Mainland China smartphone market picks up in Q1 2024, Huawei soars to regain lead

Friday, 26 April 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

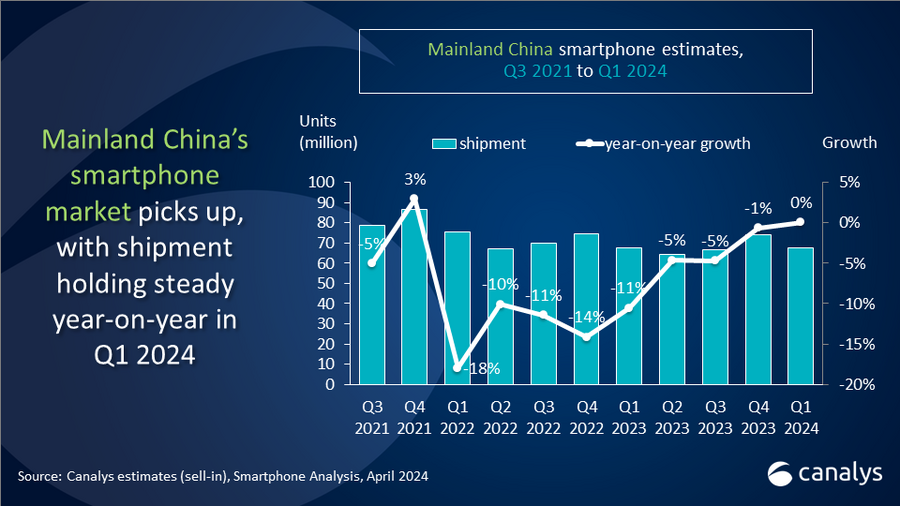

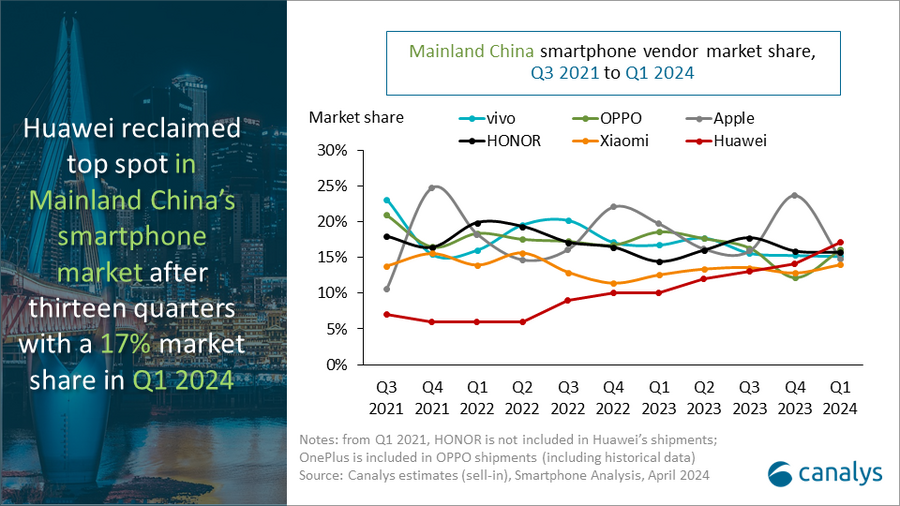

The latest Canalys research shows the Mainland China smartphone market has finally seen a rebound after two years, with a Q1 2024 shipment of 67.7 million units. Significantly, Huawei returned to the top spot after 13 quarters, shipping 11.7 million smartphones and capturing a 17% market share, thanks to an enthusiastic market response to its Mate and nova series. OPPO rose to second place, driven by its Reno 11 series’ strong performance, shipping 10.9 million units. Conversely, following a strong Q4 last year, HONOR, vivo and Apple slowed their sell-ins this quarter, and ranked third, fourth and fifth respectively. HONOR was third with 10.6 million units, with a year-on-year increase of 9%. vivo ranked fourth with 10.3 million units and saw a year-on-year decrease of 9%. Apple declined the most among the top five, with 10.0 million units, a year-on-year decrease of 25%.

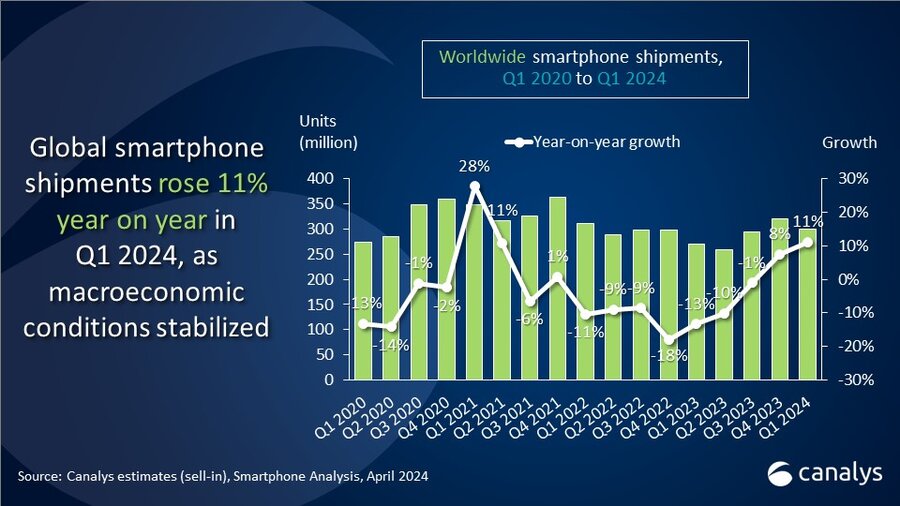

Canalys Senior Analyst Toby Zhu commented, "The mainland China market's growth is still behind the global recovery of 11%, which allowed Huawei to seize market share and reclaim the crown quickly. The production and supply shortage of the Mate 60 series improved in the first quarter, propelling it to become the key driver of Huawei's overall growth. In addition to the high-end lineup, Huawei released the nova 12 series in December, which features Harmony 4.0, expanding the Kirin chipset to more product lines and successfully boosting performance in the mid-range price band. This month Huawei also upgraded the P series to Pura 70, featuring an innovative pop-out camera lens, further sparking market interest. A key strategy for Huawei in 2024 is to focus on building AI capabilities for smart devices from hardware to software at a system level, leveraging its deep R&D capabilities in AI infrastructure and solutions for industry and enterprise customers. With the continued expansion of the HarmonyOS ecosystem, Huawei emerges as the third OS for smartphones and other edge computing devices, breaking the two-horse race of Android and iOS in Mainland China."

Canalys Research Manager Amber Liu added, "Despite Huawei's strong start, we maintain the modest recovery forecast for overall market performance in 2024 growing at 1%. The talking point within the industry surrounds intensifying competition and innovation moat building. Leading vendors are narrowing their market share, which means exploring growth opportunities in different channels is critical to capture short-term opportunities. Vendors' go-to-market capabilities in multi-channel management, price control, and inventory management will be tested."

"The Gen AI-capable smartphone presents important opportunities for Chinese vendors to differentiate in the high-end in 2024 to challenge Apple in their home market," said Canalys Research Analyst Lucas Zhong. "Canalys forecasts Gen AI-capable smartphones will reach 12% of shipments in 2024 in mainland China, ahead of the global average of 9%. Vendors are actively engaging consumers by developing interesting AI use cases and integrating AI features into their latest flagship launches with large marketing spends to educate consumers. In Q1, Xiaomi led in the Gen AI-capable smartphone market with its flagship 14 series, while HONOR explored its high-profile Magic 6 series with cross-device AI features with its MagicBook Pro 16. OPPO, on the other hand, pushed ahead with massive marketing investments on national TV channels, positioning its brand with AI features and innovation. We see an increasing divergence in Chinese vendors' R&D and AI product strategies this year, collectively driving further consumer awareness and adoption, which will feed into a sustainable monetization model."

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q1 2024 |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual

|

|

Huawei |

11.7 |

17% |

6.8 |

10% |

70% |

|

OPPO |

10.9 |

16% |

12.6 |

19% |

-14% |

|

HONOR |

10.6 |

16% |

9.7 |

14% |

9% |

|

vivo |

10.3 |

15% |

11.3 |

17% |

-9% |

|

Apple |

10.0 |

15% |

13.3 |

20% |

-25% |

|

Others |

14.2 |

21% |

13.8 |

20% |

3% |

|

Total |

67.7 |

100% |

67.6 |

100% |

0% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.