Broadcom acquires VMware

27 May 2022

Just six months after VMware completed its spinoff from former parent Dell Technologies, semiconductor vendor Broadcom confirmed plans to acquire all of VMware’s shares for US$61 billion, a premium of around 49% on VMware’s pre-announcement valuation. Broadcom is paying for the acquisition through an equal combination of cash and shares, and will take on US$8 billion of VMware’s debts. Broadcom will hold 88% ownership, with VMware retaining 12%. It expects to close the deal in its fiscal 2023, subject to approvals.

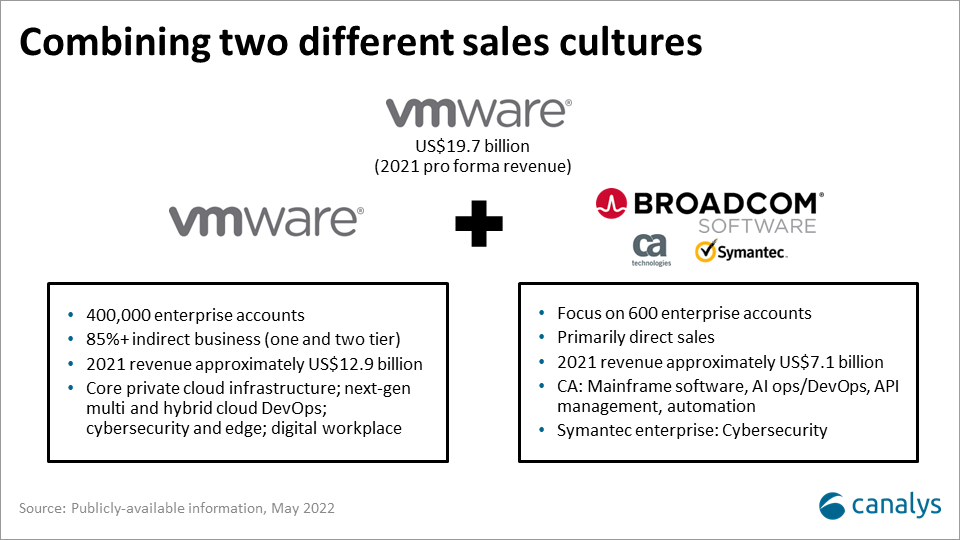

VMware is one of the most prized assets in the IT industry (although share price has dropped by over 40% in the last 12 months) and the US$61 billion price makes this the largest tech acquisition since Dell bought EMC (including VMware) for US$67 billion in 2016. Broadcom is an unexpected purchaser, given its background in semiconductor manufacturing and networking, but the company began its move into enterprise software in 2018 with the purchase of infrastructure software management vendor CA, followed by the enterprise security division of Symantec in 2019 for a combined price of nearly US$30 billion. Broadcom plans to combine VMware with its existing software assets (which currently operate as Broadcom Software Group) and rebrand it under the VMware name, creating a new enterprise software giant with proforma 2021 sales of around US$20 billion. This will represent around half of Broadcom’s combined proforma revenue, with the rest from Broadcom’s core semiconductor business, which includes networking, server, storage and mobile device connectivity. Broadcom will become a tech titan, but a key question is the potential impact of the acquisition on VMware’s indirect channel, which represents over 85% of its revenue, while Broadcom predominantly sells directly at present.

VMware’s acquisition will send ripples throughout the technology industry. It is a pivotal vendor in the enterprise IT landscape, initially as a pioneer of virtualization technology, and today as it pursues a strategy to enable enterprises to build, run and secure applications and workloads across multicloud and edge environments. Its portfolio has expanded substantially over the last ten years, and spans private cloud virtualization, multicloud and hybrid cloud management, application, container and microservices management tools, software-defined networking, hyperconverged infrastructure, cybersecurity and digital workplace. Its vendor-agnostic model is a critical differentiator, allowing it to build deep alliance partnerships with a host of cloud service providers, including AWS, Microsoft, Google and a wide array of hardware vendors such as HPE and Lenovo. The spin-off from Dell has helped to reinforce its vendor-independent strategy, and the acquisition by Broadcom represents an even greater separation from its former parent. Largest shareholder Michael Dell, who owns 40% of VMware, and Silverlake, which holds 10%, have both agreed to the deal. A more level playing field is good news for VMware’s other major hardware partners, particularly Lenovo and HPE. However, despite this, VMware is still closely tied to, and dependent on, Dell as a reseller and distributor, and as an OEM customer. Dell is VMware’s largest channel partner, accounting for around 33% of sales in FY 2022, and, including OEM business, it made up 38% of total sales.

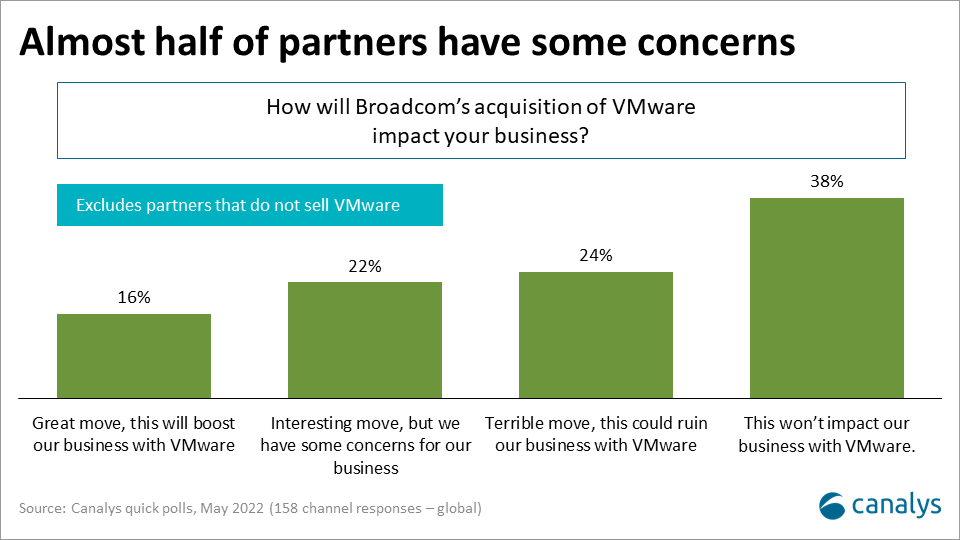

The deal raises inevitable concerns around the future of VMware’s go-to-market and channel model. 46% of VMware partners surveyed globally by Canalys have concerns about the impact of the acquisition. Only 16% see it as a great move. Broadcom’s emphasis is on using the deal to enhance its value and relevance to large enterprise accounts, and expand its reach into VMware’s enterprise customer base. This will be underpinned by an expanded direct sales focus. Since buying CA and Symantec, Broadcom has focused on building direct sales relationships with around 600 large enterprise customers across the globe, with the channel business covering mid-market and SMB largely ignored. Certain product lines were cut with little prior warning to Symantec’s channel and customers, while agreed product roadmaps between Symantec and key accounts were scrapped as part cost cutting measures. With VMware, Broadcom plans to expand its direct sales model into a further 1,500 enterprise accounts, a large proportion of which are currently served by VMware’s largest resellers and GSIs. This will be a source of real worry for many leading VMware partners. It also runs the risk of failure for the acquisition. VMware has built an enterprise channel with the deep levels of technical specialization and consulting skills to position, sell and deliver VMware’s complex technologies. It lacks a direct sales force to do this, which would need to be built. Broadcom lacks the direct capacity to do this today.

At the same time, Broadcom insists it is committed to supporting VMware’s two-tier channel model beyond the 1,500 direct enterprise accounts, but it lacks experience of operating a broad channel business. It will be dependent on maintaining these existing channel skills within VMware. A risk for Broadcom is that VMware channel staff (and other key functions), unhappy with stock options becoming Broadcom stock and a change of culture, start leaving the company. But raising salaries to improve retention would impact the ability to improve costs. Broadcom must prioritize the retention of key VMware leaders, including CEO Raghu Raghuram who took over from Pat Gelsinger last year. Giving Raghuram leadership of the combined VMware business would help ease the transition to new owners.

Dell’s role as VMware’s largest channel partner adds another dimension. Much of the ‘resell’ business that Dell does for VMware currently flows into Dell’s largest accounts. It is unclear whether Broadcom plans to include these customers within its 1,500 target direct enterprise accounts. Broadcom has an opportunity to build a strong enterprise channel proposition by reducing VMware’s channel dependence on Dell over time, and transferring that business to VMware’s other key channel partners. This would require a rethink of its current direct sales strategy however. Withdrawing from Dell’s influence may also be difficult. Dell is clearly keen to maintain its VMware partnership, given the financial and technology benefits that the partnership brings. With the spin-off, Dell negotiated a five year commercial framework agreement with VMware, with a provision to remain in place in the event of VMware being acquired. Another controversial aspect is Dell’s role as a global VMware distributor, which has seen it take share from other VMware distributors Tech Data (TD Synnex), Arrow and Ingram Micro. These distributors could benefit substantially from any moves by Broadcom to reduce VMware’s dependence on Dell.

Another key question is how Broadcom intends to drive its planned leverage from the deal. Broadcom has a goal to almost double VMware’s EBITDA from US$4.7 billion to US$8.5 billion within three years, using a variety of levers including ‘efficiency gains’ in sales and marketing, R&D and overlaps in internal functions. With Symantec and CA, this involved deep staff and operational cost cuts to drive increased efficiencies and profits, while focusing on a core set of customers with a direct sales model. VMware represents a different scale of acquisition to CA and Symantec enterprise security: both of these had significant financial and growth challenges. VMware, in contrast, is financially stronger, growing by 9% in fiscal 2022 to US12.8 billion, and has healthy GAAP operating profits of US$2.4 billion (although flat year-on-year). VMware’s success depends on continuing R&D and investments in technology innovation. The reality is Broadcom would be likely to gain greater efficiency (and reduced cost of sales) by increasing, not decreasing, its investment in VMware’s indirect channels, including distribution. Yet the biggest risk for VMware’s partners is that Broadcom pursues aggressive cuts to partner investments, resources, incentives and support, through a lack of belief in the strategic value of VMware’s channel model. Channel partners will fear any disruption to this, while competitors including Nutanix and Microsoft will seek to capitalize on these concerns.

Another key element of Broadcom’s profitability plan lies in using the growth in VMware’s SaaS and subscription business to accelerate its move to a recurring revenue model. Close to 30% of VMware’s total revenue came from SaaS and subscriptions in its latest quarter. Yet the complexity of VMware’s portfolio means this transition is not a simple process. VMware is currently in the midst of driving an aggressive shift in its go-to-market model, which will see channel incentives moving from license resell to SaaS, subscriptions and managed services, and much greater sales emphasis by partners on ‘use cases’ rather than products, and supporting customer lifecycles. VMware is in the process of building new programs and processes to support this move, as well as expanding its reach into new partner types, including hyperscaler cloud marketplaces, digital integrators and advisors, as well as distributor marketplaces. This is a long-term, expensive and complex shift, which will be challenging for many of VMware’s existing partners, and require expert guidance by VMware’s current channel leadership. Broadcom must be prepared to continue supporting this transition, which will take much heavy lifting and internal process transformation by VMware’s partner organizations. If not, this strategy could be in jeopardy.

Another big question is how Broadcom plans to bring together VMware’s portfolio with that of Symantec and CA? Broadcom envisages this creating an integrated technology portfolio spanning application development, deployment, operation, cybersecurity, ubiquitous access and performance optimization. Yet this is likely to be a complex process, with some significant overlaps and other areas lacking clear synergies. The combined security business of Symantec and Carbon Black leaves it with two endpoint security lines, for example, which will need to be rationalized. This is a highly competitive sector, with any misstep likely to be seized upon by vendors, including CrowdStrike, Microsoft and Trend Micro. The CA assets have a strong focus on mainframes, which is additive to VMware, but there is overlap in areas such as AIOps and DevOps.

The deal is subject to a 40 day ‘go shop’ clause, and VMware will no doubt attract significant attention. In reality however, the number of potential alternative buyers for VMware is small, beyond a handful of very large enterprise brands like IBM, Microsoft, Oracle or Salesforce, or a major hardware vendor like Cisco. The biggest barrier for most potential buyers with the financial strength to counter Broadcom’s bid, especially cloud service providers like AWS and Google Cloud, is the threat to VMware’s neutral multicloud position. On that basis, Broadcom’s offer is likely to be successful. The broader and longer-term impacts of Broadcom’s move are less predictable. One potential outcome could be a resetting of profit expectations in the enterprise software industry, as Broadcom focuses on boosting VMware’s profits. This could trigger a wave of activist investor action to maximize shareholder value by driving aggressive cost cutting, and further industry consolidation.