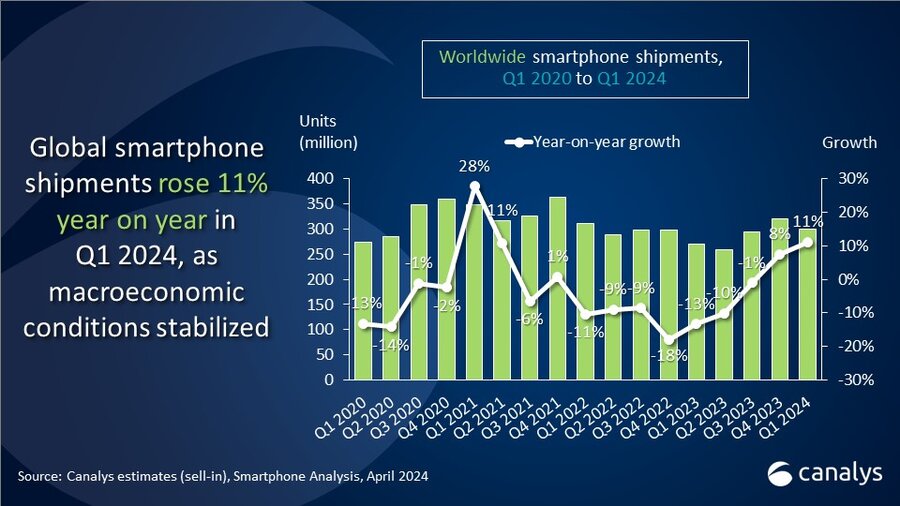

Global smartphone market starts 2024 strongly with 11% growth in Q1

Monday, 15 April 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

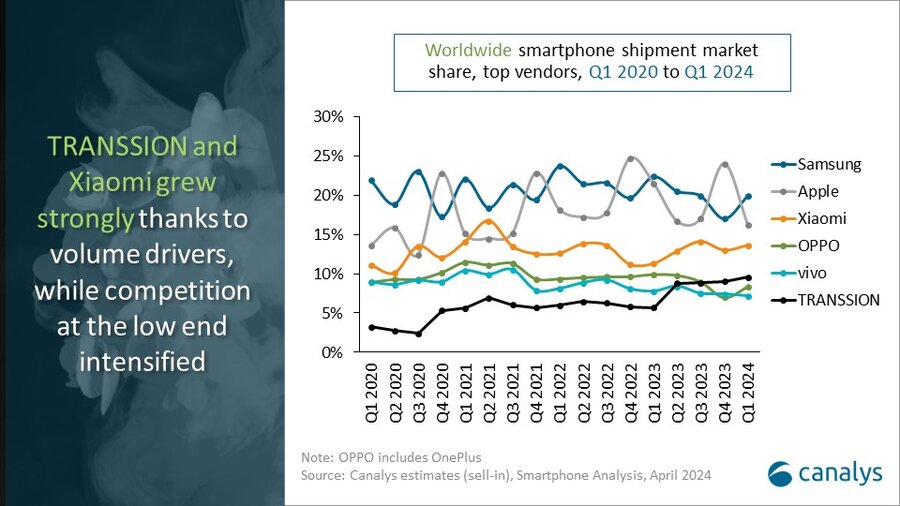

According to Canalys’ latest research, worldwide smartphone shipments grew 11% year on year in the first quarter of 2024 as consumer demand momentum picked up along with the global macroeconomic recovery. Samsung regained the top spot with a 20% share, driven by positive sentiment from the introduction of Galaxy AI. Apple came second with a 16% market share, facing headwinds in strategic markets. Xiaomi took third place, boasting a 14% market share as its competitive volume driver, the newly launched Redmi A3, gained traction. TRANSSION held fourth place with a 10% share, while OPPO completed the top five with 8%.

"The worldwide smartphone market started the year on a positive note, marking a significant improvement on the same period last year,” said Canalys Analyst Le Xuan Chiew. “Q1 2023 struggled due to a sluggish economy and inflationary pressures. But with the economy stabilizing, new product launches and strong promotional efforts, the market has rebounded, offering smartphone vendors an excellent opportunity to revitalize growth. Vendors are seizing new opportunities by promoting premium offerings that set them apart, such as cutting-edge AI features and services on flagship products, and using ecosystem-based product strategies. All eyes are on Apple in 2024, which is highly likely to make an AI announcement that would provide opportunities for the brand to drive its premium offerings and reignite product innovation across its ecosystem.”

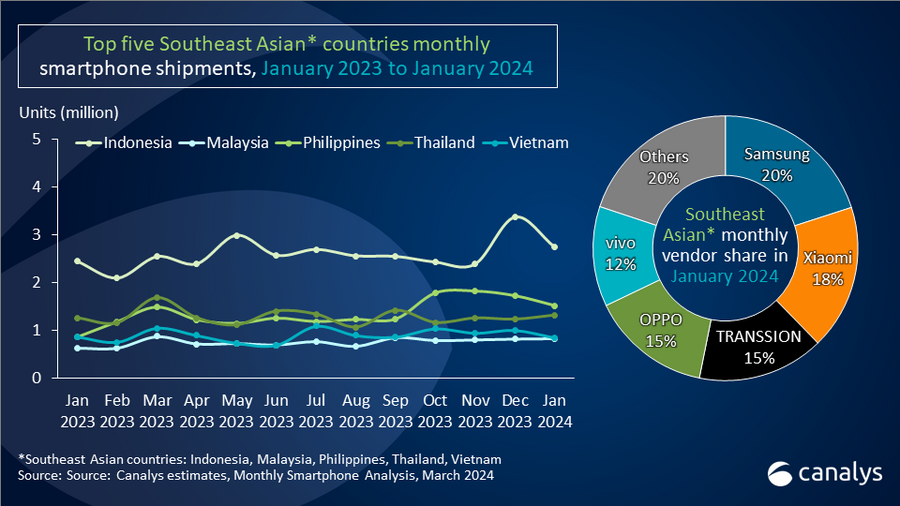

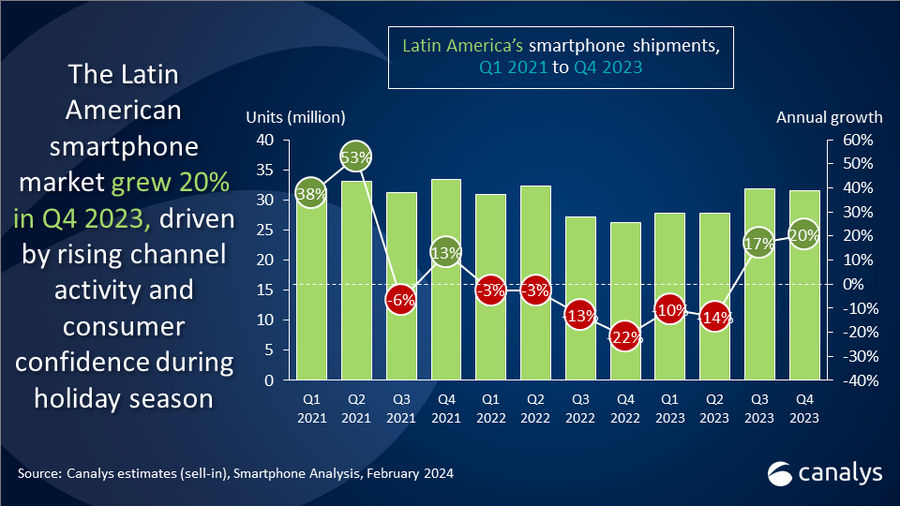

“The market is increasingly price-polarized,” added Chiew. “The entry-level segment is saturated, with new offerings from Xiaomi and TRANSSION. Meanwhile, vivo, OPPO and Samsung aim to gain a larger share of the premium market by investing heavily in marketing and exploring new avenues for growth. By consistently promoting Galaxy AI, Samsung has successfully boosted sales of its S24 series, which has surpassed the performance of its predecessor. Looking ahead, vendors are ramping up investments in emerging regions, such as Latin America and Southeast Asia. These markets boast a flourishing middle class, where smartphone penetration continues to rise compared with saturated markets, alongside evolving preferences for high-end models.”

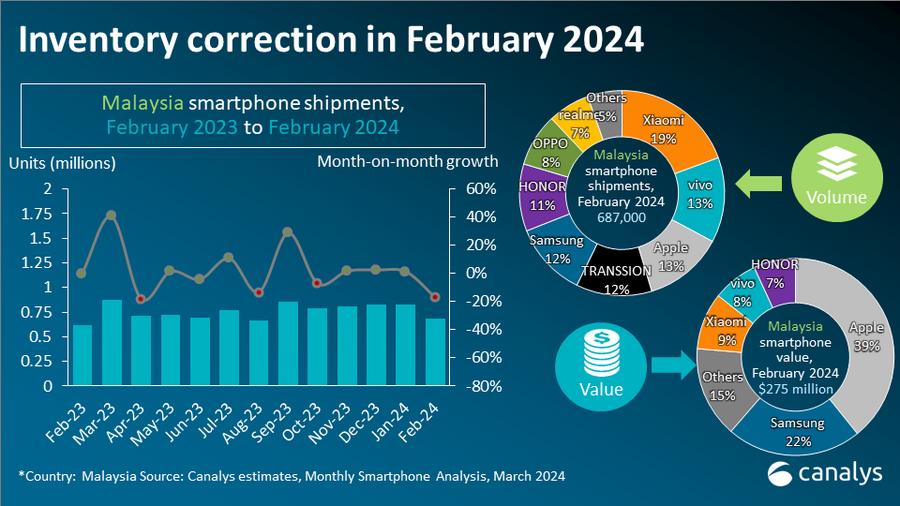

“Despite an upbeat market, it is vital that smartphone vendors keep a watchful eye on inventory levels,” said Canalys Research Analyst Lucas Zhong. “With uncertain global inflationary conditions, vendors are exercising caution in inventory management to mitigate the risk of oversupply and ensure financial stability. Anticipating a slight inventory correction in the second quarter of 2024, the channel aims to digest the aggressive shipments of past quarters, making room for new launches later in the year to bring about more sustainable longer-term growth.”

|

Worldwide smartphone market share split |

|||

|

Vendor |

Q1 2024 market share |

Q1 2023 market share |

|

|

Samsung |

20% |

22% |

|

|

Apple |

16% |

21% |

|

|

Xiaomi |

14% |

11% |

|

|

TRANSSION |

10% |

6% |

|

|

OPPO |

8% |

10% |

|

|

Others |

33% |

29% |

|

|

|

|

|

|

|

Preliminary estimates are subject to change on final release. |

|||

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.