China’s PC shipments fall 13% in Q3 2022 as commercial demand wanes

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 8 December 2022

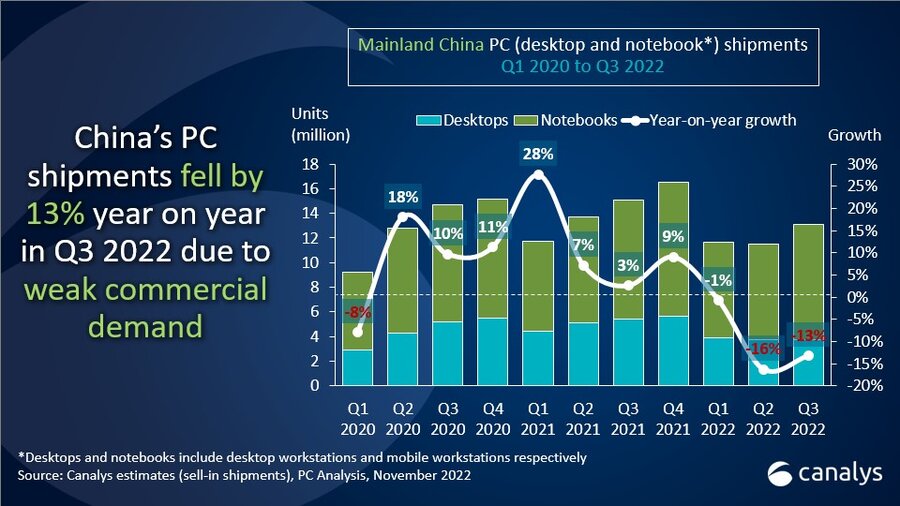

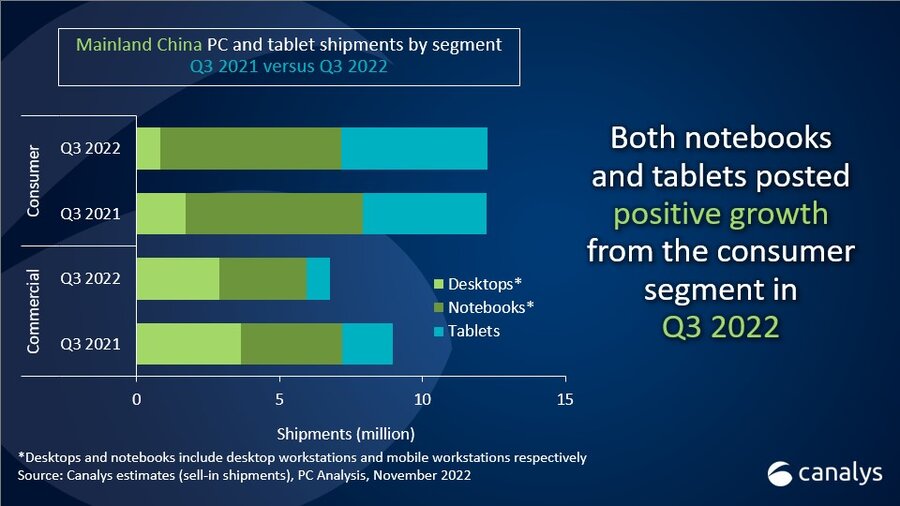

China’s PC (desktop, notebook and workstation) shipments fell 13% in Q3 2022, while tablets were down 3% year on year. Desktop (including desktop workstation) and notebook (including mobile workstation) shipments declined 31% and 3% respectively, as commercial demand was restricted by a slowdown in economic activity and weakened business confidence. The consumer segment was also lackluster ahead of the traditional peak season, and the channel’s outlook for “Double 11” sales in Q4 is pessimistic, with inventory levels elevated.

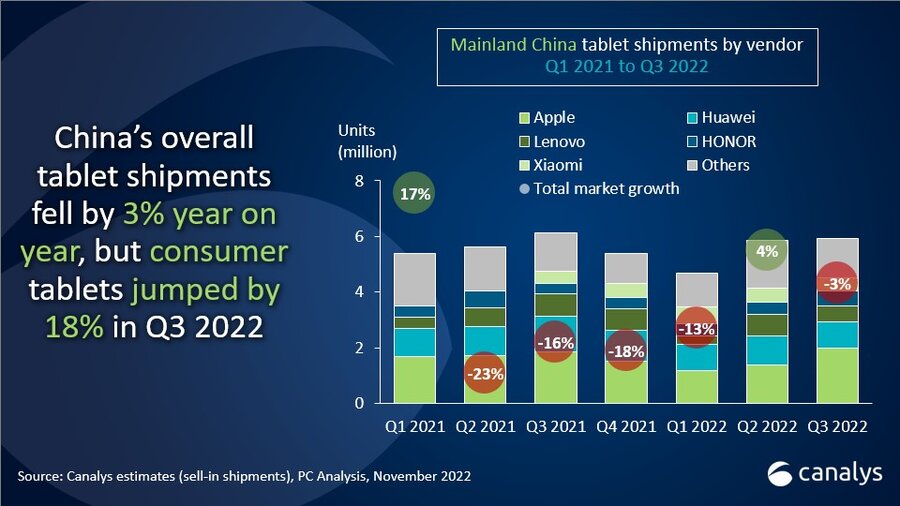

The consumer tablet market was the only bright spot in Q3, with 18% year-on-year growth, saving the overall consumer segment from the massive decline seen in the commercial space. “Smartphone vendors are proceeding full steam ahead as they see the tablet as a key opportunity to satisfy their existing users’ productivity needs,” said Canalys Analyst Emma Xu. “These new entrants bring a wealth of experience in mobile product development to the tablet space. Furthermore, they are investing in enhancing cross-device collaboration functionality and connectivity capabilities to ensure tablets fit in seamlessly with their wider IoT portfolios. Smartphone vendors are becoming serious players in the Chinese tablet market as both their channel strategies and ecosystems are becoming more developed.”

Apple held onto first place in the tablet space but its growth slowed to 7%, even as its iPad supply situation improved compared with Q2. Huawei and Lenovo came second and third, but faced a comparatively difficult quarter, both posting double-digit declines as they were hampered by component constraints and a drop in commercial demand for tablets. Fourth-placed HONOR enjoyed 41% growth in Q3, boosted by its Pad 8 series launch. Xiaomi rounded out the top five tablet vendors, posting 15% growth despite making relatively minor upgrades to its newly announced device.

Meanwhile, PC demand faltered as overall shipments fell 13% year on year, with the commercial segment down 17%. Consumer demand for PCs also remained weak, with shipments falling by 10%. “The PC market is unlikely to see growth in Q4 2022 or early 2023, given China’s current fragile macroeconomic situation,” said Xu. “China’s Purchasing Managers Indices remained low as both domestic and overseas demand tumbled. The good news is that the recovery timeline is becoming clearer as the easing of pandemic controls is starting across major cities in China. This will be a shot in the arm for the commercial sector’s confidence and activity in 2023. Despite the downturn risk coming from the global economic slowdown and geopolitical conflicts, vendors in China should accelerate their ongoing channel restructuring and adjust their marketing strategies to take advantage of rebounding sectors, such as retail, entertainment and tourism.”

Lenovo topped the PC market in China, but its shipments dropped by 17%. Second-placed Dell experienced the worst year-on-year decrease among the top vendors, at 21%, due to its dependence on the commercial segment at a time when local businesses are still restructuring. HP took third place as it followed suit with a 17% decline in shipments. Asus and Huawei came fourth and fifth, growing both annually and sequentially, benefiting from strong promotions and marketing to consumers.

|

People’s Republic of China (mainland) desktop and notebook shipments |

|||||

|

Canalys PC Market Pulse: Q3 2022 |

|||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 market share |

Q3 2021 shipments |

Q3 2021 market share |

Annual |

|

Lenovo |

4,998 |

38.2% |

6,002 |

39.8% |

-16.7% |

|

Dell |

1,531 |

11.7% |

1,948 |

12.9% |

-21.4% |

|

HP |

1,237 |

9.5% |

1,493 |

9.9% |

-17.2% |

|

Asus |

1,199 |

9.2% |

1,072 |

7.1% |

11.9% |

|

Huawei |

1,026 |

7.8% |

489 |

3.2% |

109.9% |

|

Others |

3,100 |

23.7% |

4,086 |

27.1% |

-24.1% |

|

Total |

13,092 |

100.0% |

15,090 |

100.0% |

-13.2% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys PC Analysis (sell-in shipments), November 2022 |

|

||||

|

People’s Republic of China (mainland) tablets shipments and annual growth |

|||||

|

Canalys PC Market Pulse: Q3 2022 |

|||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 market share |

Q3 2021 shipments |

Q3 2021 market share |

Annual |

|

Apple |

1,998 |

33.6% |

1,875 |

30.6% |

6.5% |

|

Huawei |

934 |

15.7% |

1,257 |

20.5% |

-25.7% |

|

Lenovo |

578 |

9.7% |

808 |

13.2% |

-28.5% |

|

HONOR |

552 |

9.3% |

390 |

6.4% |

41.5% |

|

Xiaomi |

471 |

7.9% |

410 |

6.7% |

14.9% |

|

Others |

1,410 |

23.7% |

1,386 |

22.6% |

1.8% |

|

Total |

5,943 |

100.0% |

6,126 |

100.0% |

-3.0% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, November 2022 |

|

||||

For more information, please contact:

Emma Xu : emma_xu@canalys.com +86 158 0075 6471

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.