Local vendors dominate top five for first time, as Mainland China smartphone market grows 10% in Q2 2024

Thursday, 25 July 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

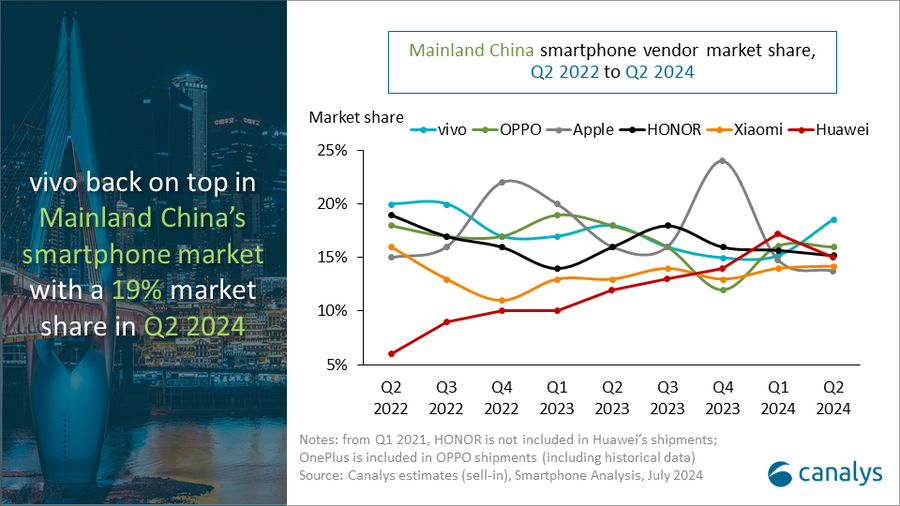

According to the latest Canalys research, Mainland China's smartphone market experienced 10% year-on-year growth in Q2 2024, with shipments exceeding 70 million units. vivo reclaimed the number one spot by shipping 13.1 million units, capturing a 19% market share. This growth, a 15% increase over the previous year, was driven by strong performance in offline channels and robust online sales during the "618" e-commerce festival. OPPO held onto second place, shipping 11.3 million units, buoyed by the launch of its new Reno 12 series. HONOR was third, with shipments of 10.7 million units, marking a 4% year-on-year increase. Huawei followed closely, taking fourth place with shipments of 10.6 million units, though its growth has slowed slightly. Xiaomi saw a 17% year-on-year increase and re-entered the top five by shipping 10 million units. The significant marketing buzz this quarter surrounding Xiaomi's first electric car, the SU7, was one of the contributors to solid sales of its K70 and flagship 14 series. Apple ranked sixth with a market share of 14%, a decrease of 2% from the second quarter of the previous year.

"The Chinese market is finally aligning with global recovery speeds," commented Canalys Research Manager Amber Liu. "This was largely driven by the supply side, which leverages nationwide sales events such as '618'. In collaboration with e-commerce platforms, smartphone vendors initiated the promotional cycle with significant discounts and promotions, which started much earlier this year. Additionally, vendors with a comprehensive smart device portfolio, such as Huawei and Xiaomi, are enhancing their offline channel advantage by expanding their channel partners and promoting the up-sell and cross-sell of products within their smart device ecosystems."

"It is the first quarter in history that domestic vendors dominate all the top five positions," added Canalys Research Analyst Lucas Zhong. "Chinese vendors' strategies for high-end products and their deep collaboration with local supply chains are starting to pay off in hardware and software features. HONOR's latest Magic V3, which leverages GenAI, has significantly enhanced the user experience of foldable devices. Conversely, Apple is facing a bottleneck in mainland China. The vendor's current channel strategy maintains a healthy inventory level and aims to stabilize retail prices and protect margins of channel partners. In the long term, the Chinese high-end market is ripe with opportunity. Local brands such as Huawei, HONOR, OPPO, and vivo are leading the way by incorporating technologies such as GenAI into products and services. Additionally, the localization of Apple’s Intelligence services in mainland China will be crucial in the next 12 months."

"The growth in the second quarter signals a gradual market normalization, but we still expect a modest single-digit recovery for the year," said Canalys Senior Analyst Toby Zhu. "Three key trends will impact the market landscape in the second half of 2024. Firstly, the market will be closely watching Huawei's upcoming launch of HarmonyOS Next, as the vendor aims to position it as a third major mobile OS alongside Android and iOS. Additionally, local players are investing in AI infrastructure, developing in-house models, and creating AI applications as key competitive advantages to disrupt the high-end segment. Lastly, the intense domestic competition is also driving overseas expansion, with Chinese brands expected to achieve new milestones in international markets throughout the rest of 2024."

|

People's Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2024 |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual

|

|

vivo |

13.1 |

19% |

11.4 |

18% |

15% |

|

OPPO |

11.3 |

16% |

11.4 |

18% |

-1% |

|

HONOR |

10.7 |

15% |

10.3 |

16% |

4% |

|

Huawei |

10.6 |

15% |

7.5 |

12% |

41% |

|

Xiaomi |

10.0 |

14% |

8.6 |

13% |

17% |

|

Others |

14.8 |

21% |

15.1 |

24% |

-2% |

|

Total |

70.5 |

100% |

64.3 |

100% |

10% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei's shipments; OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.