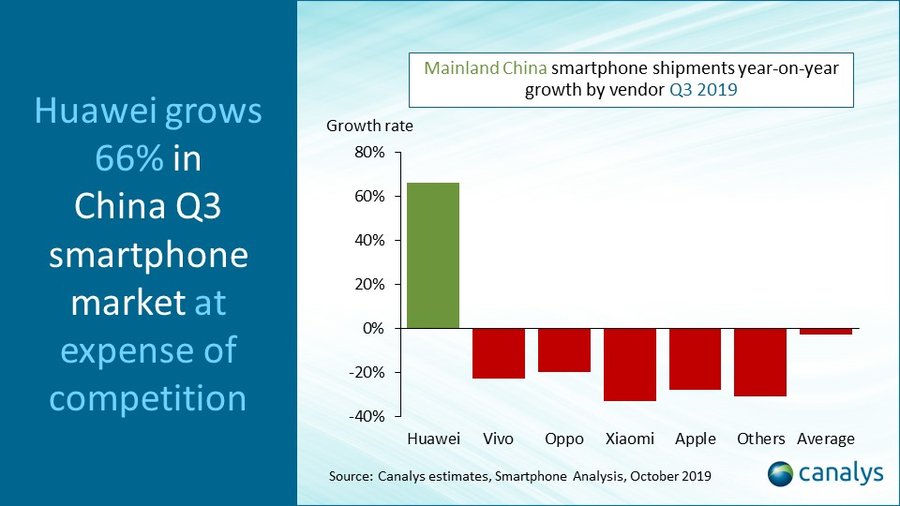

Canalys: Huawei grows 66% in China smartphone market at expense of competition

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 30 October 2019

The China (mainland) smartphone market improved sequentially in Q3 2019 as shipments reached 97.8 million, from 97.6 million units in Q2. China is still shrinking against the previous year, though the decline has narrowed to -3%. Huawei extended its market lead by shipping 41.5 million smartphones, to reach a record market share of 42%, an annual growth of 66%. This is Huawei’s sixth consecutive quarter of double-digit growth amid a gloomy China market. Shadowed by Huawei’s strong performance, the remaining top five vendors, Oppo, Vivo, Xiaomi and Apple, shrank further. Their combined share only accounted for 50% of the market, down from 54% in Q2 2019, and 64% in Q3 2018.

“Huawei opened a huge gap between itself and other vendors. It has 25% more share than this quarter’s runner-up, Vivo,” commented Nicole Peng, Canalys VP of mobility. “Its dominant position gives Huawei a lot of power to negotiate with the supply chain and to increase its wallet share within channel partners. Huawei is in a strong position to consolidate its dominance further amid 5G network rollout, given its tight operator relationships in 5G network deployment, and control over key components such as local network compatible 5G chipsets compared with local peers. This puts significant pressure on Oppo, Vivo and Xiaomi, which find it very hard to make any breakthrough.”

Vivo surpassed Oppo to take the number two position, while Xiaomi followed in fourth.

“Vivo, Oppo and Xiaomi’s shipments are in freefall, despite new products constantly being pushed to market,” added Shanghai-based Canalys Research Analyst Louis Liu. “Smaller vendors hope to leverage 5G to rapidly boost market share given that China major operators have aggressively pushed 5G pre-registration with plentiful discounts and free 5G data allowance, which has resulted in over 10 million subscribers registering an interest to move to 5G.”

“In addition to Huawei, Vivo, ZTE, Xiaomi and Samsung have launched 5G-capable smartphones between US$500 and US$1000, with more products likely to follow in Q4. However, Canalys expects 5G tariffs and device prices to fall rapidly to attract mass market consumers, with similar intense competition to the 4G era among major vendors, causing first-mover advantage in 5G to diminish in next to no time.”

Apple maintained the number five position, thanks to the immediate boost of iPhone 11 launches in September, which accounted for nearly 40% of its Q3 shipments.

“Apple is more prepared than previous years to face strong headwinds in China.” Commented Liu. “Its iPhone 11 models focused on camera improvements, which proved desirable to Chinese consumers. More importantly, a lower launch price of iPhone 11 and a more flexible channel margin structure for local distribution on the new devices, were critical market stimuli for Apple. But it faces a looming challenge, as Chinese vendors and operators are set to drive heavy marketing and promotions around 5G in the next two quarters. This could steal its thunder.”

For more information, please contact:

Canalys China

Louis Liu: louis_liu@canalys.com +86 136 2177 7745

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys India

Adwait Mardikar: adwait_mardikar@canalys.com +91 96651 38668

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys Singapore

Matthew Xie: matthew_xie@canalys.com +65 8319 8343

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Mo Jia: mo_jia@canalys.com +33 785683766

Canalys Americas

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Vincent Thielke: vincent_thielke@canalys.com +1 650 644 9970

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com