China smartphone market share Q221

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 29 July 2021

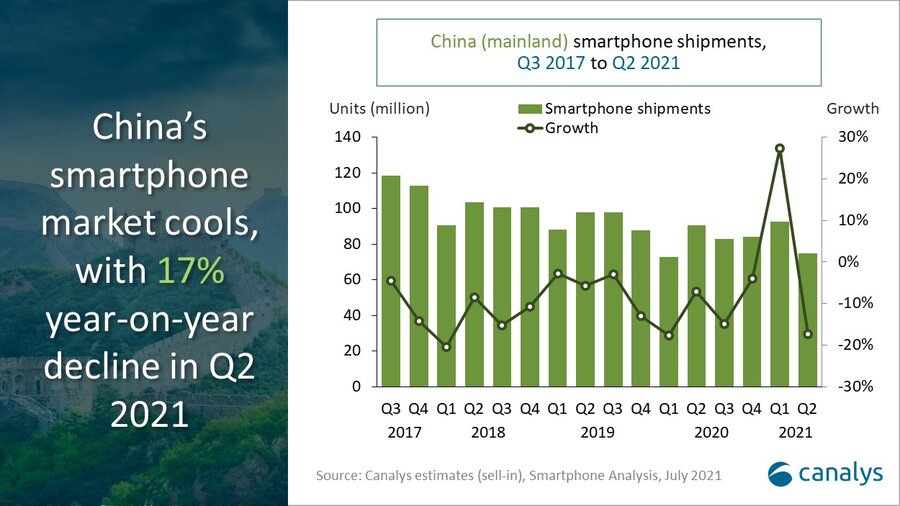

China's smartphone market cools in Q2 as shipments decline 17%

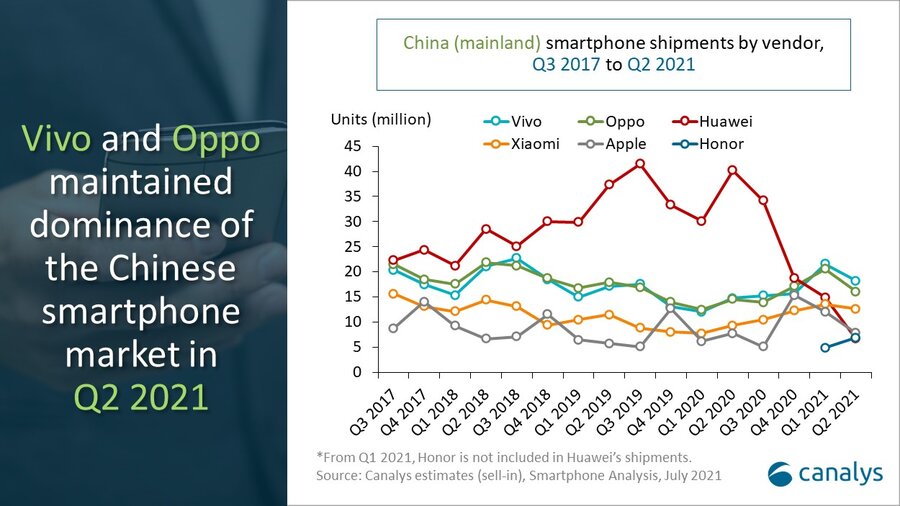

Smartphone shipments in mainland China fell by 17% to reach 74.9 million units in Q2 2021, as the number of vendors to ship more than 10 million units shrank from five to three. Vivo and Oppo remained the top two, with 18.2 million and 16.0 million units respectively, far beyond their competitors. Xiaomi replaced Huawei to become third, and shipped 12.6 million units, with market share increasing from 15% to 17% against the previous quarter. Apple ranked fourth, reaching 7.8 million units. Honor moved into the top five with 6.9 million units, a 40% quarter-on-quarter growth after its independence from Huawei. Huawei, itself, fell out of the top five in China for the first time in over seven years.

“Smartphone brands are ferociously competing to exploit the decline of Huawei, and are proactively acquiring channel resources and launching targeted new products,” said Canalys Research Analyst Amber Liu. “This led to high inventory levels in Q1 2021, which softened channel demand in Q2. In addition to this, the timescale for smartphone replacement in China is gradually lengthening, and the first half of 2021 overall is lower than the market was in 2019, before the COVID-19 pandemic, with 167 million versus 185 million units in the same period two years ago. And furthermore, the wave of 5G smartphone upgrades will start to wane in the near future, as a large proportion of consumers have already shifted to the latest network generation. To buck this trend, the market needs vendors to bring breakthrough new features.”

“The leaders Vivo and Oppo maintained their dominance in Q2 2021. Their pillar product families, such as Y and S series for Vivo, and A and Reno series for Oppo, accounted for an aggregated 46% of the entire market,” said Canalys Analyst Toby Zhu. “Honor expanded its footprint in offline channels and is investing heavily in its supply chain, efforts which have bourne fruit. And it benefitted from positive consumer response to its Play 20 and 50 series. Taking fifth place is a nice milestone for Honor, but it still has significant ground to make up on its rivals to re-enter the upper echelon of vendors.”

“There are positive signs for the second half of 2021,” commented Nicole Peng, VP of Mobility. “Firstly, a new competitive landscape has formed. The collective market share of the top five vendors has dropped from 95% in Q2 2020, when Huawei dominated, to 82% in 2021. Diversity and competition will stimulate the Chinese market. Secondly, high-end Android devices will be the next battleground. So far, the strength of the Huawei P series and Mate series has not been mimicked completely by any vendor, as the flagship segment takes time to change while vendors build a premium brand image. As it stands, there is still a gap for one vendor to seize the Android high-end in China, and new launches in Q3 2021 will create a window of opportunity.”

|

People’s Republic of China (mainland) smartphone shipments and annual growth |

|

||||||

|

Canalys Smartphone Market Pulse: Q2 2021 |

|

||||||

|

Vendor |

Q2 2021 shipments (million) |

Q2 2021 Market share |

Q2 2020 shipments (million) |

Q2 2020 Market share |

Annual growth |

|

|

|

Vivo |

18.2 |

24% |

14.8 |

16% |

+23% |

||

|

Oppo |

16.0 |

21% |

14.5 |

16% |

+10% |

||

|

Xiaomi |

12.6 |

17% |

9.3 |

10% |

+35% |

||

|

Apple |

7.9 |

10% |

7.7 |

9% |

+2% |

||

|

Honor |

6.9 |

9% |

12.8 |

14% |

-46% |

||

|

Others |

13.3 |

18% |

31.5 |

45% |

-58% |

||

|

Total |

74.9 |

100% |

90.7 |

100% |

-17% |

||

|

Note: From Q1 2021, Honor is not included in Huawei’s shipments. Percentages may not add up to 100% due to rounding. |

|

||||||

|

Source: Canalys Smartphone Analysis (sell-in shipments), July 2021 |

|||||||

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys Singapore

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Kelly Wheeler: kelly_wheeler@canalys.com +44 7919 563 270

Canalys USA

Brian Lynch: brian_lynch@canalys.com +1 650 387 5389

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.