Kaseya acquires Datto in US$6.2bn deal, but MSPs voice concern

MSP specialist vendor Kaseya has made an offer of US$6.2bn to acquire competitor Datto. The move is backed by Kaseya investors and venture capital firms Insight Partners, TPG, Temasek and Sixth Street. The deal is still subject to regulatory approval, but is expected to close in the second half of 2022.

Datto, which is majority owned by VC firm Vista Equity Partners, went public with an IPO in October 2020 at US$27 per share. On the 16 March 2022, it was trading at less than US$24 per share. A few days later it announced it was looking for a sale, though was rumored to have been looking for a buyer for some time. Since the announcement of the acquisition by Kaseya on the 11 April shares have risen to just under US$35 per share. The proposed sale price represents a 52% increase on the unaffected market capitalization figure from mid-March. To put this into context, Insight Partners acquired Veeam, a company twice the size of Datto in revenue terms, for US$5bn in 2020.

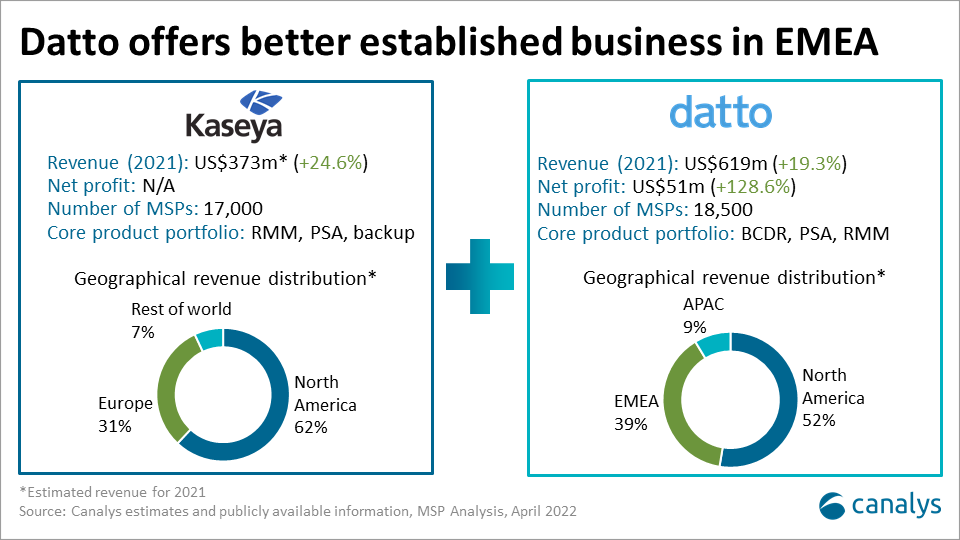

The deal will create a company with combined 2022 revenue of approximately US$1 billion, with over 60% of that coming from Datto. However, there is a lot of cross-over in the two portfolios, as both provide backup, RMM and PSA which make up the vast majority of revenue for both companies. BCDR (business continuity) is over 60% of Datto’s overall business, and also makes up a sizeable minority of Kaseya’s business. The deal could double the number of partners Kaseya has access to, on paper, but there is potentially significant overlap in the MSP customer bases of the two vendors. How the products, cultures and organizations are integrated, and what leadership remains from the two companies to take the organization forward, will be the principal measure of success in the long run.

The biggest impact will be felt by Datto’s 18,500 managed service providers (MSPs) which have been reacting mostly negatively since news of the acquisition broke. The MSP vendor space is in constant upheaval, given the level of M&A activity fueled by private equity funding. This has made the market unpredictable and subject to high levels of risk for MSPs who invest significant amounts of money and time in vendor partnerships, as they base a large part of their value propositions on these products. Consolidation and acquisition are a natural part of business, but if real value is to be found in this deal, Kaseya will need to work carefully to serve not just its financial backers, but also its newly acquired community of MSPs and customers.

Vista Equity Partners acquired Datto for US$1.5 billion in 2017 and merged it with another part of its investment portfolio, professional services automation (PSA) specialist Autotask, which it acquired in 2014 for an undisclosed amount. The combination has been a value driver for MSPs and customers as they saw PSA as a key part of their technology stacks alongside Datto’s core business continuity and disaster recovery (BCDR) tools and its remote monitoring and management (RMM) product.

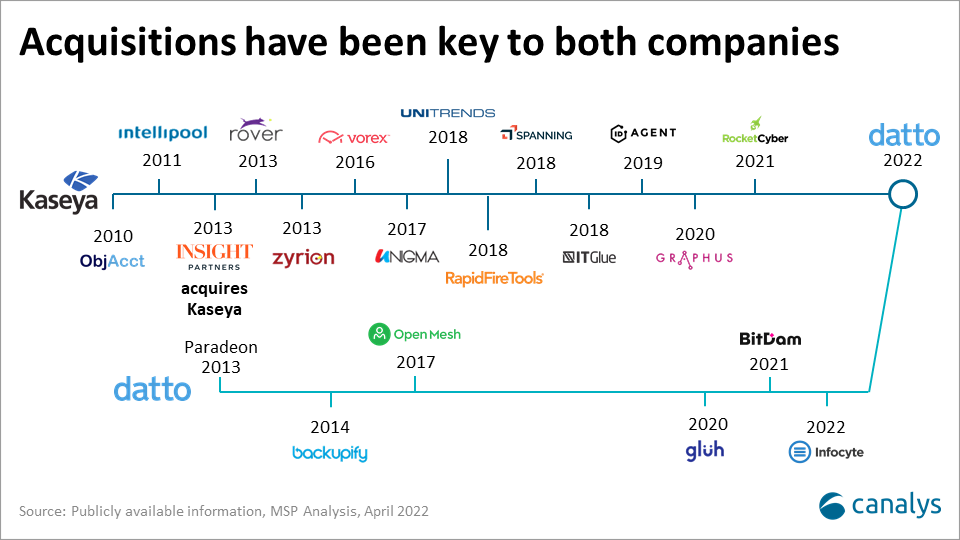

Datto has made six acquisitions of its own over the years in areas such as cloud backup (Backupify, 2014), IT procurement (Gluh, 2020) and, more recently, cybersecurity (BitDam, 2021, Infocyte, 2022). Its strategy has been building towards a complete IT platform for MSPs, as has been the ambition for several of its largest competitors including ConnectWise, N-able, and Kaseya. Datto made US$619m in revenue in 2021, growing 19.3% year-on-year, with net income of US$51 million up 128.6% year-on-year.

Kaseya, which is majority owned by PE firm Insight Partners, is a private company but its estimated revenue in 2021 was over US$370 million. It grew revenue approximately 25% in 2021 and has raised US$545 million in funding since it was founded in 2000. It has been even more acquisitive than Datto over the years, with 14 companies purchased including Unitrends and Spanning Cloud Apps for backup (2018), RapidFire Tools for threat detection (2018), IT Glue for documentation (2018), and RocketCyber for managed security operations center (SOC) services.

Some of these acquisitions have been driven by the private equity investors, which often use their portfolios to bring companies together as Vista did with Datto and Autotask, while Insight has done this with Kaseya, Unitrends and Spanning Cloud Apps. It is interesting to note two of Kaseya’s competitors are also on Insight’s books: Veeam which it acquired in 2020 for US$5bn, and Acronis in which it has a minority stake.

Kaseya had been planning an IPO for some time before news broke in July 2021 that its RMM product, Kaseya VSA, was the subject of a hack by the REvil ransomware group. Around 1,500 customers including MSPs were affected, and it spent a significant amount of time and effort getting out patches and helping companies retrieve data. The full details of the issue and the remediation process have not been disclosed and it is not known if all customers were eventually able to retrieve all their data. External agencies and cybersecurity specialists such as the FBI and Huntress were instrumental in helping manage some of the remediation, getting partners back online, and Kaseya shelved plans for an IPO at that time.

At this level, there is a lot of risk in getting integration wrong. The approximate combined market value of the two companies (based on Kaseya’s latest valuation and the price of this acquisition) will be over US$8 billion, but will this still be true if the product portfolios of the two companies cancel each other out? This is where the deal becomes confusing from an investment standpoint. Buying market share or revenue makes more sense if you retain all of the MSPs currently on the books of the respective companies, and there is clear accretive value, but if you lose many partners in the process and double up on products, how does this translate to market value?

A crucial question will arise about the long-term prospects of Kaseya. Will the plan still be to put forward an IPO (while perhaps still being majority PE-owned as Datto was), will the portfolio be broken up and sold, or will it be bought once again by another company looking for over-sized returns?

On paper, the combination of Datto and Kaseya could bring in over US$1 billion in revenue in 2022, but there are a number of issues which cannot be ignored. The first is the level of negative channel sentiment towards the acquisition from MSPs. Acquisitions always draw mixed views, sometimes good, sometimes bad, but this one has struck a nerve.

Datto is generally well viewed for its products and practices. Kaseya has typically struggled much more in the MSP community to build trust and grassroots support. Kaseya’s business practices, product development and support levels are now under even greater scrutiny. The voices of that community are now being heard loud and clear.

Kaseya has a history of failing to fully leverage previous acquisitions, such as TruMethods, IT Glue and Rapidfire, which will be a concern for Datto MSPs. All vendors should take note here, when building or growing an MSP business trust is everything. MSPs build their businesses on these products, develop their IP on these products, and many of them operate in the SMB sector. The decisions they make about engaging with a PSA or backup vendor are not taken lightly. They look to training, support, strong integrations, APIs, alliances and automation as critical ways to supplement their ultimate goal of providing value to their customers. It is a community which, as much as any other, holds true to the adage that business is about people.

There are many vendors in the MSP technology stack, but in the RMM and PSA spaces there are four key vendors: ConnectWise, Datto, Kaseya and N-able. These are supplemented by smaller specialists who will all be looking to capitalize here, though they do not have the mindshare or brand recognition of the big four. However, due to the product cross-over between Kaseya and Datto in RMM, PSA and backup MSPs are asking inevitable questions about how these will become integrated, replaced or run alongside one another.

Kaseya has typically been more enterprise focused than Datto, selling more of its products direct to end-users. Datto meanwhile does almost all of its business through the channel. Datto partners will not want to compete with the new organization if Kaseya continues with its direct sales strategy and will look to move some of their portfolios elsewhere. Questions are being asked about some other ways in which the two cultures and organizations will be integrated.

A major issue for partners has been Kaseya’s more recent licensing practices. A lot of complaints from MSPs have arisen because partners signed up to a Kaseya product for an annual license and found their renewals shifted them to a three-year deal. It is the kind of thing which loses trust and spreads like wildfire through the MSP community. Problems like this show Kaseya is not a partner-led organization, and it will need to rectify this if Kaseya is to get partners back on board.

Rivals such as ConnectWise (owned by Thoma Bravo), N-able (publicly traded but majority owned by Thoma Bravo and Silver Lake Management), and NinjaOne (independent but Summit Partners holds a minority stake) will see an opportunity to accelerate their MSP marketing and recruitment strategies as Kaseya focuses internally on integrating Datto. Initially, expect lot of communication from sales teams looking to capitalize on doubt in Datto’s channel. The breadth of the two portfolios means there are a number of competitors in different spaces. Acronis will no doubt be keen to promote its cybersecurity-focused MSP platform approach as a more attractive option for the MSP community, as will others such as Axcient, Commvault, Druva and many others in the backup spaces.

The problem for MSPs is migrating customers from a PSA or backup can be a difficult and disruptive process, particularly if you have a deep involvement with a vendor. While many Datto MSPs are looking at this acquisition with panic, a significant proportion will be locked into annual or multi-year deals and may balk at the idea of having to fully disengage once their renewals come up. There are already indications some of Datto’s competitors are offering to honor the remainder of those deals to incentivize MSPs to move their business over to them. Some may be persuaded to do so, but the anticipation of a mass migration may be premature. Watch this space.

Some providers such as ConnectWise, N-able and Acronis (as well as Kaseya and Datto) have been moving to the single platform model for some time, acquiring or building tools to gain greater wallet share with MSPs. This strategy has been driven in part by the scale of private equity investment, which has fueled much of the recent consolidation in the sector. The risk for MSPs is over-dependence on one platform or vendor. Following Datto’s IPO some MSPs were convinced this provided greater stability, and its portfolio improvements were further indications they felt they could rely on Datto for the long term. The fact Vista Equity Partners was still a majority shareholder should have been an indication they were never really in control.

Many channel partners hear marketing from vendors which pushes this ‘one-stop shop’ mentality but are savvy enough to know the risks and prefer to buy from a broader range of vendors to minimize exposure. It also affords them the ability to pick and choose ‘best of breed’ technologies, particularly given they have choice in many areas of their tech stacks. MSPs will be especially cautious moving forward about which vendors they choose to integrate into their stacks. The appeal of the MSP platform vendor will be less strong now as the idea of being exposed to one vendor for so much of your business makes less sense.

The hope for MSPs will be that Kaseya, and crucially its backers, take this opportunity to improve its leadership, and invest in its product portfolio, support, and integrations. But with the financial motivations and activities of some private equity investors seemingly at odds with the needs of the MSP community those hopes may be forlorn.