Global cloud services spend exceeds US$50 billion in Q4 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 3 February 2022

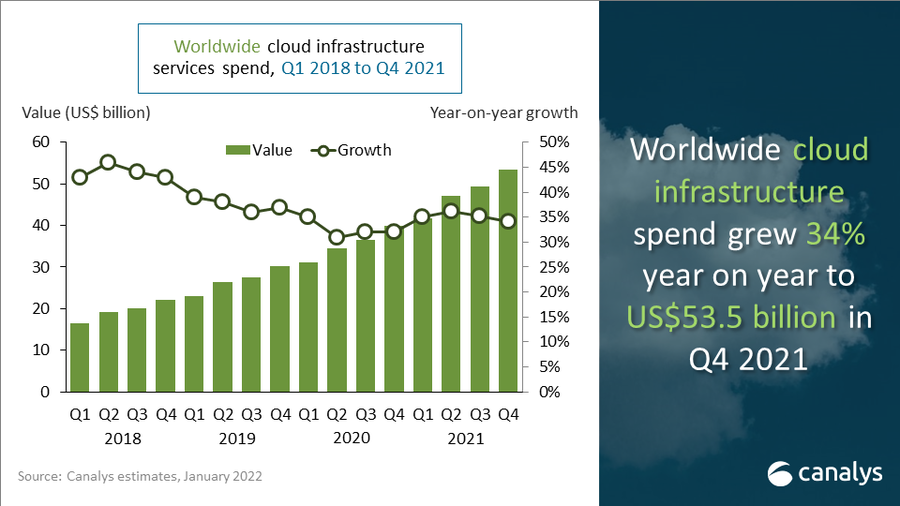

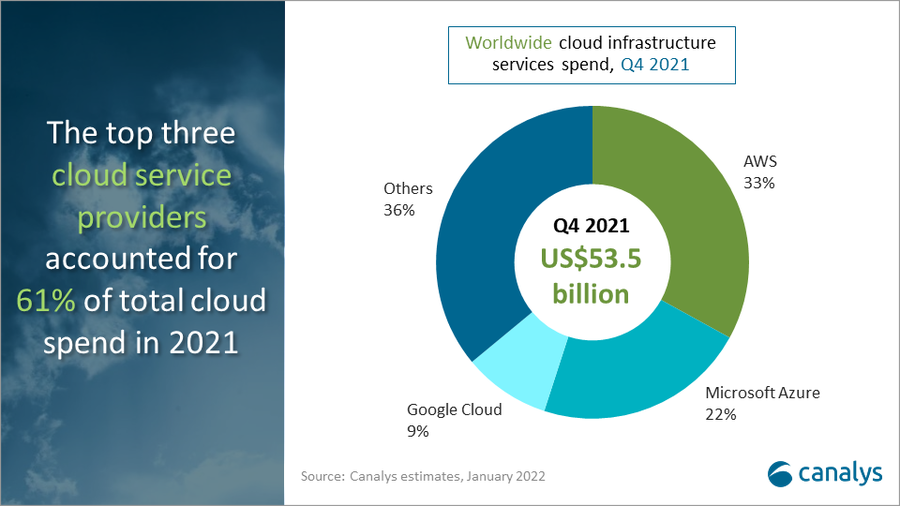

Worldwide cloud infrastructure services expenditure topped US$50 billion in a quarter for the first time in Q4 2021. Total spending grew 34% to US$53.5 billion, up US$13.6 billion on the same period a year ago. Industry-specific applications continued to diversify the use of cloud infrastructure services, especially in healthcare and the public sector. This combined with more workload migration and cloud-native application development as part of digital transformation projects, which increased demand for services. In addition, lasting pandemic-related consumption drivers, such as remote working and learning, ecommerce, gaming and content streaming, remained important contributors. New immersive use cases are emerging, such as the metaverse, which will drive future demand and the need for more powerful, distributed, intelligent and scalable services with lower latency. The leading cloud service providers are best placed to provide the infrastructure. The top three in Q4 2021, namely AWS, Microsoft Azure and Google Cloud, collectively grew 45%, to account for a combined 64% share of customer spend.

For full-year 2021, total cloud infrastructure services spending grew 35% to US$191.7 billion, up from US$142.0 billion in 2020. The reopening of economies post-lockdowns and growing customer confidence during the year increased multi-year contract commitments with cloud service providers.

As cloud service providers diversify their portfolios to reach new opportunities, many are preparing for the cloud computing required to power the shared virtual or augmented reality environment known as the metaverse. This will be a significant driver for both cloud services spend and infrastructure deployment over the next decade. In many ways, the metaverse will resemble the Internet today, with enhanced capabilities and an amplified compute consumption rate. Currently, precursors to the metaverse include use cases spanning gaming, social media, workplace collaboration, education, real estate, ecommerce and digital commerce, including non-fungible tokens (NFTs).

“Cloud services are well positioned for individual developers and organizations looking to enter the metaverse,” said Canalys Research Analyst Blake Murray. “Compute will be in high demand in virtual and augmented reality environments, while storage, machine learning, IoT and data analytics will be essential to support operations such as digital twinning, modeling and interactivity in the metaverse.”

“Continued investment in the metaverse by developers will result in a massive opportunity for cloud service providers, especially the hyperscalers,” said Canalys VP Alex Smith. “Building trust with customers and key technology partners will drive competitive positioning for metaverse development, while global infrastructure, edge deployments and 5G connectivity will be necessary for widespread low-latency experiences.”

Amazon Web Services (AWS) led the cloud infrastructure services market in Q4 2021, accounting for 33% of total spend. It grew 40% on an annual basis. Meta, previously Facebook, recently chose AWS as a long-term strategic cloud service provider and continues to deepen the relationship as Meta begins to move away from social media to become a broader metaverse company over the next five years. AWS also announced key customer wins across retail, healthcare and financial services and emphasized a key agreement with Nasdaq to migrate markets to AWS to become a cloud-based exchange.

Microsoft Azure had a 22% market share and was the second largest provider. It grew 46%, driven by long-term consumption commitments. Across its metaverse technology stack, Microsoft Azure has prepared Digital Twins to model physical objects, Azure IoT to connect physical assets to the cloud and Azure Maps, an indoor private mapping service. It continued to grow its cloud business across multiple sectors in Q4 2021, with key wins in healthcare and financial services.

Google Cloud was the third largest provider and grew 63% to account for 9% of the market. The Google for Startups Cloud Program recently expanded support for investor-backed startups and won key customers, including some in the virtual reality space. It also continued global expansion plans with a dedicated US$1 billion five-year investment across Africa to support digital transformation efforts.

Canalys defines cloud infrastructure services as those that provide infrastructure as a service and platform as a service, either on dedicated hosted private infrastructure or shared infrastructure. This excludes software as a service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Blake Murray (US): blake_murray@canalys.com +1 650 308 6687

Alex Smith (US): alex_smith@canalys.com +1 650 799 4483

Senior Canalys analysts will be attending MWC Barcelona this year and looking forward to meeting press, clients and new contacts in person. Get in touch to arrange a meeting.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.