AI-capable PC shipment share rises to 23% in Q4 2024

Tuesday, 25 February 2025

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

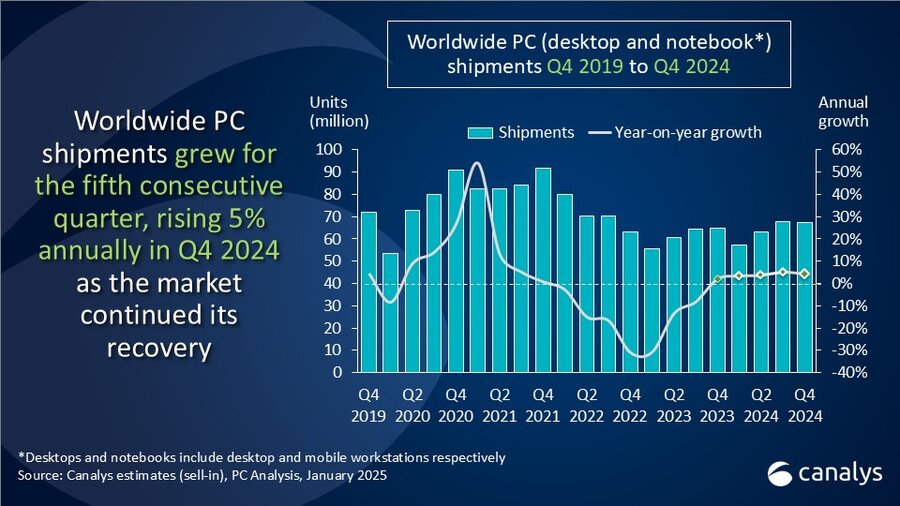

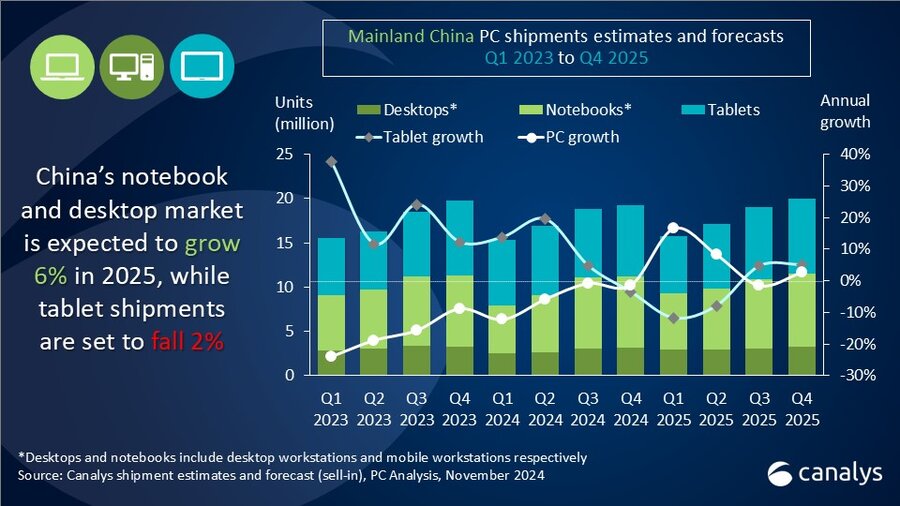

The latest Canalys, now part of Omdia, data reveals that AI-capable PC shipments hit 15.4 million units in Q4 2024, accounting for 23% of all PC shipments during the quarter. AI-capable PCs are defined as desktops and notebooks that include a chipset or block for dedicated AI workloads such as an NPU. The ramp-up in the availability of such devices led to a sequential growth of 18% for this category of PCs. For the full year 2024, 17% of PCs shipped were AI-capable, with the biggest winners being Apple at 54% share, followed by Lenovo and HP at 12% share each. The refresh cycle induced by the Windows 10 end of support will continue to drive penetration throughout 2025. However, Trump’s tariffs on US imports are causing uncertainty around price hikes, which could significantly impact the world’s largest PC market.

“Commercial deployments of AI-capable PCs continued their momentum in late 2024 as vendors introduced business-focused programs and products,” said Kieren Jessop, Analyst at Canalys. “Intel is anchoring in the premium tier, with Lunar Lake-powered devices meeting Copilot+ PC requirements but carrying higher costs than their main x86 competitor AMD, which is straddling premium and mid-range segments. Qualcomm is similarly bifurcating its portfolio as it shared plans to bring the X-series processors to US$600-range laptops. Legacy generations of Apple’s Macs have also seen price reductions, which is helping drive its commercial share, particularly in emerging markets,” added Jessop.

“As the deadline for Windows 10 end of support gets closer, it is emerging as the primary refresh catalyst among partners,” said Jessop. According to a January poll of channel partners, one-third cited Windows 10 EoS as the primary driver of their customers’ refresh decisions in 2025. “Many of these partners are expecting the majority of their customers’ refresh to occur in the second half of 2025,” added Jessop. “However, looming trade policy shifts in the US threaten to disrupt the market that accounts for around one in three shipped PCs and could hamper the upcoming commercial refresh cycle and dampen an already muted consumer outlook. So far, the Trump administration has placed a 10% tariff on all Chinese imports, which accounts for a significant majority of laptops shipped to the US.”

Vendor and platform highlights

Total Windows AI-capable PC shipments grew 26% sequentially, accounting for 15% of all Windows PCs shipped in Q4. “At CES 2025, PC manufacturers expanded their focus on AI-driven software, integrating proprietary assistants and applications across more product lines,” said Jessop. “Offerings like Lenovo AI Now, Dell Pro AI Studio, HP AI Companion and Asus StoryCube—while not entirely new—were more prominently featured, signaling a shift toward differentiation through software and user experience enhancements. Furthermore, Apple Intelligence features were released across Mac, iPad and iPhone platforms. Although AI capabilities are not a primary purchasing driver, improved AI processor performance will make personalized experiences and productivity gains increasingly important and expected. Over time, this could influence brand loyalty, shaping customers’ decisions for future device upgrades.”

“Also, at CES, Dell unveiled a major overhaul of its product naming strategy, transitioning from established brands like XPS and Inspiron to a streamlined structure comprising ‘Dell’, ‘Dell Pro’ and ‘Dell Pro Max’. Dell's rebranding strategy reflects a broader industry trend toward simplification and user-centric design. However, the transition period may require substantial marketing efforts to familiarize existing customers with the new naming conventions.”

“Apple finished strong in Q4 2024, significantly outgrowing the top three vendors and achieving a 10.2% market share in the total PC market and 45% share in the AI-capable PC market,” added Jessop. “Apple’s channel strategy continues to evolve as they announced the Apple Partner Network, launching later this year. This revamped program simplifies partner tiers and aims to take a share in the Enterprise segment while providing the necessary services to handle customers. The program highlights Mac’s compatibility and scalability within the Enterprise environment, concerns which have previously kept them out of the segment.”

Canalys AI capable PC definition:

At a minimum, an AI-capable PC must be a desktop or notebook possessing a dedicated chipset or block to run on-device AI workloads. Examples of these dedicated chipsets include AMD’s XDNA, Apple’s Neural Engine, Intel’s AI Boost and Qualcomm’s Hexagon.

Further reading:

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, with additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys, now part of Omdia, is a leading global technology market analyst firm with a distinct channel focus. We strive to guide clients on the future of the technology industry and to think beyond the business models of the past. We’ve delivered market analysis and custom solutions to technology vendors worldwide for over 25 years. Our research covers emerging, enterprise, mobile and smart technologies. Understanding channels is at the heart of everything we do. Our insightful reports, data and forecasts inform our clients’ strategies, while the Canalys Forums and Candefero online community give the channel feedback opportunities. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2025 TechTarget, Inc. or its subsidiaries. All rights reserved.