2025 Channel Partners Expo biggest takeaways: adapt, innovate and reinvent

08 April 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Channel Partners Conference & Expo took place from 24 March to 27 March 2025 in Las Vegas, NV. This year’s show consisted of approximately 150 speakers, 300 sponsors and exhibitors, and 8,000 attendees.

Below are some of the biggest takeaways from the keynotes and sessions attended at the event.

Canalys Chief Analyst Jay McBain shared several insights during his “Hot Data: MSP megatrends - making sense of the US$5.4T IT market” keynote, including four key trends to watch in 2025:

As telcos expand beyond legacy connectivity like DSL and cable modem into techcos by delivering more modern and higher growth connectivity services like fiber and fixed wireless access (FWA), and IT services like cybersecurity, cloud, and AI, their reliance on channel partners (partnerco) to provide customers with comprehensive solutions rises markedly.

The speakers on “Power Panel: the channel connection for telcos” and “Making money on channel activations with the Big 3” panels signaled a noticeable shift from “direct vs. indirect” to “direct and indirect,” resulting in:

In the beginning, TSDs primarily offered telco services but are adapting to their customers’ needs by expanding their suppliers to offer more IT solutions like SaaS, cybersecurity and AI. During the “CEO perspectives: the future of technology services distribution” keynote, panelists admitted the industry is facing challenges proving its value to suppliers and partners, continued price compression from legacy connectivity services and a need to help partners like tech advisors (TAs) expand sales from single product to multi-products for improved customer wallet share.

As the intermediary of intermediaries, TSDs discussed playing a key role in enabling partners to expand the sale of supplier solutions by offering:

M&A and private equity are prevalent in the TSD industry, and there is an expectation that market consolidation will continue and there will be only two to three major players in the future. Also, the entry of private equity is putting more scrutiny on the industry and impacting the way it operates, and causing it to mature faster.

Partners play a pivotal role in telco transformations to techco and the tools they use are just as important. The best PSA tools are those that streamline operations and cut administrative overhead, reduce procurement and billing complexity for both telco and IT services, and meet regulatory compliance standards. HaloPSA and Rev.io’s solutions announcements at the event are designed to enable partners to do just that.

HaloPSA

Rev.io

The cybersecurity market is one of the fastest-growing in the IT industry and cybersecurity services are projected to US$185 billion in total addressable market (TAM) in 2025, over 91% will be sold via partners, and will grow 13% year on year.

During “The SMB cybersecurity gold rush: 4 keys to success and 1 fatal trap” keynote, various topics were discussed which focused on the current SMB cybersecurity environment which is plagued by:

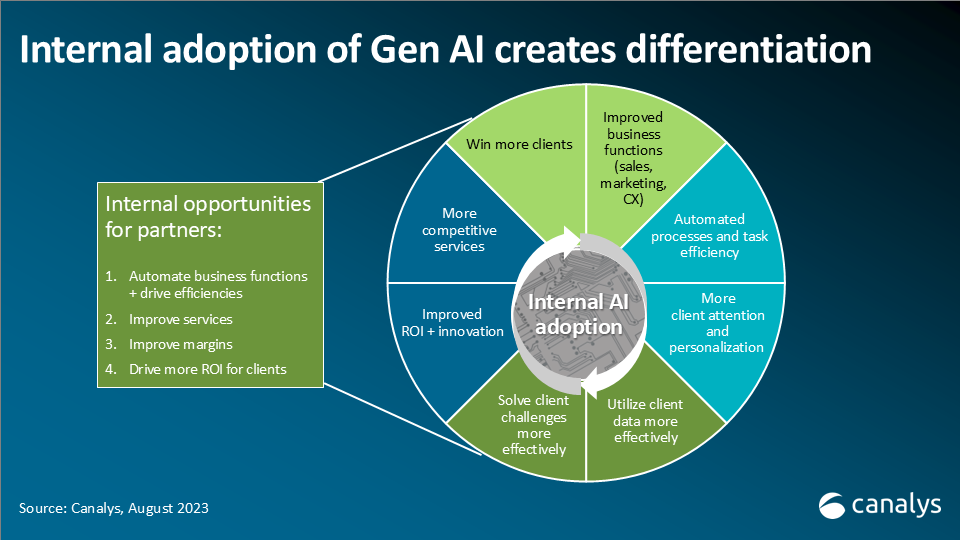

AI was a topic of discussion in many sessions with key points including:

The channel industry stands at the precipice of a revolutionary transformation, driven by the convergence of telco evolution, TSD reinvention, PSA automation, SMB cybersecurity demands and the AI revolution. And those that remain committed to traditional go-to-market models and only make subtle changes will eventually cease to exist.

For telcos, IT vendors, TSDs and channel partners, the message is clear - evolution is not just an option, it is a necessity. The traditional boundaries between telcos, technology providers and channel partners are dissolving, giving rise to a new, hyper-connected, AI-driven, platform-based ecosystem where value creation and reporting are paramount to survival and success.