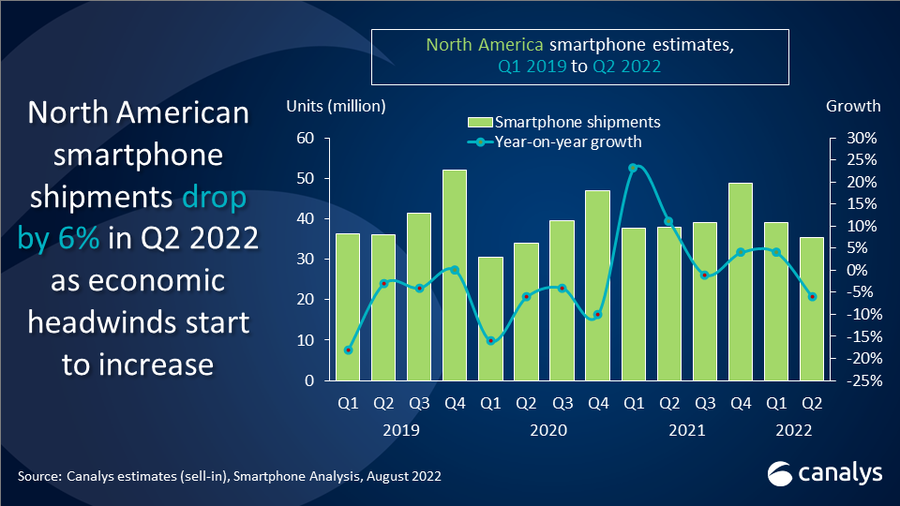

North America smartphone shipment down 6% in Q2 2022 as demand dampens

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 22 August 2022

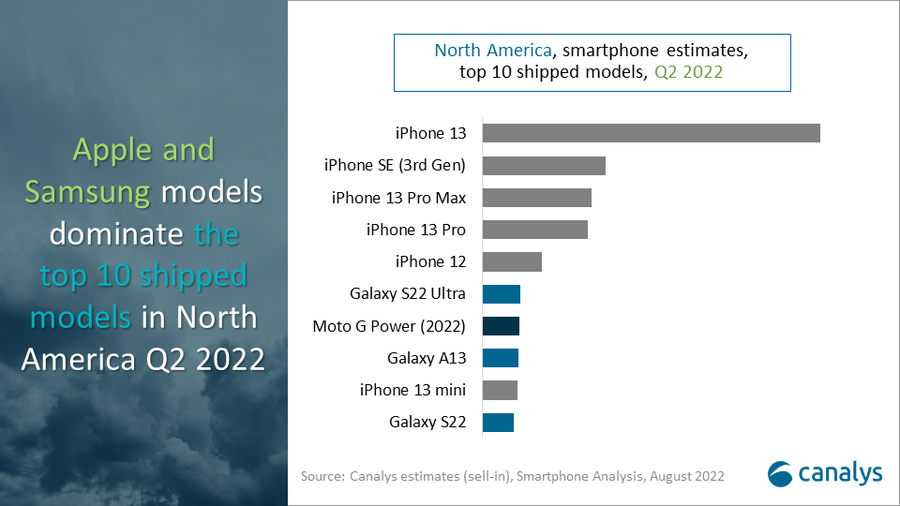

The North American smartphone market reached 35.4 million shipped units in Q2 2022, down 6.4% yearly amid economic challenges, high inflation, and poor seasonal demand. Apple grew 3% and has dominated over half the North American region for three consecutive quarters, thanks to solid iPhone 13 demand combined with a full quarter's performance of its entry-level model, the iPhone SE (3rd Gen). Samsung's shipments increased 4% as its S series and low-end A series devices continued to deliver. Lenovo (Motorola), TCL, and Google rounded of the top five, claiming 9%, 5% and 2% market share.

“Following a rapidly recovered performance in 2021, the tide has turned in the North American smartphone market,” said Canalys Research Analyst Runar Bjørhovde. “A combination of high inflation, decreasing consumer confidence, and an economic slowdown is shrinking demand in North America, which was previously the world's most resilient market. Vendors are responding quickly to falling demand and are focused on reducing the risk of oversupply as they prepare for new launches in the second half of 2022. Most top vendors matched their shipments from Q2 2021, and the volume decrease was caused by the gap LG left remaining partly unfulfilled.”

“Consumer interest for low-end and high-end devices is sustaining the market, while the appetite for mid-range devices is vanishing fast,” said Canalys Research Analyst Brian Lynch. “The performance of the iPhone SE (3rd Gen), Galaxy A53, and Galaxy A33 are poorer than initially expected. Decreasing purchasing power is forcing buyers who normally would consider devices costing between US$250 and US$600 to look for cheaper options as consumers continue to feel the financial pressure of inflation on everyday expenses. In the low-end, demand remains solid, but competition between vendors is fierce. Motorola’s refreshed G Power, Samsung’s A13 models, and TCL’s new launches with Tracfone, Verizon, and T-Mobile provide numerous budget-friendly options that are increasing in demand. The high-end’s performance also remained strong with Apple’s iPhone 13 series and Samsung’s Galaxy S series finding opportunities. For Samsung, the S Pen in Galaxy S22 Ultra has been an effective differentiator among premium Android devices, making it Samsung’s best performing model in the market.”

“Concerns over demand in the second half of 2022 have taken root for both vendors and carriers, leading to more stringent control over inventory and other costs,” continued Lynch. “Vendors are expected to invest heavily in marketing and offer promotions and bundles to speed up sell-though. This effort will be critical for low-end market challengers looking to grow their market share and defend carrier slots.”

|

North America smartphone shipments, market share, and annual growth Canalys Smartphone Market Pulse: Q2 2022 |

|||||

|

Brand |

Q2 2022 |

Q2 2022 |

Q2 2021 |

Q2 2021 |

Annual |

|

Apple |

18.5 |

52% |

18.0 |

48% |

3% |

|

Samsung |

9.0 |

26% |

8.7 |

23% |

4% |

|

Motorola |

3.1 |

9% |

3.1 |

8% |

1% |

|

TCL |

1.8 |

5% |

2.0 |

5% |

-11% |

|

|

0.8 |

2% |

0.2 |

1% |

230% |

|

Others |

2.2 |

6% |

5.8 |

15% |

-61% |

|

Total |

35.4 |

100% |

37.8 |

100% |

-6% |

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys Smartphone Analysis (sell-in shipments), August 2022 |

|

||||

For more information, please contact:

Brian Lynch: brian_lynch@canalys.com +1 503 927 5489

Runar Bjørhovde: runar_bjorhovde@canalys.com +44 7787 290 115

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.