China’s auto export set to exceed 5 million in 2023

Wednesday, 25 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

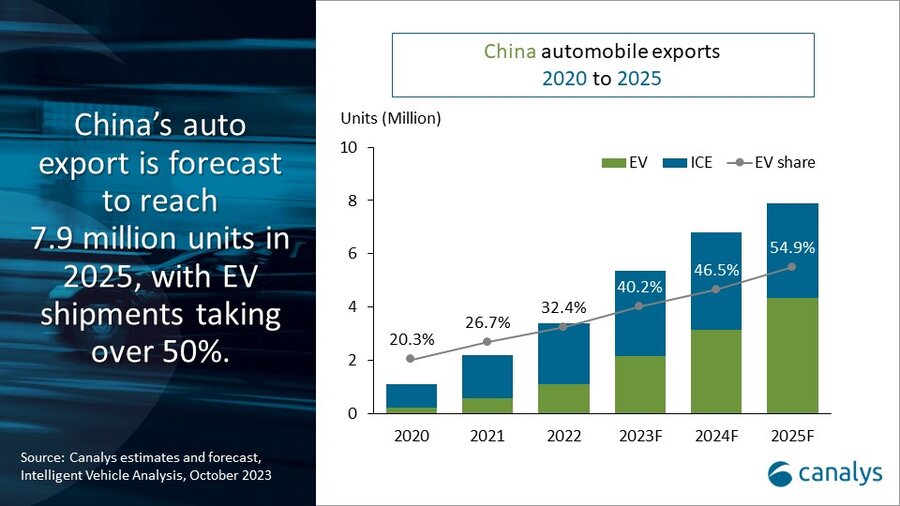

According to Canalys latest estimates, China's automobile export volume reached 2.3 million units in the first half of 2023, extending its first-quarter dominance, and maintaining its position as the world's largest automobile exporting nation. China's automobile exports are expected to sustain growth momentum for the rest of the year, resulting in China becoming the largest automobile exporter globally in 2023. Underpinned by product and technological advantages and driven by increased investments by Chinese carmakers in various aspects such as channels, R&D, and product localization, EVs are expected to continue to be the core driver of China's automobile export growth. Canalys forecasts the export volume of Chinese vehicles to reach 5.4 million units in 2023, with EVs taking up 40% to reach 2.2 million units.

Changes in subsidy rules for imported EVs in some markets may transiently impact the competitive edge of Chinese EVs. “Some European countries use carbon footprint assessments to determine whether EVs qualify for subsidies, which may lead to EVs imported from China not meeting the eligibility criteria, thereby losing part of their price advantages,” noted Canalys Analyst Alvin Liu. “Nonetheless, there is substantial demand for EVs in overseas markets. And while global automotive brands' portfolios are being optimized, a considerable window of opportunity exists for Chinese carmakers to explore overseas markets, but demand for the comprehensive capabilities of China's brands increases,” added Liu. In H1 2023, the sales of EVs in Europe and Southeast Asia, two core regions prioritized by leading EV brands, reached 1.5 million and 75,000 units, respectively, representing year-on-year growth of 38% and 250%.

An increasing number of joint ventures between international automotive makers and Chinese firms are exporting from China and continuously raising export targets. This augments the recognition of China's automobile products and their quality and manufacturing processes in international markets, thereby benefiting the global expansion of Chinese automakers. Canalys predicts the growth trend of China's automobile exports will stay strong in the coming years. The overall automobile export volume in 2025 is expected to reach 7.9 million units, with EVs accounting for over 50%.

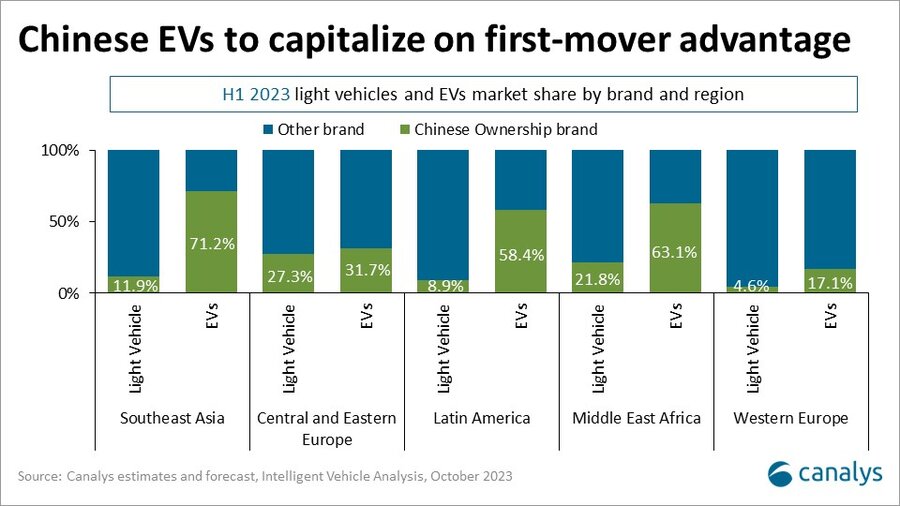

EVs from Chinese brands have performed better compared to ICE (Internal Combustion Engine) vehicles, particularly in Southeast Asia, and the Middle East and Africa markets. Here there is a growing demand for an electric vehicle transformation and market shares of Chinese brands reached 71% and 63%, respectively. BYD is Southeast Asia's best-selling EV brand, holding 39.8% share of the EV market in the region. Notably, BYD is the only brand with a market share exceeding 10% in the EV market.

Although the penetration rate of EVs in Latin America remains relatively low, Chinese brands accumulated channels and brand influence before driving their EV products to achieve 58% of the Latin American EV market.

“Considering the comprehensive aspects of export volume, product portfolio, and competitiveness in some regional EV markets, China's automobile industry is close to completing the first step of its globalization strategy, commonly referred to as "going out”. And is gradually transitioning towards the "going in" phase, a globalization journey involving balancing advanced connectivity technology with local user preferences, enhancing local consumer trust, and shaping brand strength and brand identity, which is critical,” said Liu.

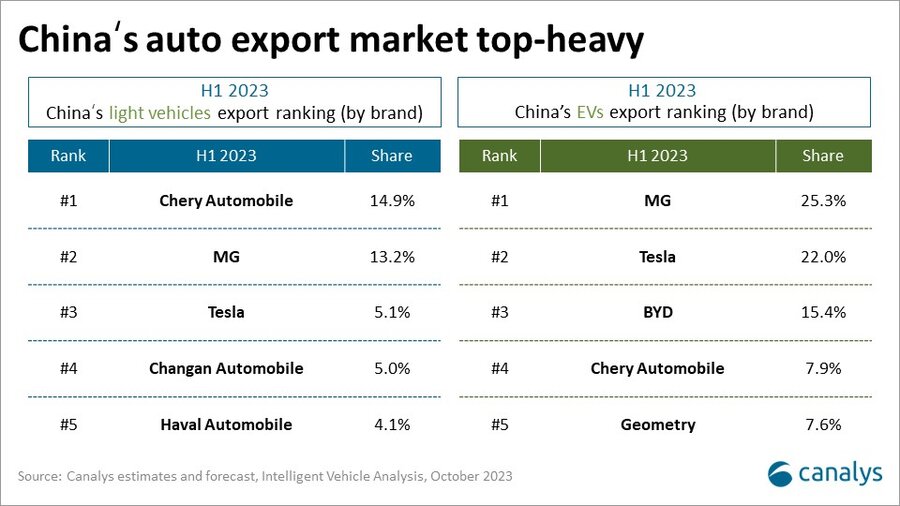

There are around 30 brands exporting EVs from China. However, the market is top-heavy – the top five brands commanded 42.3% market share in H1 2023. Tesla is the only automaker among the top five exporters that is not a Chinese domestic car brand. However, most overseas markets are still in the initial phases of the EV transition, with consumer demand continuously evolving. Therefore, a "strong get stronger" Matthew Effect has not yet materialized.

MG:

With 25.3% share, MG leads in terms of EV exports from China. In H1 2023, MG's overseas sales of light vehicles reached 259,000 units, constituting 76% of its total sales. Among them, sales of ICE vehicles were slightly higher than EVs, accounting for 56% of its overseas sales.

Western Europe stands out as MG's largest EV market. The brand's local recognition in Europe and its product innovation and cost competitiveness originating from the Chinese market have propelled MG to become the fifth-largest EV brand in Western Europe. MG4 (called MG Mulan in China) achieved sales of 32,000 units, slightly below Volkswagen’s ID.3, its core competitor, ranking it the seventh best-selling BEV in Western Europe, and the top-selling model among Chinese products. The upcoming release of the MG4 X Power in H2 2023 is expected to rejuvenate MG's presence in the performance car segment and further enhance MG4's market share in Europe with exceptional value for money.

BYD:

In H1 2023, BYD sold 74,000 EVs in overseas markets, BEV is the primary driver, representing 93% of the total export volume.

Southeast Asia serves as BYD's largest overseas market, accounting for 43% of BYD's overseas sales. As BYD's product lineup continues to improve (BYD’s Dolphin, for example, aligns with the preference for small cars in Southeast Asia), BYD is expected to become a substitute for Japanese small cars with a lower overall cost during the driving process and a much more intelligent cabin experience, expanding BYD's market share in a Southeast Asia.

*EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

For more information, please contact:

Alvin Liu: alvin_liu@canalys.com

Gain detailed insights into the transformation of the global automotive market with Canalys' industry-leading Intelligent Vehicle Analysis service. We focus on critical aspects, from brand analysis to model evaluation. With our specialized research on electric vehicles (EVs), new energy vehicles, and intelligent vehicles, Canalys provides insightful data about car connectivity, convenience, driver assistance, and safety features. The Canalys Intelligent Vehicle Analysis Service goes beyond the typical market research product. It is a tailored solution designed to empower businesses with the tools they need to make informed decisions and stay competitive in the rapidly changing automotive landscape.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.