PC shipments in China set a Q3 record by breaking through 15 million units

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 29 Nov 2021

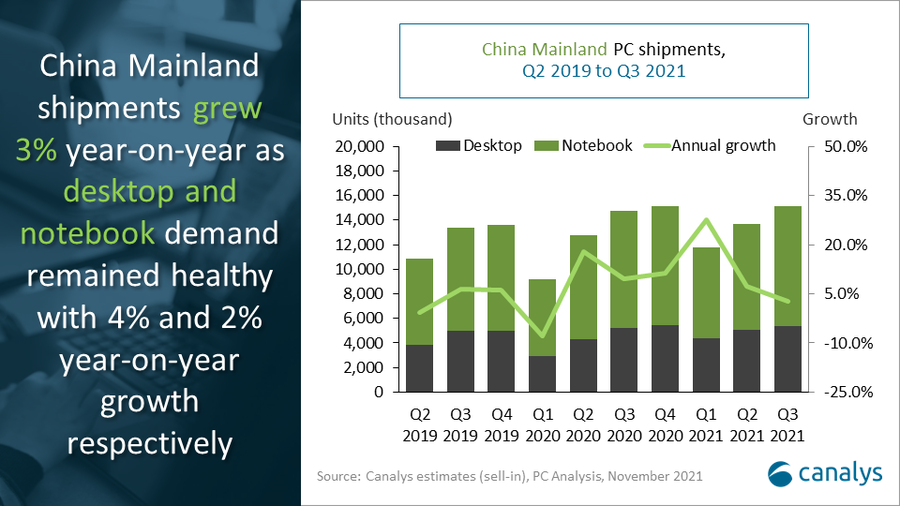

PC shipments (desktops and notebooks) in China grew 3% annually and 10% sequentially to reach more than 15 million units in Q3 2021. Compared to last year, desktop (including desktop workstation) shipments grew 3.8% to 5.3 million units. Notebook (including mobile workstation) shipments were also slightly up by 1.9% at 9.7 million units. The growth has resulted in a record third-quarter shipment in China, beating a year-old record of 14.7 million unit shipments in Q3 2020.

The top four vendors in the desktop and notebook market all enjoyed year-on-year growth in Q3 2021, highlighting the blooming tech economies globally and their impact on the China market. “The PC market for desktops and notebooks this quarter increased by 3% from a year ago and a strong 12% from two years ago owing to a new wave of upgrading in the commercial sector, and a renewed vigor in manufacturing due to the government’s ‘Industry 4.0’ initiatives. Added to this, adjusted purchasing by education to upgrade internal facilities and infrastructure has built strong momentum for the market. While commercial sectors grow, consumer shipments have also seen strong demand due to students purchasing for new school terms, and generic anticipation of good deals from the 11.11 sales in November,” said Canalys PC analyst Emma Xu.

|

China PC shipments (desktops and notebooks) and annual growth |

|

||||||

|

Canalys PC Market Pulse: Q3 2021 |

|

||||||

|

Vendor |

Q3 2021 shipments (thousand) |

Q3 2021 Market share |

Q3 2020 shipments (thousand) |

Q3 2020 Market share |

Annual growth |

|

|

|

Lenovo |

6,002 |

40% |

5,542 |

38% |

8% |

||

|

Dell |

1,948 |

13% |

1,651 |

11% |

18% |

||

|

HP |

1,493 |

10% |

1,301 |

9% |

15% |

||

|

Asus |

1,072 |

7% |

745 |

5% |

44% |

||

|

Acer |

566 |

4% |

670 |

5% |

-15% |

||

|

Others |

4,009 |

27% |

4,801 |

33% |

-17% |

||

|

Total |

15,090 |

100% |

14,709 |

100% |

3% |

||

|

Note: percentages may not add up to 100% due to rounding |

|

||||||

|

Desktops and notebooks are including desktop and mobile workstations, respectively |

|

||||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, November 2021 |

|

||||||

Top-ranked Lenovo saw commendable 8% year-on-year growth with 6.0 million units shipped and a market share increase of 2%. Dell and HP, with shipments of 1.9 million and 1.4 million units, grew by 18% and 15% respectively from Q3 2020. Dell experienced record performance from notebooks this quarter and HP picked up pace in desktops. Asus secured fourth place with 44% year-on-year growth, mostly from its strong notebook shipments, typically gaming capable, which has always been strong in China. Acer maintained its spot in the top five but was the only vendor in the group to record a year-on-year decline of 15%. Local player Huawei has seen shipments stagnate to 0.5 million, just below Acer. Despite the slow growth, it remained a strong alternative to Lenovo for local government purchasing and procurement.

“In keeping with a strategy of building hardware eco-systems, vendors from adjacent markets like smartphones and IoT are now building and enhancing their product portfolios in PCs specifically tablets and notebooks, as necessary growth engines”, added Xu. “Vendors like Oppo, Vivo, Xiaomi and Transsion have all announced new notebook or tablet SKUs, aiming to take a slice of this highly profitable hardware vertical. However, the supply-chain management to cope with the limited component production capacity is a challenge for the long term. Adding to the supply-side problems, the complexity of go-to-market strategies in both B2B and B2C means that merely launching a hardware SKU will not imply success. New vendors will need an exhaustive channel strategy to survive in a market where vendors like Lenovo, Apple, HP and Dell dominate by a mile.”

For more information, please contact:

Emma Xu (Canalys China): emma_xu@canalys.com +86 158 0075 6471

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.