The Southeast Asian smartphone market grew 12% in Q1 2024 with healthier inventories

Thursday, 23 May 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

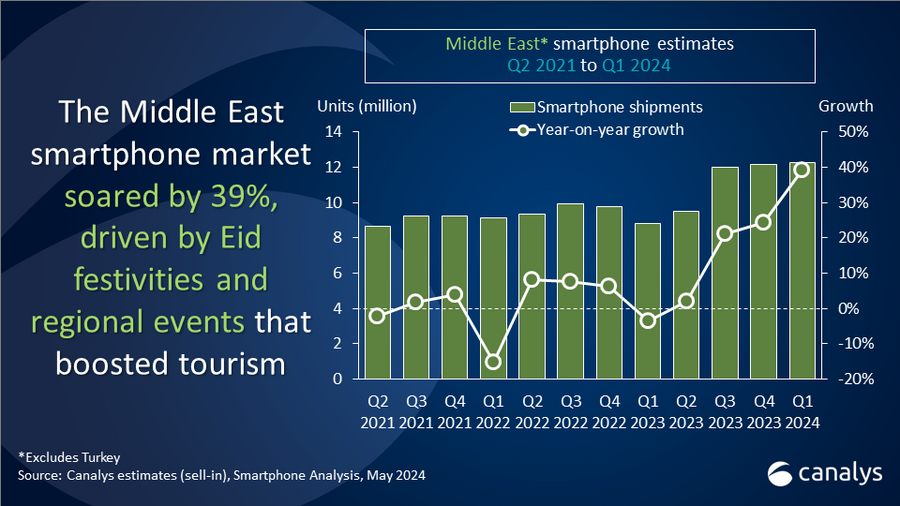

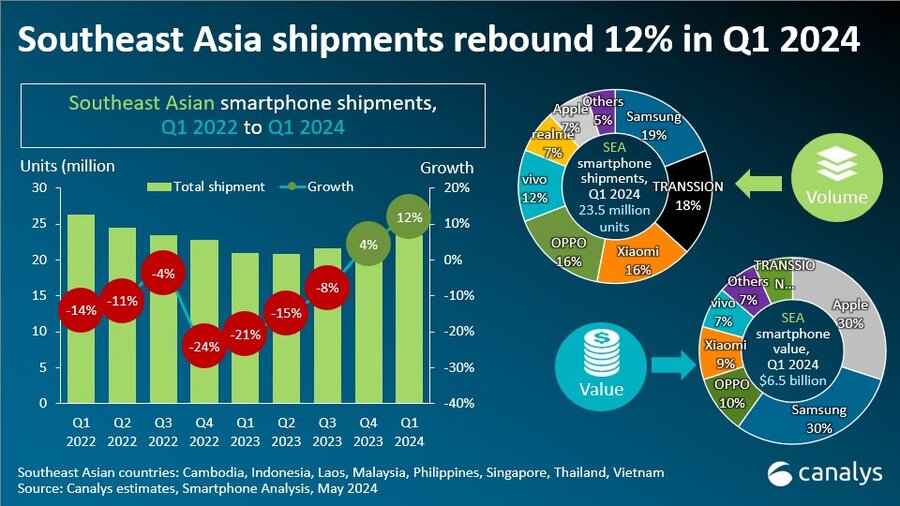

Canalys' latest research reveals that the Southeast Asia smartphone market grew 12% year-on-year in Q1 2024 to 23.5 million units. The growth is a positive sign of recovery from a difficult macroeconomic situation in 2023 but shipments are still well below pre-2023 levels.

“Smartphone manufacturers took advantage of healthier channel inventories and improving consumer sentiment to drive growth in Q1 2024,” commented Sheng Win Chow, Analyst at Canalys. “Efforts from smartphone vendors in late 2023 to normalize channel inventory paid off in Q1 2024 as its sales channels were in a healthier position to take in more sell-in. Ramadan catalyzed shipment growth in markets like Indonesia and Malaysia, with spending surpassing last year's levels due to increased Ramadan bonuses.”

“Samsung maintained its lead in Southeast Asia with a 19% market share but declined 20% year-over-year in volume. The decline in volume is expected, considering Samsung’s product strategy prioritizes expanding its mid-high segments, including the Galaxy S and the A5x and A3x categories. While models like the A1x, A0x and A2x continue to support the brand's presence in the mass market, future growth is anticipated to stem from the premium segment due to this strategic shift.”

“TRANSSION secured second place with an 18% market share and an impressive 197% year-over-year growth,” added Chow. “Its co-branding and partnerships with mobile gaming companies during Ramadan resonated with the region’s young demographics. By offering affordable, high-performance gaming devices, TRANSSION successfully appealed to this market segment. Xiaomi and OPPO each held a 16% market share in the region respectively, but their trajectories diverged. Xiaomi grew by 52% year-over-year, while OPPO declined by 5%. A competitive product mix, including entry-level models like the Redmi Ax and Cx series and strong mid-range options from the Note series, drove Xiaomi's growth. vivo captured a 12% market share, shipping 2.8 million units to grow 12% year-over-year. Having secured its market share from volume drivers like the Y17s, vivo has focused attention on growing its mid-high-end segment through the Y100 and V-series.”

“Price-sensitive markets like Indonesia and the Philippines witnessed a revival in the sub-US$100 price segment,” stated Le Xuan Chiew, Analyst at Canalys. “Increasingly affordable devices with high core specs enable customers to upgrade specs at a lower price. TRANSSION’s success in the Philippines is largely attributed to being able to differentiate similarly priced devices across its three sub-brands Infinix, Tecno and iTel. Infinix’s expansion is mainly through direct brand store partnerships with dealers, Tecno focuses on multi-brand stores and wholesalers, and iTel is fully online, offering directly to consumers. Samsung topped Thailand, Malaysia and Vietnam in Q1 2024 aided by the launch of the Galaxy S24. Samsung outperforms in these markets as they are better suited to Samsung’s premiumization strategy. Samsung can leverage premium channels like branded experience stores and telco channels to support its growth of flagships like the Galaxy S24.”

“Canalys predicts that smartphone shipments in Southeast Asia will grow by 4% in 2024,” said Chiew. “Most vendors are cautious about expecting a large external sales boost from a natural refresh cycle. Although the market rebounded by 12% in Q1 2024, most of the growth was in price-sensitive markets like Indonesia and the Philippines. In the near term, volatile factors like fluctuating currency and component costs present new challenges. Vendors with optimized supply chains and operational efficiency will be best positioned to succeed. The long-term outlook for the Southeast Asian market is positive though. A combination of the young population and increasingly democratized digital financial services are strong markers for growth in consumer spending which will spur an increase in demand for premium devices. Tim Cook’s recent visit to Singapore and Indonesia highlights Apple’s commitment and interest in the region.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Samsung |

4.5 |

19% |

5.6 |

27% |

-20% |

|

TRANSSION |

4.2 |

18% |

1.4 |

7% |

197% |

|

Xiaomi |

3.8 |

16% |

2.5 |

12% |

52% |

|

OPPO |

3.8 |

16% |

4.0 |

19% |

-5% |

|

vivo |

2.8 |

12% |

2.5 |

12% |

12% |

|

Others |

4.4 |

19% |

4.9 |

24% |

-10% |

|

Total |

23.5 |

100% |

20.9 |

100% |

12% |

|

|

|

||||

For more information, please contact:

Chiew Le Xuan: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.