PC and tablet market stays strong with 118 million units shipped in Q1 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 4 May 2022

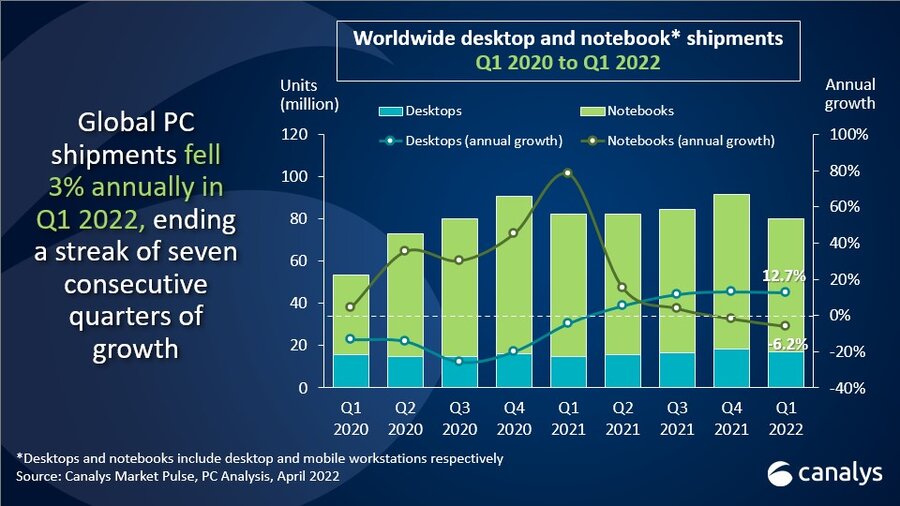

The latest Canalys data shows that worldwide PC (including tablet) shipments fell just 3% annually in Q1 2022, to 118.1 million units. Despite this dip, shipments remain extremely strong compared with before the pandemic, with a three-year CAGR of 12% from Q1 2019. While commercial demand is healthy, the slowdown in consumer and education has taken its toll on Chromebooks and tablets, both of which suffered further shipment declines. Tablet numbers fell 3% year on year to 38.6 million units, while Chromebooks dipped to 4.9 million units, a 60% fall from their record performance in Q1 2021.

Worldwide tablet shipments fell slightly, by 3%, but against what was an exceptionally strong Q1 2021. Apple, in first place, saw a 2% fall in shipments in Q1 as it shipped 14.9 million iPads worldwide. Second-placed Samsung also posted a 2% decline for a total of 7.9 million tablets shipped. For the first time in over a year, Amazon surpassed Lenovo to take third place with a growth of 3% on the back of heavy discounting of its Fire tablets. Lenovo endured the second biggest decline of the top five vendors, with its shipments down 20% year on year to 3 million units. Huawei rounded out the top five, with a 22% decline and 1.7 million tablets shipped globally.

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

Apple |

14,881 |

38.6% |

15,185 |

38.2% |

-2.0% |

|

Samsung |

7,860 |

20.4% |

7,995 |

20.1% |

-1.7% |

|

Amazon |

3,568 |

9.2% |

3,453 |

8.7% |

3.3% |

|

Lenovo |

3,004 |

7.8% |

3,757 |

9.5% |

-20.0% |

|

Huawei |

1,679 |

4.4% |

2,143 |

5.4% |

-21.7% |

|

Others |

7,604 |

19.7% |

7,183 |

18.1% |

5.9% |

|

Total |

38,595 |

100% |

39,716 |

100% |

-2.8% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|

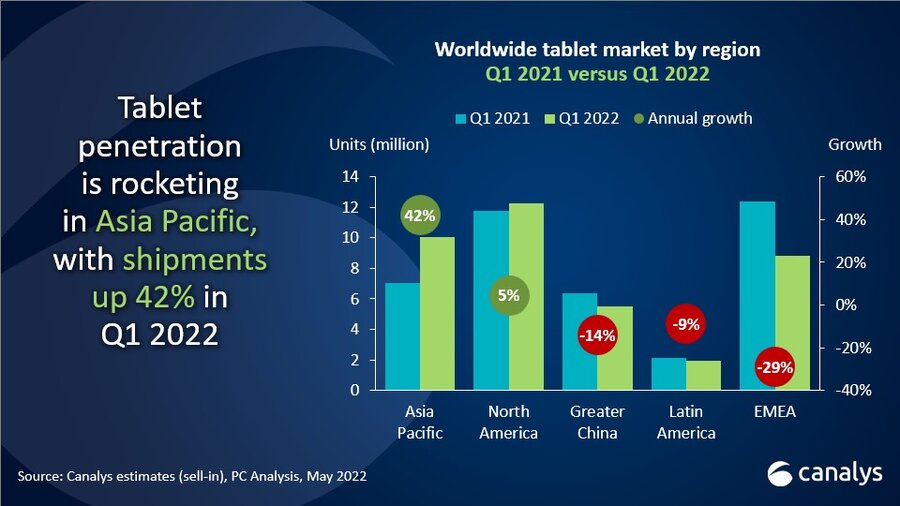

||||

“Despite the shipment decline in Q1, tablets’ resurgence remains strong,” said Canalys Analyst Himani Mukka. “The market has now posted eight consecutive quarters of shipment numbers greater than in Q4 2019, before the pandemic. Increasing commercial deployments are now helping to offset the softening of consumer demand that has followed the large buildup of the tablet installed base over the last two years. Looking ahead, the market will face greater pressure on supply from the Russia-Ukraine conflict and COVID-related lockdowns in China. Lingering tablet demand from Q4 2021 was expected to extend into Q1 2022, but the supply situation is now likely to push backlogs into the second quarter. From a regional perspective, Asia Pacific is set to be the growth engine for tablets as they cater to price-conscious users in markets where broadband connectivity is a luxury. For example, certain education deployments in India are bundling tablets with free cellular data packages to ensure students are equipped to handle new digital learning processes. In such markets, tablets are also able to support basic productivity needs at affordable prices and with better accessibility in the channel.”

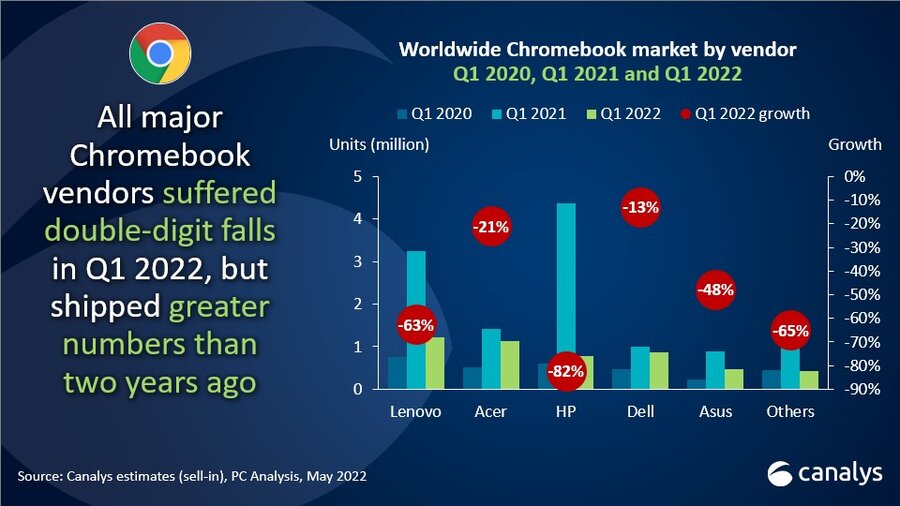

Chromebook shipments fell by 60% year on year in Q1 to 4.9 million units following the category’s massive surge in the first half of 2021 when education bodies in major markets were buying devices in great numbers. The North American market, which makes up 72% of worldwide Chromebook shipments, fell by 64%. Chromebook numbers began to fall in the second half of 2021 after the US and Japan concluded their respective periods of education purchasing. Since then, they have experienced a period of inventory build-up as the channel awaits the next Chromebook refresh cycle.

Lenovo topped the worldwide Chromebook market despite its shipments falling by 63% after the completion of Japan’s GIGA project, which almost exclusively sourced from Lenovo. Acer moved to second place in the worldwide market with 1.1 million units shipped, down by 21%. Dell had the smallest decline of all vendors, partly due to its limited presence in the education segment, which has carried the majority of shipments for other vendors. HP suffered from the steepest drop in shipments at 82%. HP specialized in the US education market for several quarters but has suffered greatly from the market’s saturation. Asus rounded out the top five, with a 48% fall in shipments.

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

Lenovo |

1,221 |

24.9% |

3,235 |

26.6% |

-62.3% |

|

Acer |

1,129 |

23.1% |

1,428 |

11.7% |

-20.9% |

|

Dell |

876 |

17.9% |

1,005 |

8.3% |

-12.8% |

|

HP |

775 |

15.8% |

4,364 |

35.9% |

-82.2% |

|

Asus |

460 |

9.4% |

879 |

7.2% |

-47.7% |

|

Others |

437 |

8.9% |

1,245 |

10.2% |

-64.9% |

|

Total |

4,898 |

100.0% |

12,156 |

100.0% |

-59.7% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|

||||

“The global Chromebook market has undergone an expected slowdown,” said Brian Lynch, Canalys Research Analyst. “The saturation of the Japanese and US education markets and a slowdown in consumer spending following the COVID-19 demand spike have brought inevitable declines in shipments. Nevertheless, Chromebooks still had an impressive Q1 when viewed in the wider context of historical performance, and growth is set to return as developed markets undergo refresh cycles in coming years. Furthermore, developing education markets are starting to solidify their plans around digitalization, which will lend additional momentum to Chromebooks. The Latin American market is set to see a ramping up of Chromebook shipments as local and state governments, especially in Brazil, are quickly adopting the platform for educational purposes. Meanwhile, Indonesia has begun an initiative to start local manufacturing for Chromebooks, aiming to produce large volumes for both domestic education use and export. Chromebooks have faced difficulty in expanding beyond the education segment in a significant way but remain a viable option in enterprise settings as an affordable and easy to manage option. Chrome was among the biggest winners of the pandemic in the entire PC ecosystem, a success that will extend well into the future as its market continues to mature.”

In the total PC market (including desktops, notebooks and tablets), Apple took first place from Lenovo as it shipped 22.3 million units in Q1 2022, up 1% annually. Second-placed Lenovo saw a year-on-year decline of 12%, shipping 21.1 million devices worldwide. HP’s shipment of 15.9 million units placed it third as it also underwent a significant decline of 18%. Both HP and Lenovo faced a difficult comparison from a volume perspective due to their large Chromebook output in Q1 2021. Dell took fourth place and benefited from the commercial demand surge, helping it achieve a healthy 6.1% growth in shipments to 13.8 million devices. Samsung rounded out the top five with 8.8 million units shipped.

|

Worldwide PC (including tablet) shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q1 2022 |

Q1 2022 |

Q1 2021 |

Q1 2021 |

Annual |

|

Apple |

22,303 |

18.8% |

22,058 |

18.1% |

1.1% |

|

Lenovo |

21,088 |

17.8% |

24,020 |

19.7% |

-12.2% |

|

HP |

15,866 |

13.4% |

19,252 |

15.8% |

-17.6% |

|

Dell |

13,808 |

11.7% |

13,012 |

10.7% |

6.1% |

|

Samsung |

8,766 |

7.4% |

9,740 |

8.0% |

-10.0% |

|

Others |

36,738 |

31.0% |

34,020 |

27.9% |

8.0% |

|

Total |

118,571 |

100% |

122,102 |

100% |

-2.9% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2022 |

|

||||

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com +65 8223 4730

Brian Lynch: brian_lynch@canalys.com +1 503 927 5489

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.