Cloud services spend in China hits US$7.3 billion in Q2 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 8 September 2022

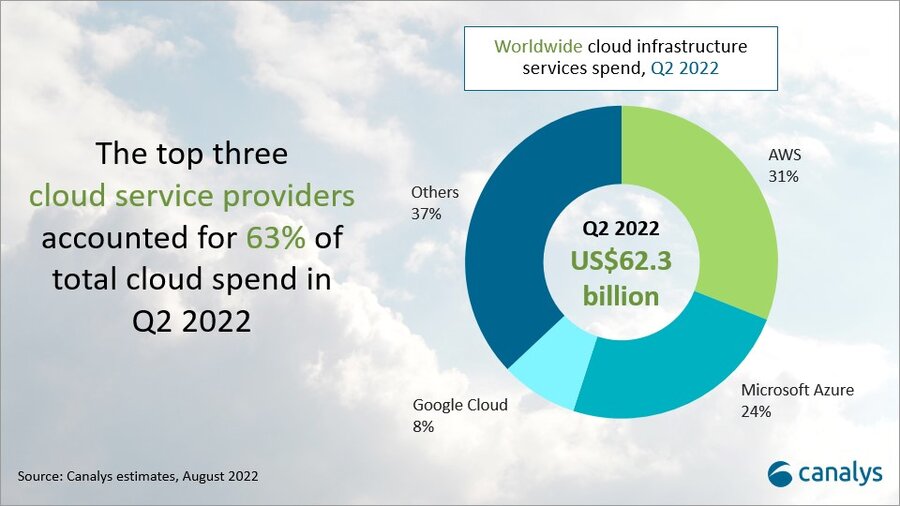

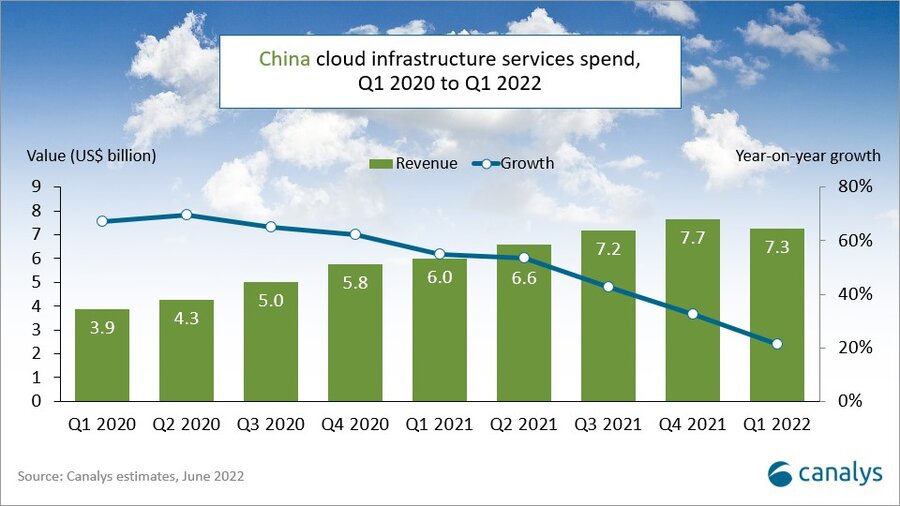

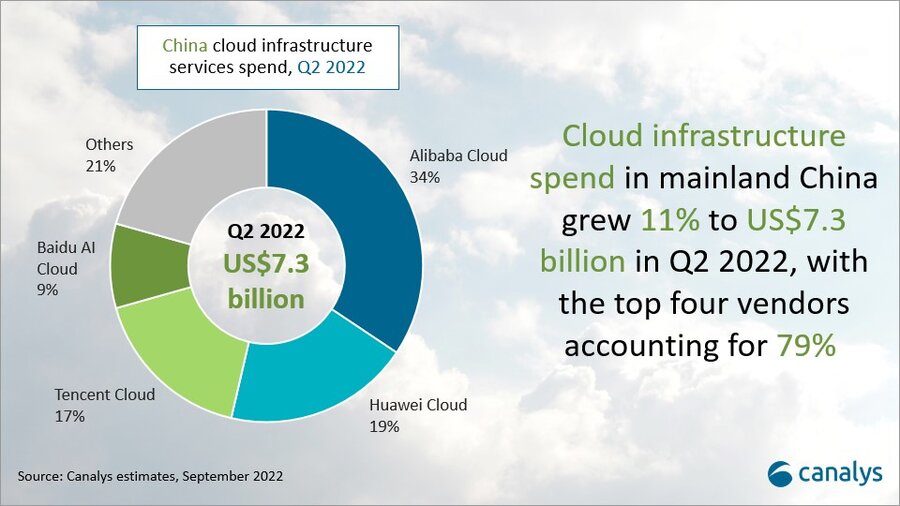

Cloud infrastructure services spend in mainland China grew 11% year on year in Q2 2022, reaching US$7.3 billion and accounting for 12% of overall global cloud spend. In contrast to the high growth momentum of 33% seen in the global cloud services market, China’s market growth slowed significantly, falling below 20% for the first time. The resurgence of COVID-19 in China was a major factor. Canalys forecasts that the Chinese cloud market will regain momentum in the second half of the year as business activities began to resume in first-tier cities in June. Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud maintained their positions as market leaders in the Chinese cloud market. The top four providers accounted for 79% of total expenditure in China, but all four saw a fall in their growth rates compared with past quarters.

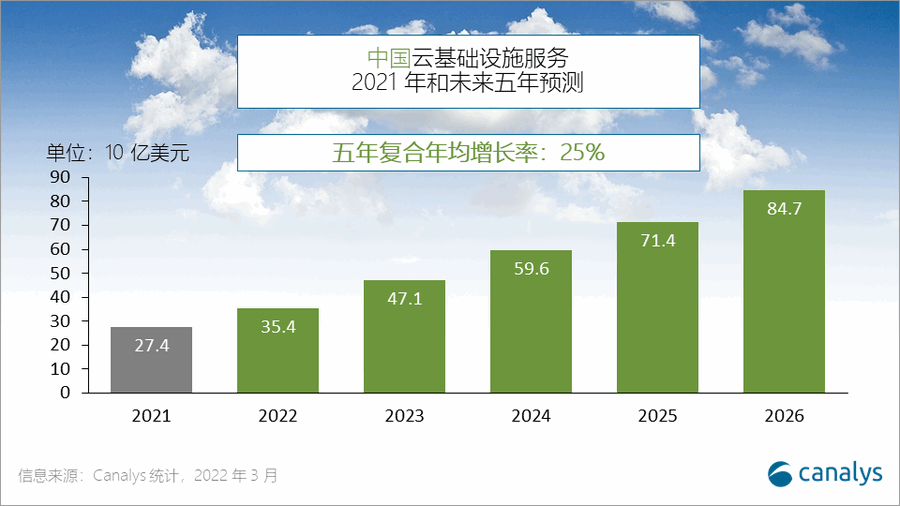

The decline in growth rate was due to the resurgence of COVID-19 in China. But there is still strong potential for cloud adoption in the country as enterprise IT spend is far less there compared with countries with higher levels of cloud readiness. There remain many enterprise customers in traditional industries in China that are looking for ways to migrate to the cloud, especially SMBs.

“China’s cloud services have entered a new era where cloud vendors are no longer focused on just revenue scale and business growth, but more on high-margin, standardized products,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are trying to enrich their cloud capabilities by building their own channel ecosystems to bring together self-developed platform technologies and industry experience from partners. These market leaders have recently held, or will hold, channel ecosystem summits to recruit more channel partners.”

“Chinese cloud vendors typically emphasize having strong vertical focuses, creating products and solutions specific to certain industries, but that comes with high customization costs that can be challenging to navigate when economic pressures increase,” said Canalys VP Alex Smith. “Channel partners can help avoid this by taking over the services component, leaving the vendors to focus on broader platform development.”

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Yi Zhang (China): yi_zhang@canalys.com

Alex Smith (US): alex_smith@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.