Foldable smartphone shipments to exceed 30 million in 2024

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 14 February 2022

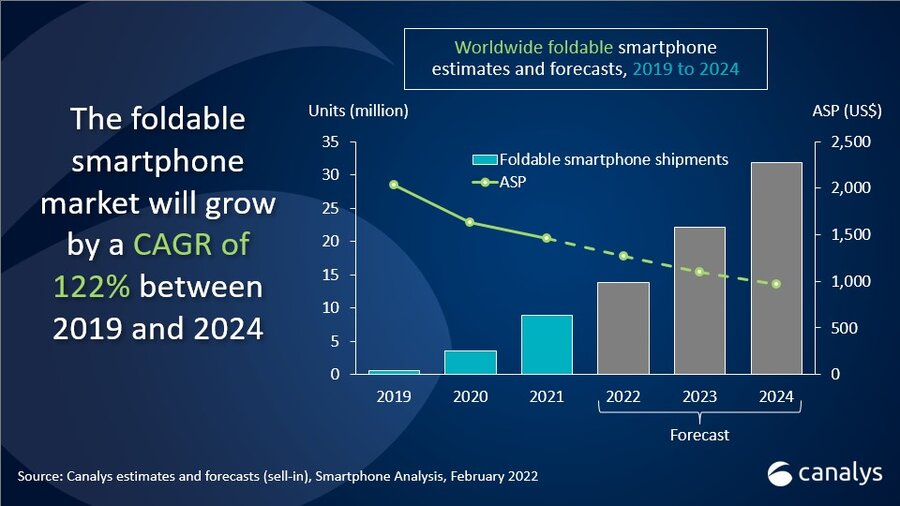

Foldable smartphone shipments are forecast to increase by a CAGR of 53% between 2021 and 2024 to exceed 30 million in 2024, according to the latest Canalys forecasts. The segment is forecast to grow by a CAGR of 122% between 2019, the year the first foldable products launched, and 2024. Driven by Samsung, foldable smartphone shipments reached 8.9 million in 2021. The foldable segment grew 148% year on year despite high price tags, while the overall smartphone market only grew 7% (see Canalys global smartphone market press release).

“The key catalyst for foldable smartphones has been the booming use of large-screen devices during the pandemic,” said Runar Bjørhovde, Research Analyst at Canalys. “As consumers are constantly looking for a better experience on their day-to-day mobile devices, the bar has now been set even higher by the productivity and entertainment experience on large screens. As the world continues to reopen, it brings new opportunities for smartphone vendors to provide products such as foldable smartphones that can fulfill consumers’ needs and desires.”

“Foldable form factors present vital differentiation for vendors to stimulate smartphone sales. They are especially appealing to early adopters and high-end users,” said Toby Zhu, Canalys Analyst. “Android vendors are under big pressure in the premium segment, as shipments of US$800-plus smartphones have fallen 18% below the 2019 level while iOS shipments have grown 68% over the same time. Google and the major Android device vendors must double down on their investments in differentiated hardware and state-of-the-art user experiences to keep appealing to high-end customers.”

“Fortunately, the supply chain ecosystem for foldable devices has developed rapidly over the last few years, thanks to Samsung. While there are an increasing number of suppliers for foldable displays, hinges and other key components, device vendors are also highlighting innovative engineering solutions and product designs for a better user experience while constantly pushing down prices,” said Amber Liu, Research Analyst at Canalys. “In addition to major hardware design innovations, the real battlefield for device vendors is the software user experience, which requires substantial investment in the user interface and capable software as the foldable app ecosystem is still far from optimal. Last November, Google’s Android Dev Summit brought many new features for foldable and dual-screen app developers, providing a vital booster for this category with promising user experience improvements likely to come soon.”

“Major smartphone vendors are getting ready to compete in the foldable category, which will become a vital part of their high-end strategies and corporate branding. We expect this year will see many new foldable device launches as vendors continue reducing thickness, weight and price, which will be vital for mass-market adoption. The leading players will start to flex their muscles in the ecosystem to leapfrog their competitors with advanced and differentiated experiences,” said Liu

For more information, please contact:

Runar Bjørhovde (UK): runar_bjorhovde@canalys.com +44 7787 290 115

Toby Zhu (China): toby_zhu@canalys.com +86 150 2674 3017

Amber Liu (China): amber_liu@canalys.com + 86 136 2177 7745

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.