The M3 launch reveals Apple is not playing catch up

3 November 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Google Pixel continues to capture industry attention through its product launches, expanded geographical presence, diversification into new device categories and targeting new end-user segments. However, it prompts an important question: why is Alphabet, Google's parent company, venturing into the device space and why now? Answering this question is vital to making sense of Google Pixel's strategic direction in 2024.

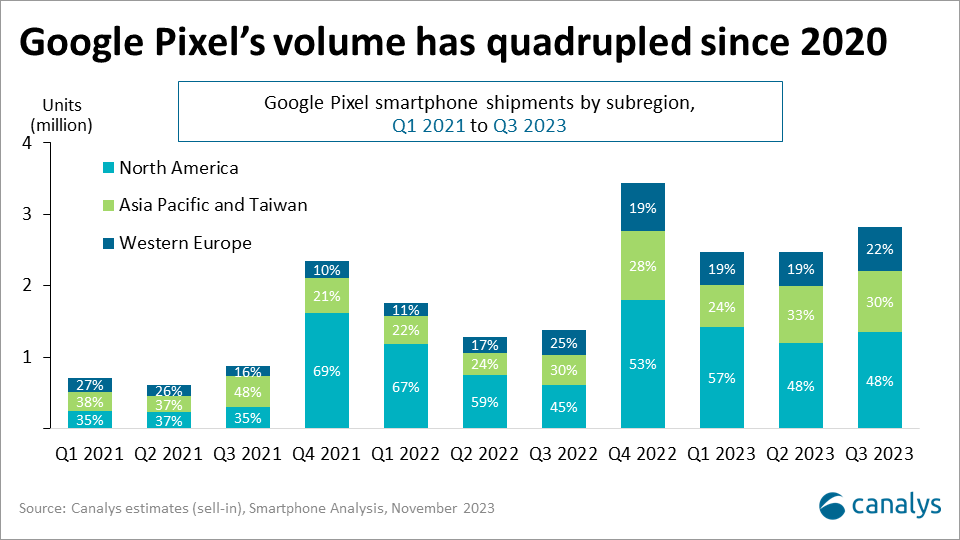

The Pixel 6 launch in 2021 marked a shift in Google Pixel’s strategy. It transitioned from merely showcasing Android’s capabilities to actively competing for market share. Since then, Google has invested substantially in product innovation, marketing and channel MDFs, helping it to become one of the strongest growing vendors. According to Canalys estimates, Google shipped 7.8 million smartphones in Q1 2023 to Q3 2023, a 76% year-on-year increase, sharply contrasting its 2.7 million shipments in 2020. Despite these gains, Google’s market share remains modest, making up 0.94% of global shipments from Q1 to Q3 2023.

Nevertheless, Google Pixel continues to capture industry attention through its product launches, expanded geographical presence, diversification into new device categories and targeting new end-user segments. This underscores Google’s commitment to gain a share in a competitive market. However, it prompts a more important question: why is Alphabet, Google's parent company, venturing into the device space and why now? Answering this question is vital to making sense of Google Pixel's strategic direction in 2024.

Google Pixel is closely intertwined with Alphabet’s long-term ambitions and concerns. Canalys has pinpointed four key drivers that emphasize the role of Pixel:

All these points are long-term in focus, with two specifically targeting the threat posed by Apple. Let us delve deeper into the challenge that Apple poses.

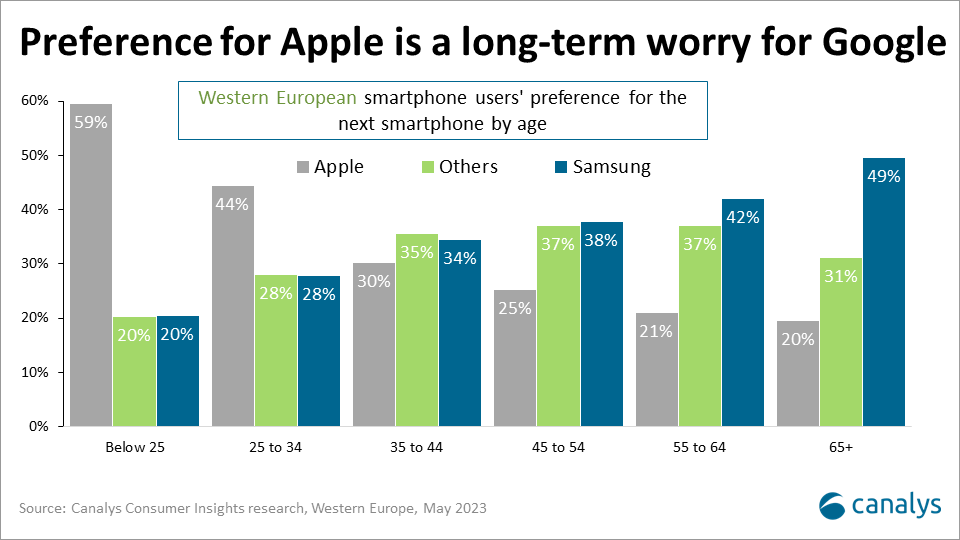

The graph below, from a Canalys Consumer Insights study investigating brand preferences in Western Europe, depicts a clear trend: younger users are significantly skewed toward Apple. While the graph focuses on Western Europe, Canalys’ research reveals an even more extreme rate in North America and extends to other device categories such as wearable bands.

The immediate threat to Android is not that extreme. There is a substantial older user base that prefers Android vendors. However, Alphabet’s concern is that Apple can leverage its financial resilience to play the long game and gradually capture a little more market share every year. What the market will look like in five, ten or fifteen years, particularly if the next generations are even more skewed toward Apple? This threat is a great concern for Alphabet as it will increase the vulnerability of some of its biggest revenue segments.

Only time will tell if Google’s strategy succeeds, particularly since it is still in its early days for its foray into devices. Google Pixel has moved up the rankings in its core markets and started taking some market share, but the more significant question is whose market share Google is currently capturing.

Switching Apple users is notoriously challenging. Many Android vendors have been trying for over a decade, but no one has been able to consistently capture significant switchers over time. Google Pixel faces a similar challenge. Switching Apple users will likely take considerable time and substantial investments. Most of Google’s current share has come from struggling vendors who have exited markets or been unable to maintain their investments. Furthermore, Google’s short-term attraction will be strongest among current Android users looking to try the ultimate Android experience.

While having its eyes on long-term end-user shares, Google must be careful not to take out other Android vendors. This is already causing apprehension among other Android players, particularly vendors who are dependent upon short-term success to fund long-term investments. Finding a sweet spot between Android and Pixel will be critical for Alphabet to keep its vendor partners committed. Although Pixel is “just another vendor” for Android, Android and Pixel are under the same senior leadership that determines strategic direction and investments. Google must communicate about these challenges, otherwise, Android vendors will start to search for different solutions.

Google Pixel is moving into the holiday shopping season of 2023 and 2024 with strong momentum. Canalys clients can access an in-depth report discussing Google Pixel’s strategic outlook in 2024, seeking answer to: