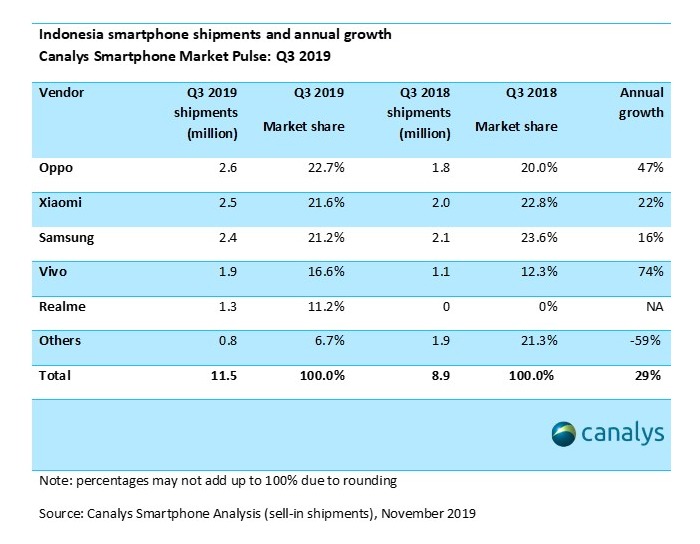

Canalys: Indonesia grew fastest in global top 10 markets and reached a record 11.5 million smartphone shipments in Q3 2019

Singapore, Shanghai (China), Bengaluru (India), Reading (UK) and Portland (US) – Friday, 6 December 2019

Indonesia’s smartphone market reached 11.5 million shipments, growing 29% annually in Q3 2019. It grew the fastest among the top 10 global smartphone markets, while Russia came second with a 15% year-on-year growth. Oppo solidified its lead by growing 47% annually with 2.6 million smartphone shipments. Second-placed Xiaomi recorded 2.5 million units and a 22% year-on-year growth, regaining momentum after a stagnant performance in the first two quarters of 2019. Samsung, the only non-Chinese vendor in the top five, dropped to third place and shipped 2.4 million smartphones with a 16% year-on-year growth. Vivo and Realme completed the top five by shipping 1.9 million units and 1.3 million units respectively.

“Chinese vendors are investing heavily in Indonesia,” said Matthew Xie, Canalys Analyst. “Suffering from the intense competition pressure in their home court (see Canalys press release 30 October 2019 Canalys: Huawei grows 66% in China smartphone market at expense of competition), Oppo, Vivo and Xiaomi are eager to make up lost ground through overseas expansion. Indonesia, the world’s fourth largest smartphone market, is still showing a lot of potential, thanks to the country’s vast young population and relatively low smartphone penetration. Stabilization of the Rupiah against the US Dollar in 2019 also strengthens foreign vendor’s investment confidence.”

Oppo topped the market for the second consecutive quarter. The vendor has registered stellar growth in the past three quarters thanks to its low-end products such as A5s and A1K, which contributed 65% of total shipments in Q3. “Indonesia is the second biggest market for Oppo outside China, contributing 8% of its global shipments. To compete in the market against long-term champion Samsung, Oppo aggressively increased investments in its offline channel developments,” said Matthew. “Oppo re-organized and rapidly expanded the size of its local sales team, and increased the number of retail stores to a wider geographical coverage. Besides having comprehensive offline coverage, Oppo’s mid-to-low end portfolio had an aggressive price-to-spec ratio to address local market competition. It gave the vendor a strong short-term boost, but the overreliance on low-end could backfire on their brand image in the mid-to-high end in the future.”

Xiaomi surpassed Samsung for the first time and climbed back to second place in Q3. “Xiaomi is determined to succeed in Indonesia,” commented Matthew. “After it fully completed the process of incorporating locally, Xiaomi has focused on building a local Indonesian ecosystem. In September, at its first MIDC (Xiaomi Developer Conference), which is to attract local developers to its app store, Xiaomi announced it had 24 million active MIUI users in the country. Xiaomi also added six more distributors to cover areas outside Java island. Although it will take time to see the channel expansion effort bear fruit, the increased distribution channels bring a better channel capability, allowing Xiaomi to focus on opening more Mi stores and develop its online channel.”

Realme was the market highlight as it surged to fifth place despite the vendor only entering the market a year ago. “The channel strategy is key to Realme’s fast expansion as it is able to leverage Oppo’s offline network. This has given the young brand a jumpstart and a massive advantage in the complicated distribution landscape. Meanwhile, Realme’s decent price-to-spec ratio is highly competitive even in the online channel. It could grow to be a major threat to Xiaomi and Vivo, as well as Oppo itself.”

“Indonesia’s smartphone market is poised to deliver continuous strong growth in the next 12 months thanks to major vendors’ marketing push and rapid product refreshment,” said Nicole Peng, VP of Mobility at Canalys. “Significant investments in the market by vendors will continue to improve the retail channel infrastructure and logistics networks, as well as increase local consumer awareness and to flourish the mobile ecosystem. These will, in return, further stimulate smartphone sales and speed up the displacement of feature phones, although it will take a relatively long time. Meanwhile, competition between vendors will be even more fierce especially in the low-end market. Constrained by income level changes and local consumers’ affection for price-to-spec ratio, it is unlikely to change soon.”

For more information, please contact:

Canalys Singapore

Matthew Xie: matthew_xie@canalys.com +65 8223 4730

Shengtao Jin: shengtao_jin@canalys.com +65 9113 7976

Canalys China

Louis Liu: louis_liu@canalys.com +86 136 2177 7745

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys India

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 7 856 837 66

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com