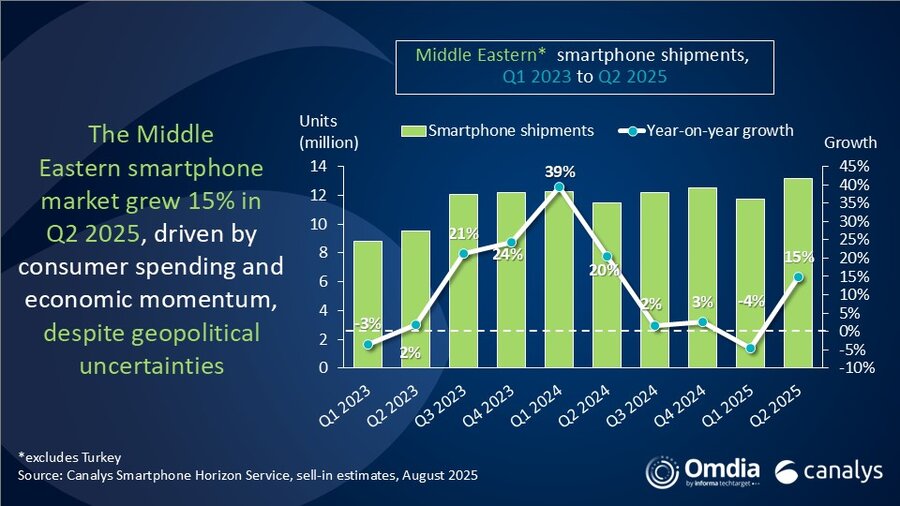

Middle Eastern smartphone shipments jump in Q2 2025, breaking early-year slowdown

Thursday, 14 August 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

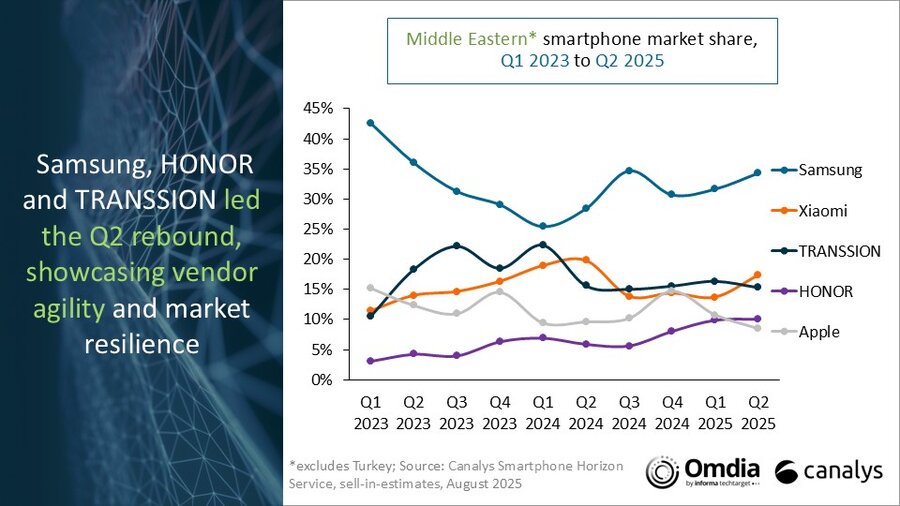

The latest research from Canalys (now part of Omdia) reveals that the Middle East’s (excluding Turkey) smartphone market grew 15% to 13.2 million units in Q2 2025, making it the strongest-growing region worldwide. The rebound was powered by value-conscious buyers, festive season spending and strong economic momentum, positioning the region for continued expansion in smartphone shipments despite geopolitical headwinds.

“The Middle East’s smartphone market delivered its highest quarterly volume since Q2 2019, reflecting strong and consistent demand across the region,” said Manish Pravinkumar, Principal Analyst at Canalys (now part of Omdia). “Following a muted start to the year in Q1, the region rebounded strongly in Q2 2025, fueled by channel replenishment and vendors refreshing their mid-tier portfolios. For many vendors, the Middle East has become a core investment target for growing their businesses, aligning with regional governments’ bold visions and infrastructure projects, rising disposable incomes, expanding addressable markets and a diversifying economy. With improving political stability, a steady influx of travelers and its role as a global commercial crossroads, the region is cementing its status as a launchpad for success both locally and internationally.”

“Samsung and HONOR both had exceptionally strong performances in Q2, reaching high double-digit growth rates in Q2,” said Pravinkumar. “Samsung benefits across the region, particularly from more targeted use of its entry-level Galaxy A series 4G models. Additionally, the enduring demand for the Galaxy S25 series and S24 FE is being fueled by buy-now-pay-later options and faster refresh cycles driven by an increased desire for consumers to update. HONOR nearly doubled its shipments compared with Q2 2024, with the GCC emerging as a core growth market. Its rapid rise is underpinned by aggressive retail expansion, a strong AI-driven product proposition that resonates with local consumers and compelling channel incentive programs. Combined with bold promotions and an expanding network of Experience Stores, these factors have been pivotal to HONOR’s success.”

“AI needs to be the backbone in all vendors’ strategies in the Middle East, both to capture consumers’ interest, channel traction and business opportunities,” added Pravinkumar. “The region is quickly becoming a global AI hub, led by the UAE, Saudi Arabia and Qatar, which are deeply integrating AI into their national strategies. This is resulting in growing consumer interest, making it a vital component to capture users through eye-catching features and targeted influencer campaigns, and to match technological infrastructure investments that are being built and expanded. To win, vendors must combine advanced AI features, such as real-time translation, hyper-personalized recommendations and instant content creation, with strong creator partnerships to drive engagement, shape consumer preferences and convert influence into loyalty in an increasingly competitive market.”

|

|

|||||

|

Vendor |

Q2 2025 |

Q2 2025 |

Q2 2024 |

Q2 2024 |

Annual |

|

Samsung |

4.5 |

34% |

3.3 |

28% |

39% |

|

Xiaomi |

2.3 |

17% |

2.3 |

20% |

1% |

|

TRANSSION |

2.0 |

15% |

1.8 |

16% |

13% |

|

HONOR |

1.3 |

10% |

0.7 |

6% |

95% |

|

Apple |

1.1 |

8% |

1.1 |

10% |

1% |

|

Others |

1.9 |

15% |

2.4 |

21% |

-19% |

|

Total |

13.2 |

100% |

11.5 |

100% |

15% |

|

|

|

|

|||

|

Note: Xiaomi includes sub-brands Redmi and POCO. TRANSSION includes sub-brands Infinix, iTel and TECNO. Percentages may not add up to 100% due to rounding. Source: Canalys Smartphone Horizon Service, sell-in estimates, August 2025 |

|

||||

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

The worldwide Smartphone Horizon service from Canalys (now part of Omdia) provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.