Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

MSP trends and predictions 2025 - executive summary

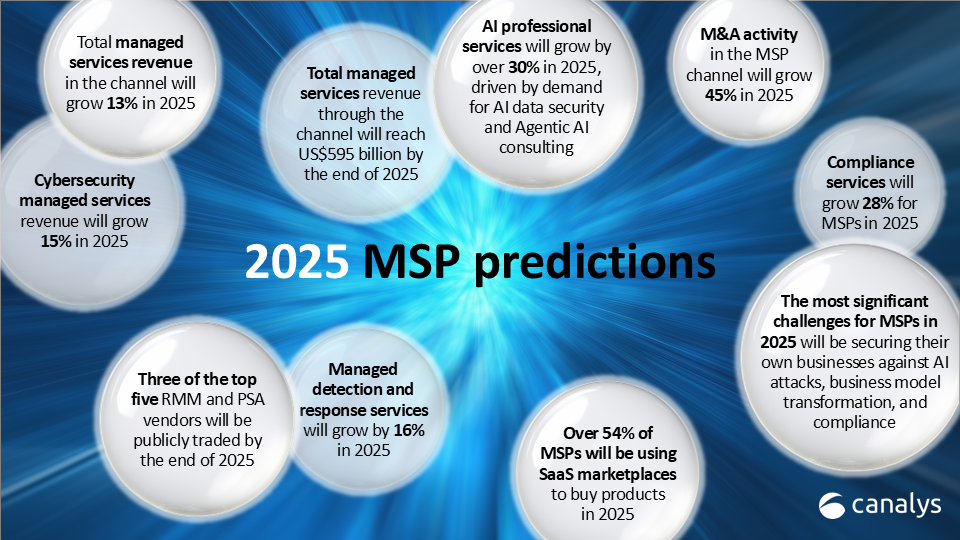

In 2025, the IT managed services industry is poised for significant growth globally, led by a surge in demand for cybersecurity-focused services amid evolving buyer preferences. The year ahead also brings opportunities and challenges such as the adoption of cutting-edge technologies like Agentic AI, increased M&A activity, and the need for MSPs to navigate complex compliance and regulatory landscapes within the industry.

2025 will see good growth for partners in managed services

IT managed services revenue in the channel will grow approximately 13% year-on-year in 2025, to US$595bn globally. This accounts for all IT managed services delivered by channel partners of all kinds around the world. By the end of the year, there will be around 341,000 partners delivering these managed services. The APAC region is likely to see the highest growth in 2025, around 15%, while EMEA and North America will trail slightly, at approximately 12% and 10% respectively.

New buyers helping shift MSP model towards security first

The MSP model has shifted in recent years and 2025 is likely to see a greater push towards MSP 3.0. Customers have been pushing a different buying path towards a more co-managed and cloud-first model. The complexity of the new delivery model encompasses not just technology, whose scope is increasing to include cybersecurity as standard (rather than as an add-on to IT support), but also compliance, regulation, and vertical expertise. So MSPs that do not offer these things may not be able to operate in the near future, or at least fewer of these will be able to.

Newer cyber solutions expected to see high growth for MSPs

MSPs have moved from anti-virus to multi-factor authentication (MFA), and endpoint detection and response (EDR) services, but these are now fast becoming saturated, and managed and extended detection and response (MDR and XDR) are becoming more common, as are secure access service edge (SASE), Zero-trust, anti-data exfiltration (ADX), SaaS monitoring and backup, password management, DNS protection, content filtering, and domain-based messaging authentication and reporting conformance (DMARC) to name just a few. The key for MSPs here is that cybersecurity sees a high markup, but in order to stay ahead of customer expectations, MSPs must continue to stay ahead of the technology curve.

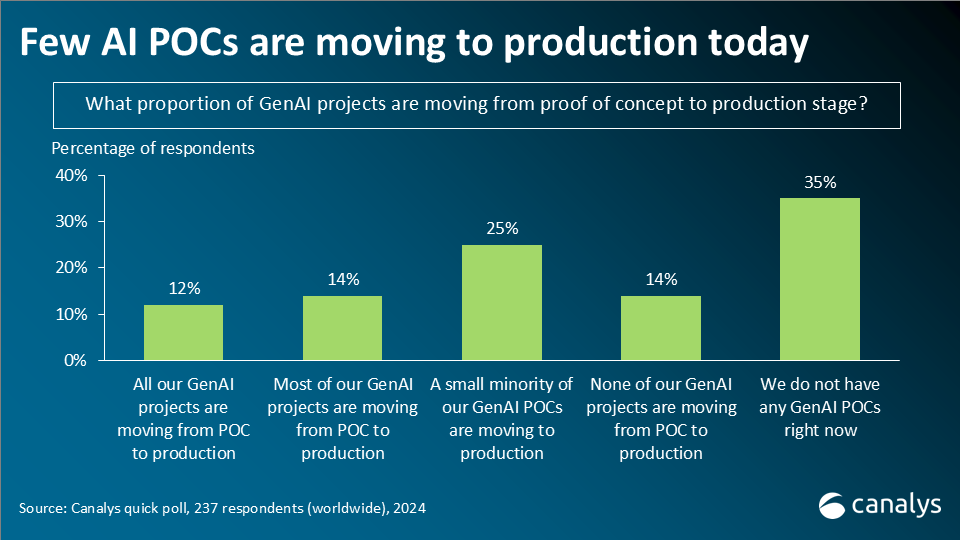

2025, the year of Agentic AI…marketing

According to a recent Canalys poll, 61% of partners still struggle to get AI projects out of the proof-of-concept stage with customers but these stats are changing quickly and there is no doubt AI, in some form or other, is being rapidly adopted and adapted by both partners and customers. This year, partners should also be working with customers to define the ROI of AI integrations in line of business (LOB) tools. Almost all software providers are either building or trying to define AI improvements to their tools, and this will impact sales, marketing operations, finance, HR, and legal teams regarding the software they use most commonly. If partners are not educating themselves on how vendors in those spaces are building AI improvements and using this knowledge to help customers define the ROI of AI for these teams, they will lose out on the opportunity to influence the buying process and the potential managed services opportunities that may derive from that.

Compliance and regulation will be a key challenge for MSPs in 2025

The number of regulations affecting service providers and their customers is growing, the latest in the EU being the Digital Operational Resilience Act (DORA), which applies and ICT risk framework to financial entities. DORA is just the latest in a long line of regulations affecting MSPs delivering services to customers around the world. Compliance and regulation will be one of the three key challenges for MSPs in 2025 as they increase the liability faced by partners in delivering services, particularly those operating in certain verticals.

M&A activity will grow this year in both the channel and vendor spaces

The number of mergers and acquisitions in the MSP channel grew less in 2024 than in 2023, mostly due to the higher cost of borrowing, and political and economic uncertainty, but 2025 is set to produce strong growth numbers across the board. 2025 will almost certainly see continued acquisitions in the MDR and XDR vendor spaces, as well as see AI tools being added to portfolios by vendors to boost their platform plays. A number of AI service management and ticketing vendors are emerging, and these will be very interesting acquisition targets for other vendors in the MSP space. Canalys predicts three of the top five vendors in the RMM and PSA spaces will either file for an IPO or be acquired by private equity by the end of 2025.

Cloud marketplaces and distribution are converging, but the value is in the data

Over 70% of all IT revenue flows through the channel. As this second tier of channel increases its integration with the large cloud marketplaces such as AWS, Microsoft, and Google it must define its value more clearly. There are several different types of partners in the distribution layer of the channel; global distributors with cloud marketplaces such TD SYNNEX, Ingram Micro, Arrow ECS, and Westcon, cloud services e-commerce platforms such as Pax8, and cloud solutions providers such as Sherweb are all pushing hard to get closer to the partner and ultimately deliver greater value to the end-customer. It is vital they take the next step in 2025 and maintain their investment in the channel.

MSP certification and training could be overhauled in 2025

MSPs are also looking to consolidate some of their training, to get industry-wide framework certifications, such as CMMC, Cyber Essentials Plus, Essential Eight, or NIS2 for example recognized by vendors within their MSP programs. This would mean MSPs would have to spend less time and money on having their businesses certified across multiple vendors for delivering managed security for customers. These certifications would not replace the individual technological certifications which are taken by the MSP’s tech staff, but would go a long way to making it easier for MSPs to be recognized by vendors in their program tiering and would make it easier for vendors from an administrative perspective.

Telco services packages are on the rise

The total addressable market (TAM) for telecommunications (telco) services will reach US$1.5T in 2025, growing 3.7% year-over-year (Y-o-Y), while other IT services are projected to reach US$1.8T and grow 10.7% Y-o-Y. 80% of channel partners in a recent Canalys poll said they bundle IT and connectivity solutions for customers at least some of the time. 2025 is likely to see a continuation of this trend as partners look to capture higher value services while still delivering necessary connectivity solutions.