Global tablet shipments grew 9% in 2024

Thursday, 6 February 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

According to the latest data from Canalys, worldwide tablet shipments grew 5.6% year on year in Q4 2024, reaching 39.9 million units. This brought total shipments for full-year 2024 to 147.6 million units, up 9.2% compared with 2023. Growth was seen in all regions except North America, marking a healthy recovery from the lows of 2023.

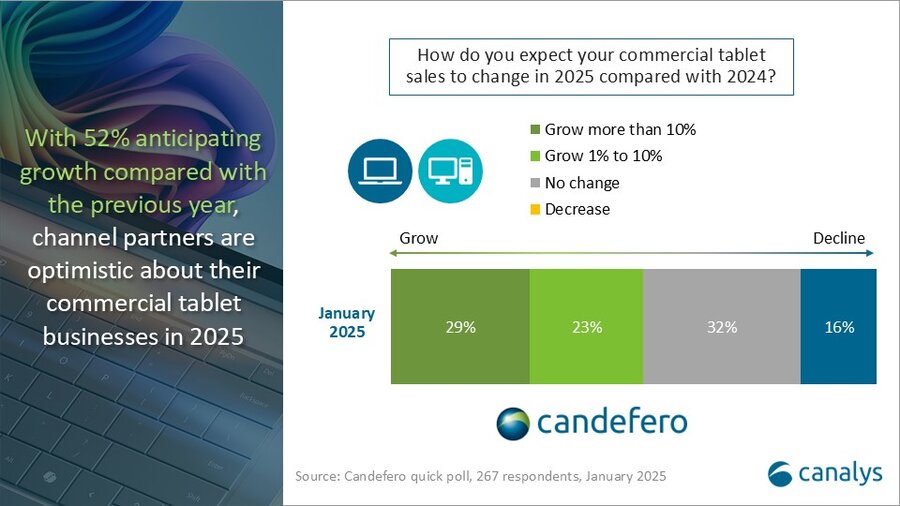

“As the PC market pivots toward a commercial refresh cycle, there is also a recovery in demand for tablets,” said Himani Mukka, Research Manager at Canalys. “A recent Canalys survey of channel partners found that 52% of those that sell commercial tablets expect their shipments to increase in 2025, with 32% expecting flat performance and just 16% anticipating a decline. Refresh opportunities will remain abundant across a variety of industries and verticals as IT investment is expected to strengthen following an extended period of budget restrictions.”

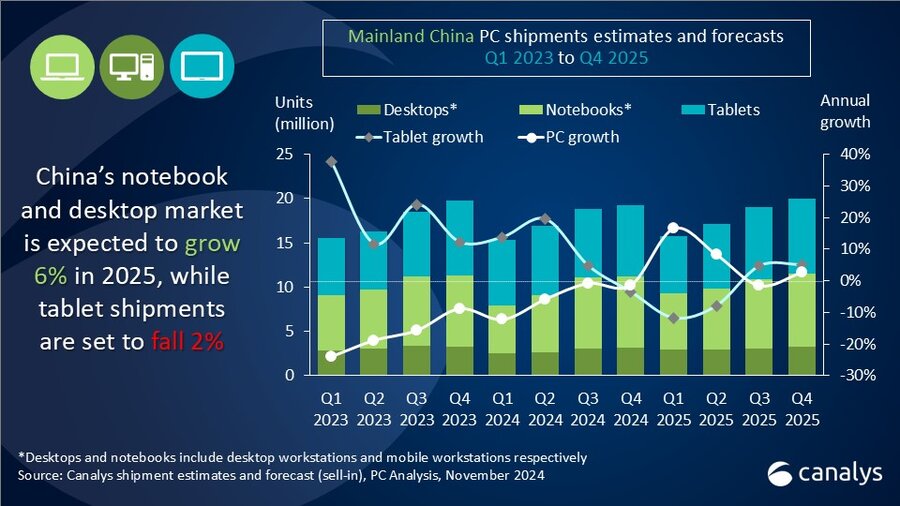

“Consumer tablets are set for a more constrained performance this year, but there will be pockets of opportunity for vendors to target,” said Mukka. “Even in China, where government subsidies have significantly bolstered electronics sales, tablet shipments saw only single-digit growth in the fourth quarter of 2024. But the subsidy program is set to extend into 2025, providing vendors with additional scope to drive consumer interest. In Japan, government-led initiatives, such as ‘Society 5.0’, and the next wave of the education-focused GIGA project present digital transformation funding to help fuel tablet sales.”

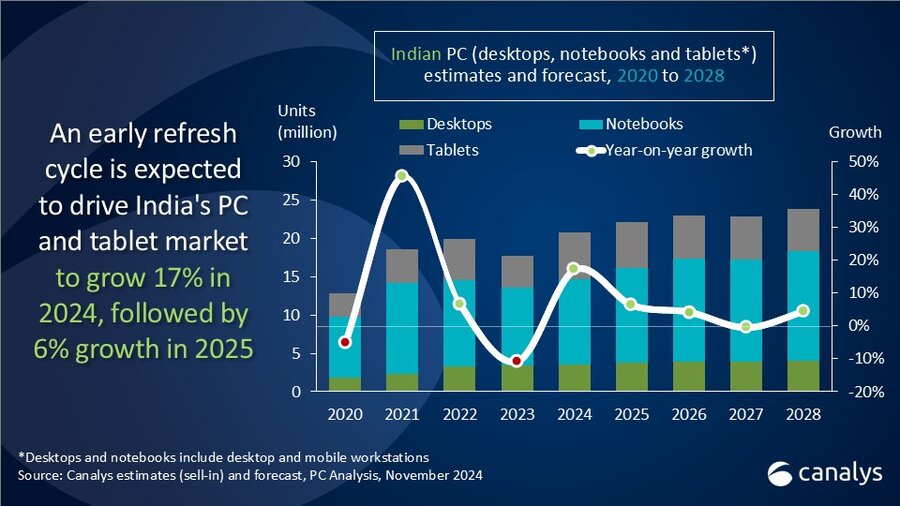

“On the vendor side, Chinese brands are expanding their presence in their home market and beyond,” said Canalys Analyst Kieren Jessop. “HONOR is working to strengthen its foothold in Indonesia as incumbent brands face challenges in the region. The vendor has also introduced bundling offers in the UK following the launch of its HONOR Magic7 Pro smartphone last quarter. Meanwhile, Xiaomi launched its Pad 7 Pro in Q4 2024, capitalizing on its growing domestic popularity and targeting an ambitious 20,000 retail stores in China by 2025 as part of its aggressive expansion strategy. Additionally, Apple has recently reaffirmed its commitment to India – one of the largest smartphone and PC markets – by expanding its presence and opening new stores to strengthen its position in the region in the coming year. All these factors point toward a healthy environment for tablets this year, but US tariffs will remain a risk that could dent demand, particularly for high-end devices.”

In 2024, Chinese vendors performed strongly in the tablet market. Xiaomi led the charge with a remarkable 73% annual growth, securing fifth place in the overall rankings, surpassing Amazon. Huawei also saw impressive growth, with a 29% increase in shipments, allowing it to rise to third place. Lenovo came fourth, shipping 10 million tablets and achieving 12% year-on-year growth. Apple expanded its leading position with 14% growth in Q4 2024, and a modest 5.3% increase for the full year, shipping 16.9 million iPads in the quarter. This growth was fueled by the release of new iPad Mini and iPad Air models. Samsung claimed second place, shipping 7.1 million units and recording 3.9% annual growth.

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2024 |

Q4 2024 |

Q4 2023 |

Q4 2023 |

Annual |

|

Apple |

16,863 |

42.3% |

14,821 |

39.2% |

13.8% |

|

Samsung |

7,096 |

17.8% |

6,829 |

18.1% |

3.9% |

|

Lenovo |

2,832 |

7.1% |

2,682 |

7.1% |

5.6% |

|

Huawei |

2,639 |

6.6% |

2,815 |

7.5% |

-6.3% |

|

Xiaomi |

2,542 |

6.4% |

1,679 |

4.4% |

51.4% |

|

Others |

7,896 |

19.8% |

8,943 |

23.7% |

-11.7% |

|

Total |

39,867 |

100.0% |

37,770 |

100.0% |

5.6% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2025 |

|

||||

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2024 |

2024 |

2023 |

2023 |

Annual |

|

Apple |

56,919 |

38.6% |

54,058 |

40.0% |

5.3% |

|

Samsung |

27,791 |

18.8% |

25,687 |

19.0% |

8.2% |

|

Huawei |

10,742 |

7.3% |

8,308 |

6.1% |

29.3% |

|

Lenovo |

10,426 |

7.1% |

9,310 |

6.9% |

12.0% |

|

Xiaomi |

9,218 |

6.2% |

5,325 |

3.9% |

73.1% |

|

Others |

32,531 |

22.0% |

32,557 |

24.1% |

-0.1% |

|

Total |

147,626 |

100.0% |

135,245 |

100.0% |

9.2% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2025 |

|

||||

For more information, please contact:

Himani Mukka (Singapore): himani_mukka@canalys.com

Kieren Jessop (UK): kieren_jessop@canalys.com

Ishan Dutt (Singapore): ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.