European smartphone market declined 3% in Q4 2023, while Apple reclaimed pole position

Tuesday, 20 February 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

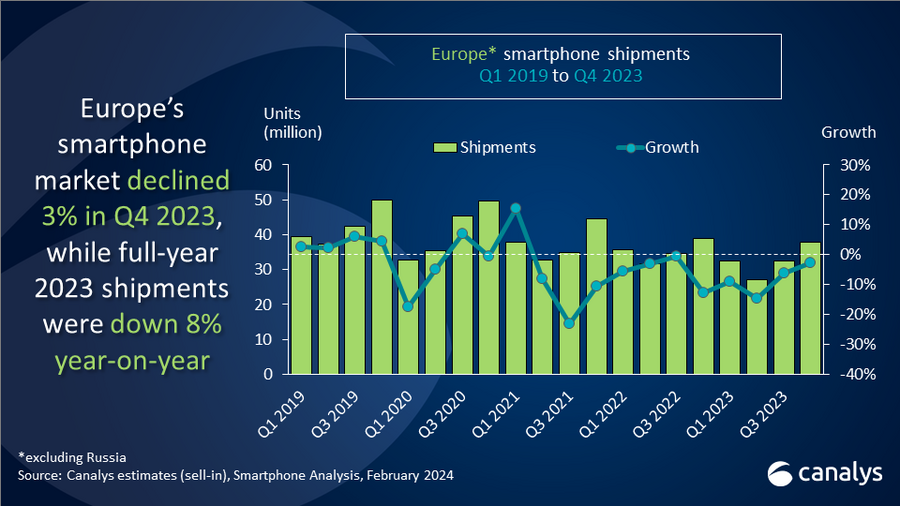

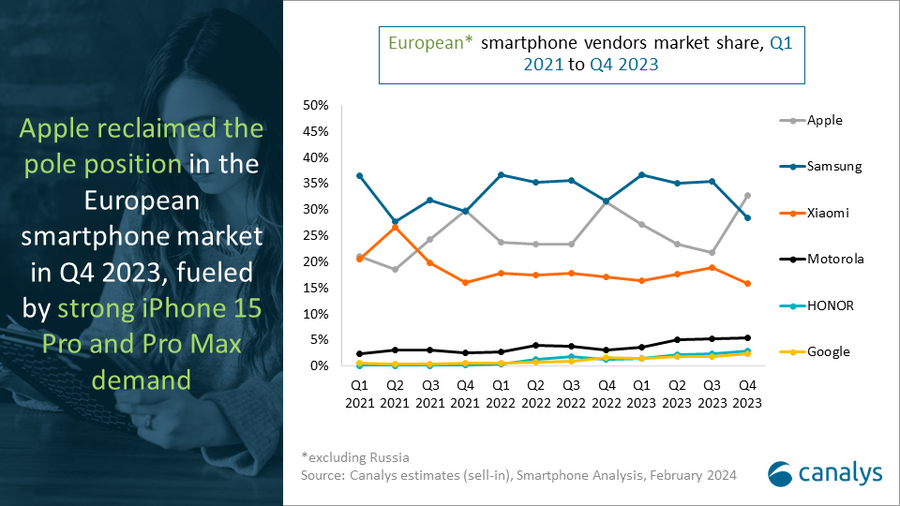

Canalys’ latest research reveals that smartphone shipments into Europe (excluding Russia) fell 3% year-on-year to 37.8 million units in Q4 2023. Apple returned to the lead position of the ranking table after seven quarters behind Samsung, growing 1% year-on-year to 12.4 million units. Samsung took the second spot, declining 12% to 10.8 million units, offset by stable S-series and mid-range A-series shipments. Notably, Samsung was the largest vendor throughout 2023. Xiaomi defended the third position, despite declining 10% to 6.0 million units, bolstered by positive momentum in Central and Eastern Europe. Motorola and HONOR rounded off the top five, shipping 2.0 million and 1.1 million devices, with extraordinary growth rates of 73% and 116% year-on-year, respectively.

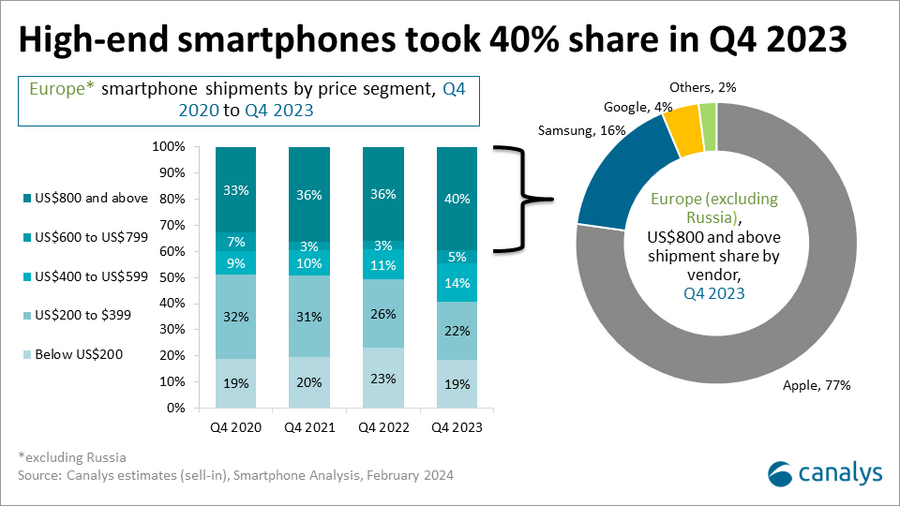

“High-end smartphones took a record share of the European market in Q4 2023. Almost 40% of smartphone shipments were priced at US$800 or higher,” said Runar Bjørhovde, Analyst at Canalys. “The dominance of the high-end was mainly fuelled by strong iPhone 15 Pro demand alongside consistent Galaxy S-series volumes and a growing Google Pixel. Looking ahead, Apple will aim to capitalize on the impending refresh cycle. This includes exploring new routes to market to enable consumers to buy iPhones, such as the bank-as-a-channel approach co-piloted with Santander in Spain. In Samsung's case, the premium S-series and foldable devices remain a priority, seeking to test a service-based subscription model.”

“Beyond the top three, the vendor landscape shifted drastically in 2023, with strong growth from a few selected vendors offsetting the overall market decline,” commented Brandon Gurney, Research Analyst at Canalys. “Motorola was the strongest growing vendor in 2023, focusing on securing targeted mobile network operator slots across the region to grow throughout the year. Following Motorola, HONOR broke into Europe’s top five in Q4 for the first time, achieving a key milestone in proving market potential as it progresses toward an IPO.”

“Competition has been fierce over the last years, but will only intensify further in 2024,” added Gurney. “OPPO, vivo and realme aim to retake market share following the settlement of their patent disputes with Nokia. HMD will seek to improve its position through its recently launched own sub-brand, specifically targeting European consumers and channel partners. In addition, the expanding footprint of Nothing and TRANSSION’s brands will further fuel the competitive environment, presenting consumers with numerous excellent options over the coming years.”

“In 2024, single-digit growth will return to the European smartphone market, driven by an impending refresh cycle of devices that were bought during the pandemic,” added Bjørhovde. “To capitalize on this opportunity and stand out, vendors must apply a holistic approach emphasizing innovation, reliability, backend logistics, regulatory compliance, and a clear brand message. In the long run, vendors will increase focus on the on-device user experience with AI at the core, emphasizing personalization, ecosystem interaction, productivity, and entertainment. AI integration in smartphones will continue to advance steadily and is currently serving as a pivotal R&D-driven feature crucial to maintaining long-term competitiveness. Even so, vendors must ensure to educate consumers on maximizing the power of on-device AI features to achieve strong returns on their investments.”

|

Europe (excluding Russia) smartphone shipments and annual growth |

|||||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

||

|

Apple |

12.4 |

33% |

12.2 |

31% |

1% |

||

|

Samsung |

10.8 |

28% |

12.3 |

32% |

-12% |

||

|

Xiaomi |

6.0 |

16% |

6.6 |

17% |

-10% |

||

|

Motorola |

2.0 |

5% |

1.2 |

3% |

73% |

||

|

HONOR |

1.1 |

3% |

0.5 |

1% |

116% |

||

|

Others |

5.5 |

15% |

6.1 |

16% |

-8% |

||

|

Total |

37.8 |

100% |

38.9 |

100% |

-3% |

||

|

Note: Xiaomi includes POCO. Percentages may not add up to 100% due to rounding. |

|

||||||

|

Europe (excluding Russia) smartphone shipments and annual growth |

|||||||

|

Vendor |

2023 |

2023 |

2022 |

2022 |

Annual |

||

|

Samsung |

43.7 |

34% |

48.9 |

35% |

-11% |

||

|

Apple |

34.6 |

27% |

36.2 |

26% |

-4% |

||

|

Xiaomi |

22.2 |

17% |

24.7 |

18% |

-10% |

||

|

Motorola |

6.4 |

5% |

4.7 |

3% |

34% |

||

|

OPPO |

3.7 |

3% |

6.7 |

5% |

-45% |

||

|

Others |

19.2 |

15% |

19.6 |

14% |

-2% |

||

|

Total |

129.8 |

100% |

140.8 |

100% |

-8% |

||

|

Note: Xiaomi includes POCO, OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||||

Join our analyst breakfast with rapid-fire insights from Canalys and go into your MWC meetings fully prepared for more meaningful discussions.

Register now as seats are limited - https://canalys.com/mwc

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Brandon Gurney: brandon_gurney@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.