Have the industry’s channel chiefs really moved to an ecosystem model?

22 February 2023

Canalys outlines the key market trends driving the global EV market in 2023.

Canalys automotive sector analysts' recent webinar took a close look at the outlook for the global electric vehicle (EV) market in 2023. Here are the important trends affecting conditions for the year ahead:

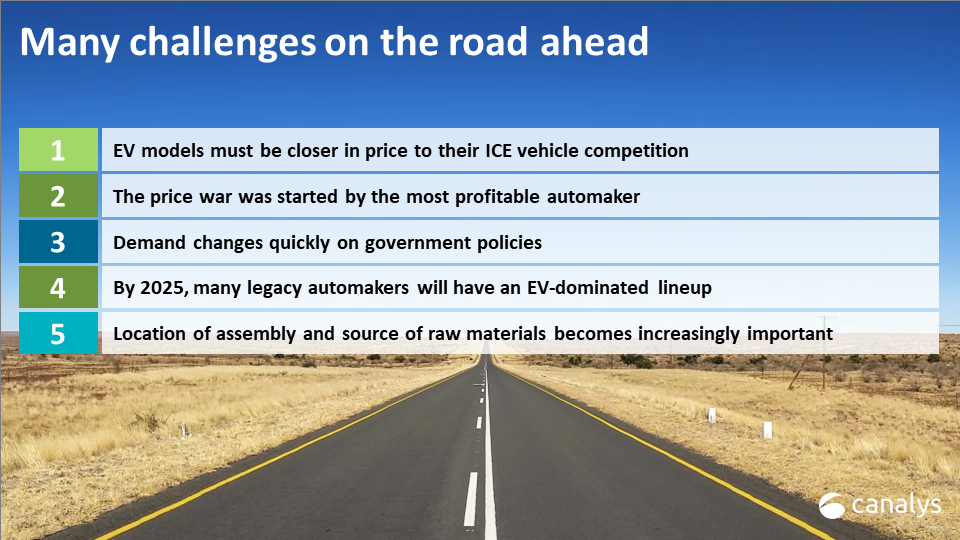

There were many changes to government subsidies for EVs around the world, simultaneously, in January 2023. This caused huge disruption to EV sales in 2022 as buyers brought forward purchases to take advantage of 2022 subsidies, or delayed purchases to take advantage of 2023 subsidies. The changes have already impacted orders in 2023, mostly negatively, and will continue to do so throughout the year. Some of the changes in major EV markets include: China, Norway, Sweden and the UK removed subsidies completely. France, Germany and The Netherlands continued to reduce subsidies. The US is one of the few markets where consumers will benefit in 2023 depending on the brand of EV they choose. The new scheme gives eligibility to EV models dependent on price, where the vehicle is assembled and the source of minerals and components of the battery. Unfortunately, it could be a case of 'one step forward, two steps back' in the US as the policy results in fewer vehicles qualifying for the federal tax credits in 2023, than in 2022.

Tesla cut prices of its vehicles in January 2023, increasing pressure on its rivals. When the market leader and the most profitable company in a sector drops prices, there will be many losers as a result – especially those emerging auto makers yet to post a profit. Tesla’s price drop of around 20%, depending on the model and the market, increases its total addressable market – helped further as more of its models will qualify for subsidies in 2023 than in 2022, especially in the US. The price cuts also help in markets where subsidies have been removed. Without a dealer network, marketing campaigns or management hierarchy holding it back, Tesla can make quick decisions and adapt to local market conditions. Its increased manufacturing capacity and efficiency gives it economies of scale and the ability to deliver quickly – unlike many competitors. The price cuts will impact its margin and frustrate customers who bought at higher prices, but for Tesla – more cars on the road increases its monetization opportunities in software and services.

Several emerging Chinese EV brands sell their vehicles outside China, keen to exploit opportunities in markets with strong demand and/or poor supply, or limited product choice. Europe has been a key target region. More than a dozen Chinese automakers sold EVs in Europe in 2022. They typically start with a distributor partner, but some have opened a European HQ, service centers and showrooms. However, the automakers must be flexible in 2023 and switch markets if necessary – EV demand is heavily influenced by price and the availability of government incentives. Take the incentives away and flashy showrooms in cities such as Oslo, Norway will quickly lose visitors. Away from Europe, there are good opportunities for the emerging brands in Australia, India, Japan, Latin America and South East Asia in 2023 – many of which lacked EVs from mainstream car brands in 2022.

Amid rising interest rates and inflation and general economic uncertainty, 2023 will be another year of modest growth in low single digits, at best, in the overall light vehicle market. With the bill of materials and cost of manufacturing rising in 2022, so did EV prices. In the US the average EV price in 2022 was approximately US$65,000 (€61,000) – and there is not an exhaustive number of potential customers for a US$65,000 EV. The US customer lacks choice in other vehicle segments. In China auto makers have done well to launch EVs to meet the needs, and importantly, the budgets of all customers. EVs start as low as 33,000 RMB (US$4,800) for the super-successful Wuling Hongguang Mini EV. Wuling has sold an incredible one million units since the vehicle’s launch in mid-2020, and has resulted in many copycat, but less successful, products from rivals. Europeans have plenty of EVs to choose from, including in the popular compact car segment, however they typically pay around a 25% premium for the EV version, including the EV version of Europe’s most popular car, the Peugeot 208.

So while there is not market saturation yet, without EVs in every vehicle segment, without EVs at more comparable prices to their ICE vehicle peers, with weak economies and with the removal of EV subsidies in many markets, and because it is harder to grow year after year at 50%+ rates, EV sales growth will slow in 2023.

Find more information on Canalys automotive research services or contact us directly here. To hear more on this topic, listen to our recent webcast here.