Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

How are changing market dynamics shaping the future of managed cybersecurity services?

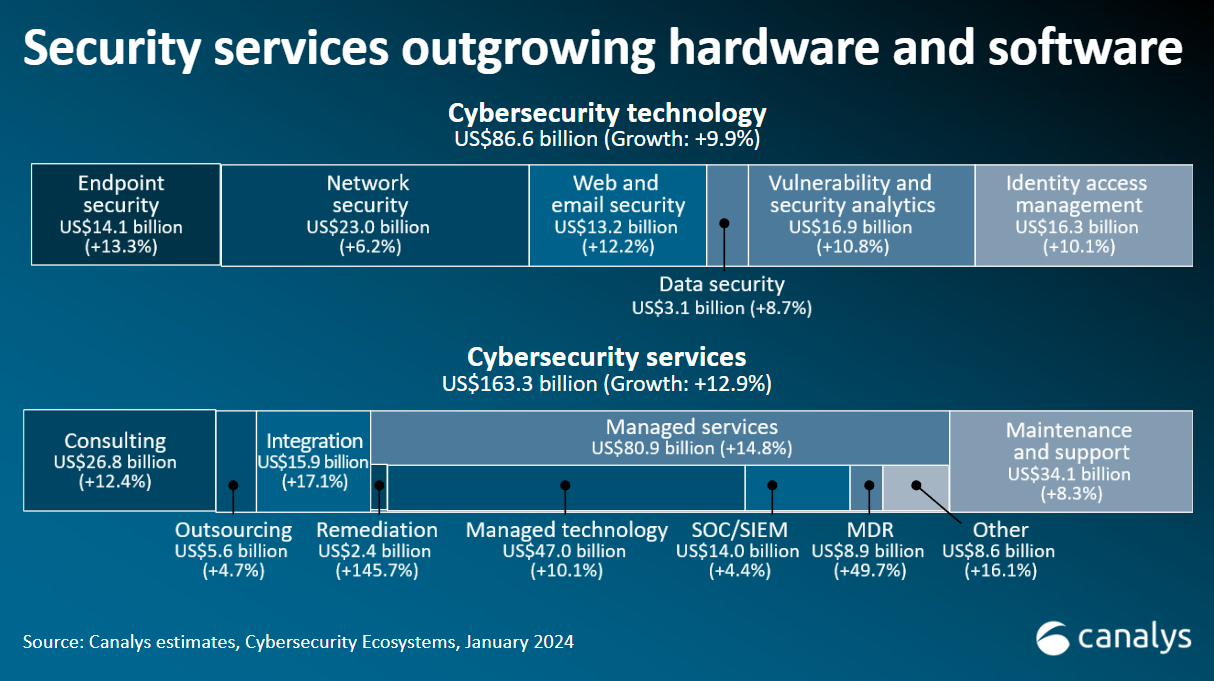

The cybersecurity managed services market is forecast to grow by 15% in 2024, according to the latest Canalys estimates . Our comprehensive report delves into the factors driving this expansion, including increased demand for robust security measures and the evolving Managed Service Provider (MSP) model amid continuous mergers and acquisitions.

Highlighting recent disruptions like the global Microsoft/Crowdstrike outage, our analysis examines the implications for enterprise spending patterns and the broader MSP ecosystem. Understand the ‘platform battles’ in enterprise and SMB sectors, and how major players like Palo Alto Networks, Fortinet, and Google are shaping the market. The report critically assesses the risks of vendor concentration and discusses strategic measures companies are implementing to mitigate these risks, including diversification and enhanced risk management practices.

Examine the transition towards more comprehensive service offerings that extend beyond traditional endpoint management to include consulting and advanced frameworks like Managed Detection and Response (MDR) and Extended Detection and Response (XDR). The report details how new and evolving partnerships are critical to addressing enterprises' complex security needs.

The report addresses the risks associated with vendor concentration and the strategic moves by companies to mitigate these risks through diversified investments and enhanced risk management strategies. Canalys also discusses the responsibilities of vendors and partners in managing breaches and the importance of maintaining stringent service agreements to ensure compliance and accountability.

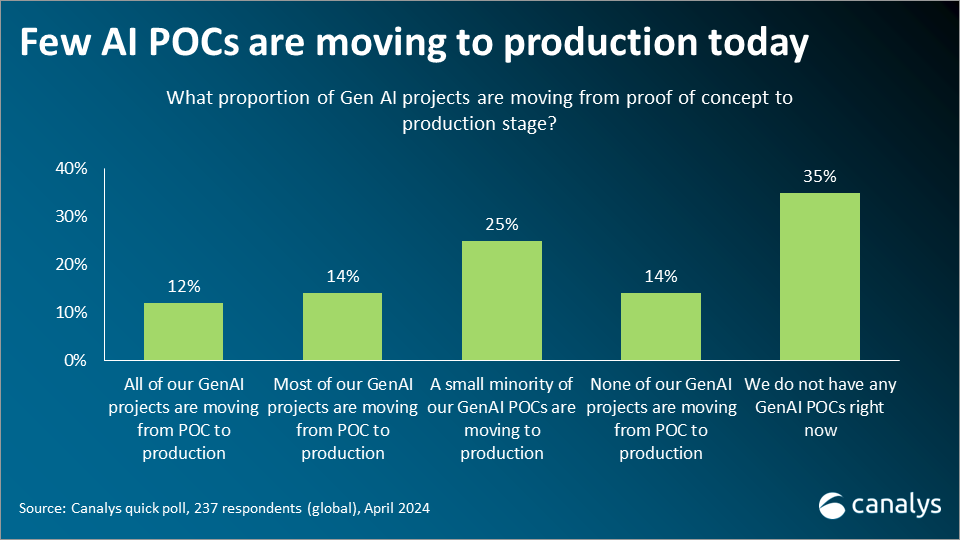

The report also explores how AI is transforming managed services from its hyped beginnings to practical, value-driven applications. Canalys provides insights into AI’s role in automating service delivery and enhancing cybersecurity, along with real-world applications and the future potential for MSPs.

Key topics

- The dominance of cybersecurity managed services in enterprise procurement strategies.

- The critical role of channel partners in sustaining marketplace momentum, expected to handle the majority of transactions by 2025.

- The evolving vendor landscape and the strategic shifts required to maintain competitiveness.

Companies mentioned: Atera, Cisco, ConnectWise, CrowdStrike, Datto, Fortinet, Google, Kaseya, Microsoft, N-able, NinjaOne, Palo Alto Networks, TeamViewer SentinelOne, SonicWall, Syncro, WatchGuard

Aimed at technology vendors, channel partners, enterprise IT decision-makers, and the financial community, this report offers indispensable insights for navigating the complex landscape of cybersecurity managed services, providing strategic recommendations for stakeholders at every level of the cybersecurity ecosystem.

Your next steps

Access the report

Gain comprehensive insights into the future of cybersecurity managed services by accessing the full report. This detailed analysis provides in-depth examinations, market projections, strategic recommendations, and much more.

Connect with Canalys analysts

Reach out for personalized insights and to discuss the implications of the report findings for your business. Our experts are available to provide tailored advice and help you navigate the complexities of the cybersecurity market.

Stay updated

Subscribe to Canalys updates to stay informed about the latest trends and developments across the enterprise channel ecosystem. Receive notifications about new reports, industry insights, and exclusive events directly to your inbox.

By following these steps, you can leverage the insights from the report to make informed decisions, drive innovation, and maintain a competitive edge in the rapidly changing landscape of software distribution.