Huawei: How to secure a foothold in China’s high-end wearables market

31 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

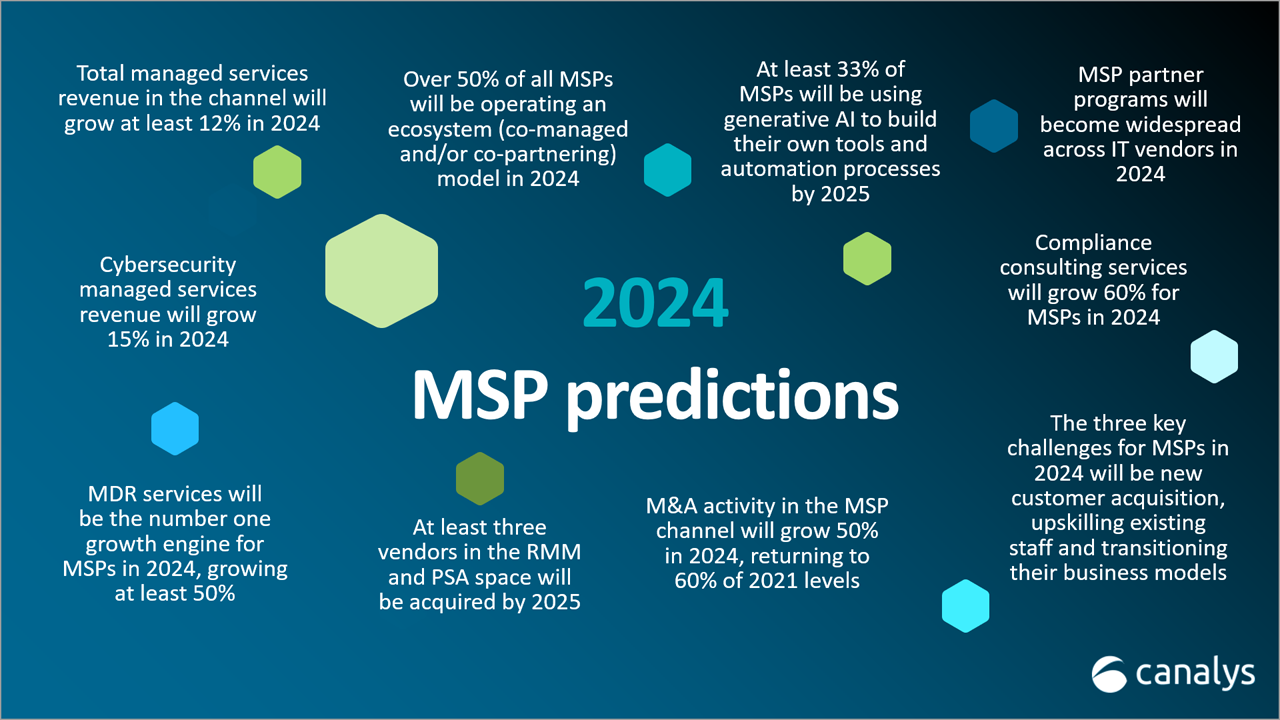

In a recent Canalys poll, 56% of channel partners expected over 10% year-on-year growth in their managed services businesses in 2024. A quarter of all partners in the same poll expected over 20% growth. Though global economic conditions remain uncertain and geopolitics are in turmoil, the reality for many businesses is that they still need channel partners to help manage their IT estates and add value to their investments.

Growth in the MSP space in 2024

Canalys estimates managed services revenue in the channel will grow at least 12% in 2024, driven by customer demand for cybersecurity management, cloud infrastructure, application development, AI solution consulting and compliance requirements (among other things). Managed services are outgrowing many other areas of the channel, and there are more competitors in the space coming from a broader set of partners, all looking to capitalize on customers’ need to find specialists.

The MSP model is evolving, and the ecosystem will bring better customer outcomes

While the term MSP has been around for over a decade, the evolution of the business model has been relatively slow. Today, we are seeing a significant rise in the different types of partners involved in managed services, and even smaller partners can offer managed services to large customers across a broad geographical range.

50% of MSPs report they will be working in a managed services hybrid delivery model in 2024. This means they will be working in an ecosystem of other partners and vendors, as well as with customers’ IT teams, to deliver solutions to those customers.

Cybersecurity managed services will bring more value to partners and customers

34% of partners expect over 20% year-on-year growth in their cybersecurity revenue in 2024, while almost two thirds expect over 10% growth. Cybersecurity has changed everything about the managed services space, from the services partners can offer to the complexity of the solutions delivered to customers. But relatively few partners can deliver full-stack services.

Helped by the rise in co-managed and co-partnering models in 2024, MDR and XDR are two areas where we will see the full value of the channel used to deliver these kinds of solutions as vendors, partners and customers work together to provide all the services and skills required to protect the end customer.

AI generates opportunities for better customer management

One of the most important and immediate opportunities for MSPs in AI is likely to begin with questions around Microsoft Copilot. Customers have seen ChatGPT and the explosion of consumer-available generative AI, but they are still getting to grips with what it really means and how they can use it.

MSPs today are proactively using AI for several tasks, including scripting in RMM, automation in ticketing and billing for PSA, project management, proposal creation, and a few others. But the vast majority of partners will be using AI as a feature of existing and future tools, where it will be working in the background to improve the accuracy of software such as in data centers, IaaS and cybersecurity.

M&A activity in the channel is returning

M&A activity in the channel fell approximately 60% in 2023 from 2022. Interest rate rises and economic uncertainty depressed sales and had an impact on valuations, affecting both the supply and demand side for M&A. Company groups were formed as several MSPs merged to take advantage of their specializations and create economies of scale, looking to move up toward enterprise managed services and bringing valuable specializations within reach of large customers.

2024 is likely to see those levels of M&A return (though not quite to the same heights) as valuations move up and interest rates in some countries drop enough to entice buyers back into the market.

Vendor consolidation in RMM is inevitable

In RMM and PSA, companies such as Addigy, Atera, HaloPSA, NinjaOne and Syncro will be in high demand this year from other vendors and private equity firms.

Among the leading vendors, there will also likely be some movement, given recent trends. ConnectWise has long been up for sale but has been unable to find a buyer at its current price, and with Kaseya’s CEO Fred Voccola’s recent announcement that 2024 would see something significant for the vendor, there is speculation a public offering or acquisition will be forthcoming following its acquisition of Datto in 2022.

MSP partner programs will become more widespread in 2024

A recent Canalys poll showed that 69% of channel partners felt a dedicated MSP program would improve their relationship with a vendor, but the number of vendors that have delivered an MSP program is relatively low. Many have MSP tracks within existing programs or have re-branded their reseller programs as “MSP-focused” but have not delivered truly dedicated go-to-market engagements around managed services.

With the right incentives and support investments, vendors can make themselves much stickier to their partners than reseller programs ever could. By balancing technology, support and integrations, vendors can find a far more compelling offering to partners when they transition to a managed services-focused motion.

Compliance and regulation will drive consulting opportunities

The cyber-insurance industry was worth an estimated US$17 billion in 2023 and is projected to grow by a CAGR of around 26% to 2030. 50% of partners in a recent Canalys survey said they were engaged with cyber-insurance today, while only 38% said all or most of their customers were.

2024 will see 60% growth in compliance consulting revenue for channel partners, and the role of the partner in helping customers select and comply with cyber-insurance will be vital. They are often at the inflection point for customers, and they themselves have had to go through their own (and their customers’) audits. The channel’s wealth of knowledge is an invaluable resource for customers.

Challenges for MSPs will revolve around new customer acquisition, budgets and skills

MSPs will face several challenges this year, the most significant of which are likely to be new customer acquisition, upskilling existing staff and managing customer budgets. For some partners, new customer acquisition will be at the top of this list, and their focus may be on expanding their work with existing clients. Marketing is a closely related challenge, and many MSPs don’t have the budget or size to justify marketing spend, but more partners are reporting they will be recruiting marketing headcount while others are likely to be training existing staff in marketing to boost awareness and raise their brand profile.

For our valued clients, the comprehensive “Canalys outlook: predictions for the MSP landscape in 2024” report is available for a deeper dive into these insights – simply click here to access your copy. If you’re not yet a client but are interested in learning more, we invite you to get in touch with us for detailed information and tailored services that can propel your business forward.