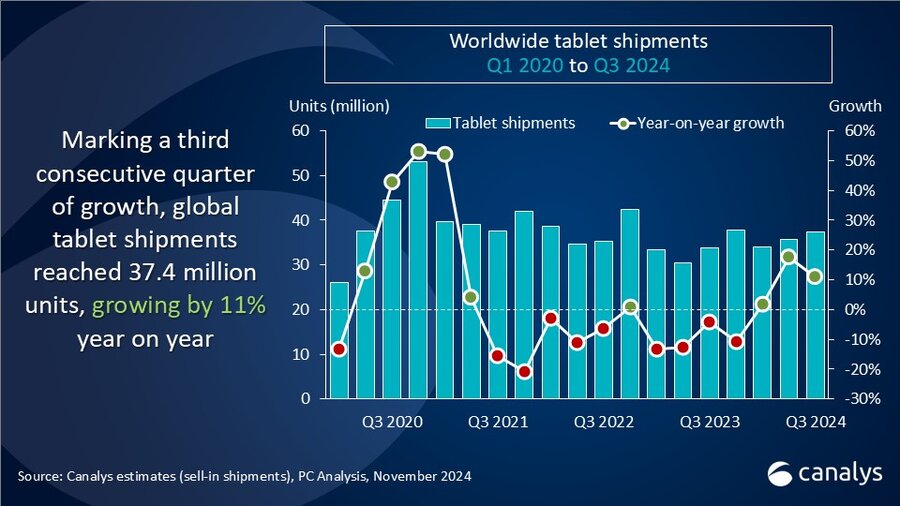

Worldwide tablet shipments grew 11% in Q3 2024 ahead of the holiday season

Tuesday, 5 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

According to the latest Canalys data, worldwide tablet shipments increased by 11% year on year in Q3 2024, reaching 37.4 million units. This marks the third consecutive quarter of growth for the tablet market, driven by a resurgence in demand across both the consumer and commercial sectors. The tail-end of back-to-school seasonal demand, channel inventory buildup ahead of the holidays and an uptick in business IT spending all contributed to healthy performance for the tablet industry.

“Bundling offers and aggressive promotions across various markets have helped drive tablet shipments in a challenging spending environment,” said Canalys Research Manager Himani Mukka. “The third quarter of this year witnessed a buildup of inventory in the retail channel in anticipation of the holiday season, in which discounting began early. Whether for Black Friday or Cyber Monday in Western markets or the Singles’ Day shopping festival in China, vendors have been gearing up for the shopping spree with new product launches aimed at enticing users to upgrade older tablets. Even in markets where factors like inflation have weakened consumer demand, business demand has picked up, leading to device refreshes as well as new deployments of tablets in commercial scenarios. Industry verticals like education, healthcare and retail are notable examples of renewed investments in tablets to drive digital transformation efforts. While the overall market growth has remained modest, recent performance indicates a healthy outlook for the role of tablets across different end-user segments.”

The overall tablet market grew by 11% year on year in Q3 2024, following a significant 18% growth in the previous quarter. In Q3 2024, Apple maintained its leading position in the tablet market with 36% market share and 13.6 million tablets shipped. Apple is enhancing its market competitiveness with the launch of the latest iPad mini, which brings Apple Intelligence features to the full iPad lineup, improving the user experience. Samsung secured the second spot, shipping 6.9 million units and achieving a 12% year-on-year growth. Chinese tech giants Lenovo, Xiaomi and Huawei rounded out the top five. Lenovo experienced 14% growth, while Xiaomi emerged as the fastest-growing vendor with a 58% increase. Huawei shipped 2.9 million units, achieving a 29% growth.

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Apple |

13,591 |

36.3% |

13,547 |

40.1% |

0.3% |

|

Samsung |

6,886 |

18.4% |

6,127 |

18.2% |

12.4% |

|

Lenovo |

2,974 |

7.9% |

2,600 |

7.7% |

14.4% |

|

Huawei |

2,867 |

7.7% |

2,227 |

6.6% |

28.8% |

|

Xiaomi |

2,563 |

6.8% |

1,618 |

4.8% |

58.4% |

|

Others |

8,549 |

22.8% |

7,630 |

22.6% |

12.1% |

|

Total |

37,430 |

100% |

33,749 |

100% |

10.9% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2024 |

|

||||

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, and additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.