Global smart personal audio devices market achieved a remarkable growth of 11.2% in 2024

Monday, 3 March 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

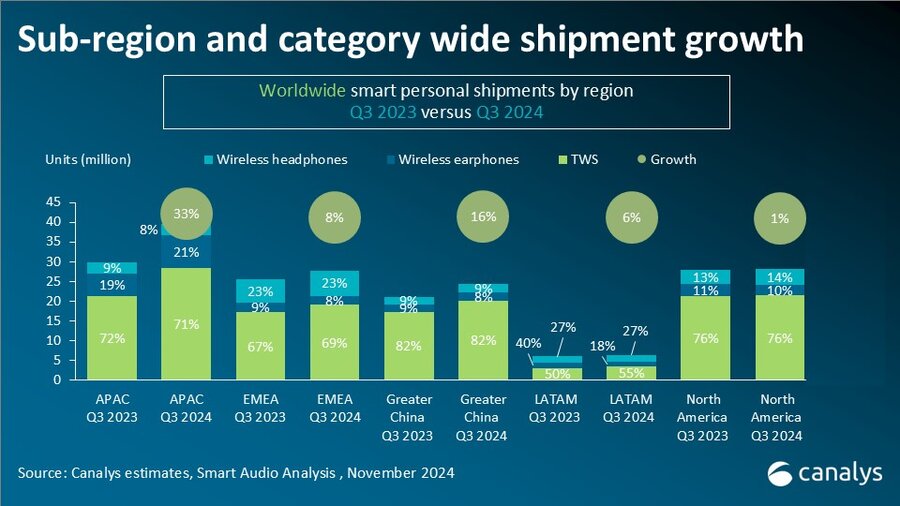

According to Canalys, now part of Omdia, latest estimates, global shipments of smart personal audio devices (including TWS, wireless headphones and wireless earphones) reached 455 million units in 2024, marking an 11.2% year-on-year growth. All product categories saw shipment increases, with China and emerging markets (APAC, Latin America, Middle East and Africa regions) serving as key growth engines.

“While leading brands have maintained stable market positions, their differentiation strategies are increasingly taking shape,” highlighted Canalys Research Analyst Jack Leathem. In the ecosystem category, players like Apple continue to reinforce their competitive edge through deep hardware-software integration. Apple’s in-house chipset enables seamless cross-device connectivity while integrating spatial audio technology with Apple Music to deliver a high-resolution audio experience. Meanwhile, domestic players like Xiaomi and Huawei are capitalizing on their smart ecosystem strategy, leveraging IoT device synergies to enhance user experiences.

In the established audio segment, Sony, Bose and Edifier collectively command roughly 25% of the wireless headphone market. They prioritize profitability by targeting high-end consumers with advanced audio codecs, Hi-Res certifications and strategic streaming partnerships. For example, Edifier’s collaboration with QQ Music to launch a master-level audio quality service effectively caters to the exclusive expectations of discerning music enthusiasts.

“Emerging brands are rapidly gaining traction through precise market positioning,” noted Leathem. Emerging players like Shokz and Cleer Audio have successfully penetrated the sports and health segments with their open-form designs. Meanwhile, Oladance’s breakthrough collaboration with AI Doubao has sparked a surge in translation technology—an approach that has been widely imitated, driving rapid product expansion in overseas markets with strong cross-lingual communication needs. These emerging brands also employ differentiated pricing strategies to align with local consumer purchasing power while swiftly launching innovative, region-specific products. Regionally, Greater China led the surge with a 22% growth rate, followed by Asia-Pacific (19%), EMEA (10%) and Latin America (7%).

“AI is redefining the boundaries of smart personal audio functionality, with nearly all manufacturers exploring new applications of AI,” stated Canalys Research Manager Cynthia Chen. “However, several critical challenges remain before these solutions achieve large-scale commercial application.” Current AI explorations in smart audio focus on three primary areas:

The effective application of AI must be grounded in a deep analysis of user behavior data, focusing on addressing the core pain points of specific scenarios rather than merely adding features.

Canalys forecasts that global shipments of smart audio devices will surpass 500 million units by 2025, reflecting a cautiously optimistic outlook. In the near term, the market is expected to witness active player participation and exhibit three key trends:

Over the long run, manufacturers must develop a comprehensive competitive strategy encompassing technology development (including acoustic components, chips, algorithms and others), establish ecosystem partnerships aligned with their business models, and target specific application scenarios. Converting AI-driven technological advantages into tangible user benefits will be pivotal in shaping the future market landscape.

|

Worldwide smart personal audio shipments and growth in 2024 |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Apple |

81.8 |

18.0% |

87.2 |

21.3% |

-6.1% |

|

Samsung |

37.9 |

8.3% |

34.9 |

8.5% |

8.5% |

|

boAt |

28.0 |

6.2% |

22.4 |

5.5% |

25.0% |

|

Xiaomi |

26.8 |

5.9% |

17.3 |

4.2% |

54.9% |

|

Sony |

18.4 |

4.0% |

16.0 |

3.9% |

14.6% |

|

Others |

261.6 |

57.5% |

230.9 |

56.5% |

13.3% |

|

Total |

454.6 |

100% |

408.8 |

100% |

11.2% |

|

|

|

|

|||

|

Note: Apple includes Beats; Samsung includes Harman subsidiaries; Percentages may not add up to 100% due to rounding |

|

||||

|

Worldwide TWS shipments and growth in 2024 |

|||||

|

Vendor |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Apple |

76.5 |

23.1% |

81.8 |

27.8% |

-6.5% |

|

Samsung |

28.2 |

8.5% |

25.1 |

8.5% |

12.6% |

|

Xiaomi |

26.0 |

7.9% |

16.5 |

5.6% |

57.7% |

|

boAt |

19.8 |

6.0% |

16.7 |

5.7% |

18.2% |

|

Huawei |

14.8 |

4.5% |

9.3 |

3.2% |

59.2% |

|

Others |

166.2 |

50.1% |

144.9 |

49.2% |

15.9% |

|

Total |

331.6 |

100% |

294.4 |

100% |

12.6% |

|

|

|

|

|||

|

Note: Apple includes Beats; Samsung includes Harman subsidiaries; Percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com

Jack Leathem: jack_leathem@canalys.com

Canalys’ Smart Personal Audio Analysis is a service that provides qualitative and quantitative insights into the market for smart personal audio devices. It guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and sell on the appropriate platforms to engage in different markets worldwide.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.