North American wearables market Q2 2020

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, September 4, 2020

The value of North America's wearable band market in Q2 2020 remained flat year-on-year at US$2 billion, despite shipments growing 10% annually. The average selling price declined 11% to US$235 due to a boom in low-end activity trackers and 30% year-on-year growth for Apple Watch Series 3. Apple Watch Series 5 was North America’s best-selling smartwatch, matching last year’s Series 4 shipments.

North America was only one of two regions to grow quarter-on-quarter, demonstrating sustained consumer demand for wrist-worn devices. As consumers scrutinized personal budgets, their thrift fueled a remarkable growth among the long-tail of lesser-known brands of activity trackers on e-commerce platforms like Amazon. Canalys Analyst Vincent Thielke commented, “Americans invested heavily in sub-US$50 trackers during the pandemic to stay accountable for the greater amount of time spent at home. Amazon’s Q3 introduction of the Halo tracker was timely, following two back-to-back quarters of strong activity tracker sales. Subscription-based companion apps helped Fitbit and less-familiar players like Whoop better differentiate themselves against the vast array of devices sold online. Turnkey service offerings proved a surprising pandemic winner as social distancing discouraged personal trainers and exercising in close proximity to others.”

The surge in basic bands offset the United States’ third consecutive quarter of smartwatch decline, triggered by the clearing-out of channel inventory as Samsung and Fitbit prepared August releases. Wear OS brands also greatly reduced sell-in because of store closures, but also as they began transitioning to Qualcomm’s next-generation chip. As all major vendors set their sights on 2021, medical-oriented devices will move certain products into an elevated tier, creating stronger differentiation between casual fitness and advanced health tracking.

|

North America wearable band shipments by vendor and year-on-year growth |

||||||

|

Vendor |

Q2 2020 |

Q2 2020 regional share |

Q2 2019 |

Q2 2019 regional share |

Annual |

|

|

Apple |

3.2 |

37.6% |

2.9 |

37.9% |

+9% |

|

|

Fitbit |

1.6 |

19.3% |

1.9 |

24.1% |

-12% |

|

|

Garmin |

0.7 |

8.1% |

0.5 |

7.0% |

+27% |

|

|

Samsung |

0.4 |

5.0% |

0.8 |

10.6% |

-48% |

|

|

Verizon Wireless |

0.1 |

1.9% |

0.0 |

0.4% |

+478% |

|

|

Others |

2.4 |

28.1% |

1.5 |

20.0% |

+54% |

|

|

Total |

8.5 |

100.0% |

7.7 |

100.0% |

+10% |

|

|

Note: percentages may not add up to 100% due to rounding. Shipments are in millions. |

||||||

For more information, please contact:

Canalys China

Cynthia Chen: cynthia_chen@canalys.com +86 158 2151 8439

Jason Low: jason_low@canalys.com +86 159 2128 2971

Canalys India

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys Singapore

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Canalys EMEA

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785 683 766

Canalys USA

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2020. All rights reserved.

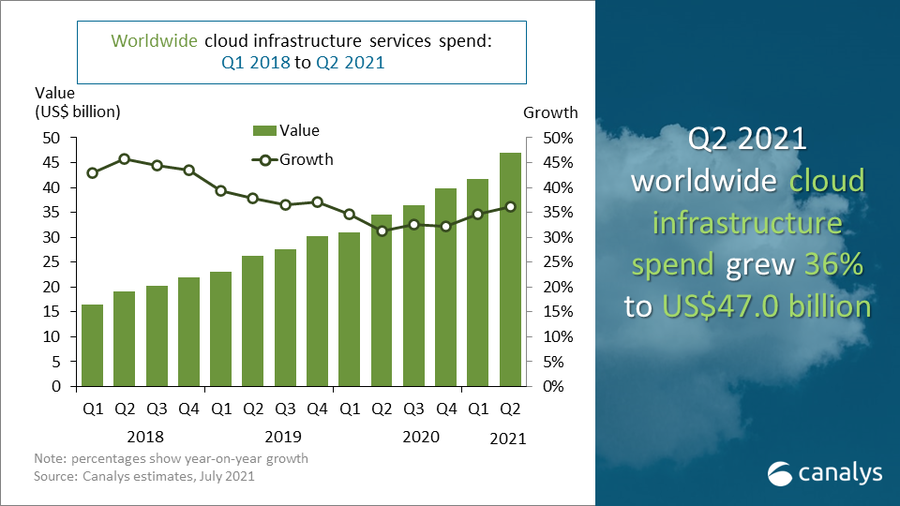

Global cloud services spending exceeded US$47 billion in Q2 2021