Global wearable band market expands in 2024, driven by China and emerging markets

Wednesday, 5 March 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

According to Canalys, now part of Omdia, the global wearable band market achieved steady growth in 2024, with shipments reaching 193 million units, a 4% year-on-year increase. This was the second consecutive year of expansion following the 2022 market correction, showing renewed momentum in the industry. Growth was primarily fueled by strong demand in China and emerging markets, offsetting declines in mature regions, such as the US and India. The basic watch and basic band segments played key roles in driving entry-level adoption, while competition among the leading vendors intensified as Apple, Xiaomi and Huawei battled for market share.

China leads global growth, outpacing India and the US

China remained the largest wearable band market, accounting for 30% of global shipments in 2024. It saw a strong 20% year-on-year increase, with Q4 alone growing 50% as vendors capitalized on a mix of government subsidies, product enhancements and strategic ecosystem integration.

“While China thrived, India and the US struggled, highlighting regional disparities in market performance,” said Canalys Research Analyst Jack Leathem. “India, the world’s second-largest wearable band market, saw shipments fall by 22% in 2024, as local vendors struggled to enhance functionality and performance in the basic watch segment, which accounted for 96% of India’s shipments.”

Emerging markets drive volume as vendors target new consumers

“Beyond China, emerging markets played a pivotal role in global growth, with Xiaomi, Huawei and TRANSSION building brand awareness and driving volume,” said Canalys Research Manager Cynthia Chen.

The Middle East led global expansion, growing 55% year on year, followed by Southeast Asia (45%), Latin America (21%) and Central and Eastern Europe (20%). Much of this growth came from affordable basic devices, as brands focused on price accessibility and retail expansion to capture first-time buyers.

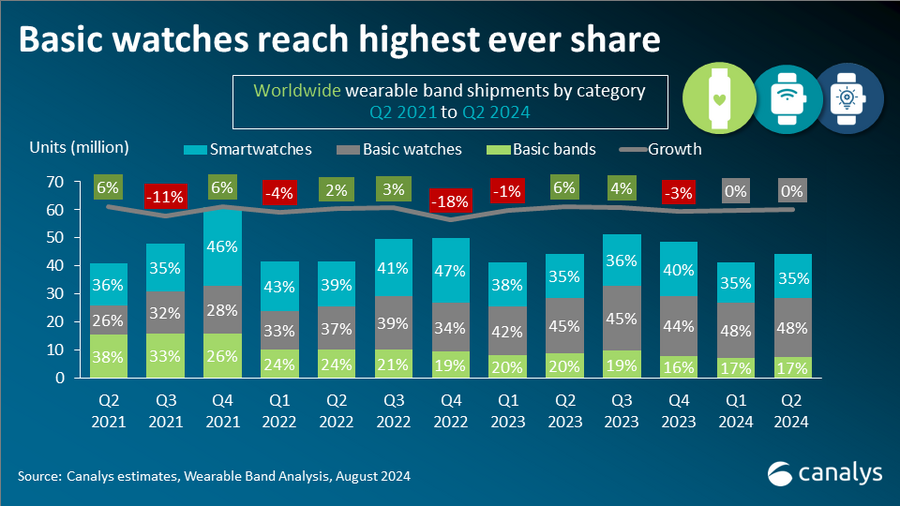

Basic watches continue momentum, while basic bands rebound

The basic watch category remains a key driver of market growth, growing by 8% in 2024 following a strong 25% surge in 2023. Huawei and Xiaomi collectively held a 41% market share, with both companies actively diversifying their product portfolios. The evolution of basic watches is no longer limited to incremental upgrades of entry-level bands but is shifting toward more business-focused, advanced sports and medical-oriented devices, such as Xiaomi’s Watch S series and Huawei’s Watch D series.

Meanwhile, the basic band market has rebounded after years of decline. Shipments returned to growth in Q3 (up 7%) before accelerating sharply in Q4 (49%), driven primarily by Xiaomi (46%), Samsung (18%) and Huawei (17%). This resurgence highlights sustained consumer demand for simple, lightweight and non-intrusive wearables, particularly for health and fitness tracking. The rising popularity of smart rings suggests a growing preference for minimalistic wearable solutions.

Samsung’s re-entry into the basic fitness band segment with the Galaxy Fit 3 has filled a gap in its product lineup and intensified competition. This move has prompted Xiaomi to enhance its pricing and distribution strategies, particularly in Latin America, the Middle East and Southeast Asia, as part of its broader strategy to transition users to higher-margin wearables. Similarly, Samsung’s return to this category follows a strategic rationale: attracting new users to the Samsung Health ecosystem via entry-level wearables, then guiding them toward future smartwatch upgrades while expanding the ecosystem’s accessibility among budget-conscious and mid-tier Samsung smartphone users in these regions.

Outlook: innovation and market expansion key to 2025 growth

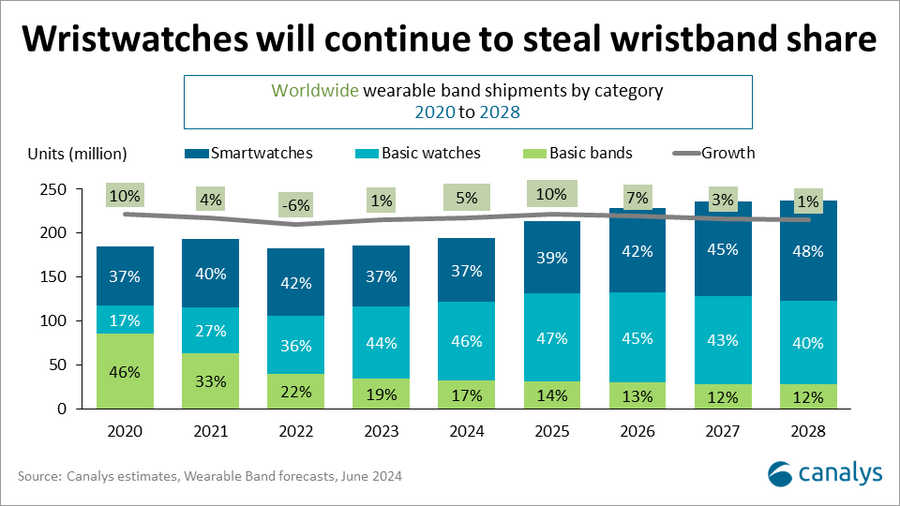

Chen added that, “the wearable band market’s continued expansion in 2024 highlights the growing demand for affordable wearables in emerging markets. But mature markets face increasing challenges, with longer upgrade cycles and stagnant innovation slowing demand.”

“As vendors navigate these shifts, their success in 2025 and beyond will depend on balancing innovation with affordability, expanding their global reach and leveraging emerging trends, such as smart rings and advanced health tracking, to drive adoption,” said Leathem.|

Global wearable bands shipments and growth 2024 |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Apple |

34.5 |

17.9% |

35.5 |

19.2% |

-3.0% |

|

Xiaomi |

29.3 |

15.2% |

20.6 |

11.1% |

42.2% |

|

Huawei |

26.5 |

13.7% |

17.2 |

9.3% |

54.2% |

|

Samsung |

15.6 |

8.1% |

11.8 |

6.3% |

34.9% |

|

Noise |

8.8 |

4.5% |

11.8 |

6.4% |

-25.9% |

|

Others |

78.4 |

40.6% |

88.8 |

47.8% |

-11.7% |

|

Total |

193.0 |

100.0% |

185.4 |

100.0% |

4.1% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Jack Leathem: jack_leathem@canalys.com

Cynthia Chen: cynthia_chen@canalys.com

Canalys’ Wearable Band Analysis service provides qualitative and quantitative insights into the wearable band market and addresses the areas where vendors can improve. Our best-in-class service guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and enhance go-to-market strategies to engage in different markets worldwide. The data has detailed splits, tracking a list of 50+ features around connectivity, components, sensors, chipsets and many other different categories. Model-level information is available for 30+ key markets.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.