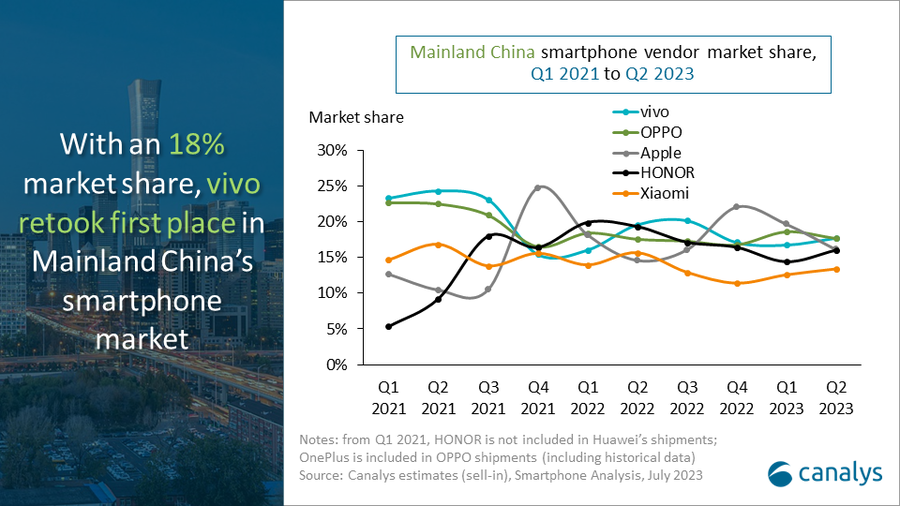

According to Canalys estimates, smartphone shipments in Mainland China fell by 5% year on year to 64.3 million units in Q2 2023. After taking control of inventory levels, vivo retook first place with an 18% market share and 11.4 million shipments, helped by several new launches. OPPO (including OnePlus) followed closely with an 18% market share, driven by solid online performance and improved channel capabilities. Apple took third with 10.4 million iPhones shipped, followed closely by HONOR, with 10.3 million shipments. Xiaomi improved its market share sequentially to 13% and held on to fifth place.

“Chinese consumers are increasingly willing to pay for high-quality products,” said Canalys Analyst Amber Liu. “The average selling price of smartphones exceeded US$450 last year and is expected to keep rising in the coming quarters. Apple and Huawei have achieved impressive year-on-year growth with their flagship devices, indicating solid and sustained high-end demand. Vendors benefiting from consumer product upgrades are motivated to invest in more product innovations to stay ahead of the technology curve. The recently launched foldable phones, such as the HONOR Magic V2, vivo X Fold2 and Huawei Mate X3, have ignited significant interest from channels and consumers around new form factors and use cases.”

“Vendors are looking to improve their channel capabilities and operational efficiencies in a continuously challenging macroeconomic environment,” said Canalys Analyst Toby Zhu. “A few vendors are expanding offline coverage, which will become a key battlefield in the coming quarters. OPPO is upgrading and developing its flagship stores while HONOR is following suit after a major channel shakeup last year. Distribution-led vendors are leveraging fulfillment distribution models to address existing channel issues and avoid inventory build-up and pricing conflicts.”

“The smartphone market in Mainland China is entering a new stage of competition,” said Zhu. “The market will likely recover moderately in the second half of 2023. Government-led incentives should encourage demand for consumer electronics in lower-tier cities while operators increase entry-level smartphone device subsidies, benefiting local brands. As local market sentiments gradually improve, vendors must start mobilizing resources for important product launches in the second half of the year to take advantage of early signs of recovery.”

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual

|

|

vivo |

11.4 |

18% |

13.2 |

20% |

-14% |

|

OPPO |

11.4 |

18% |

11.8 |

18% |

-4% |

|

Apple |

10.4 |

16% |

9.9 |

15% |

5% |

|

HONOR |

10.3 |

16% |

13.0 |

19% |

-21% |

|

Xiaomi |

8.6 |

13% |

10.6 |

16% |

-19% |

|

Others |

12.2 |

19% |

8.9 |

13% |

37% |

|

Total |

64.3 |

100% |

67.4 |

100% |

-5% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; |

|

||||

For more information, please contact:

Lucas Zhong: lucas_zhong@canalys.com

Toby Zhu: toby_zhu@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.