Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Unlocking growth with software, services and features in the smart personal audio market

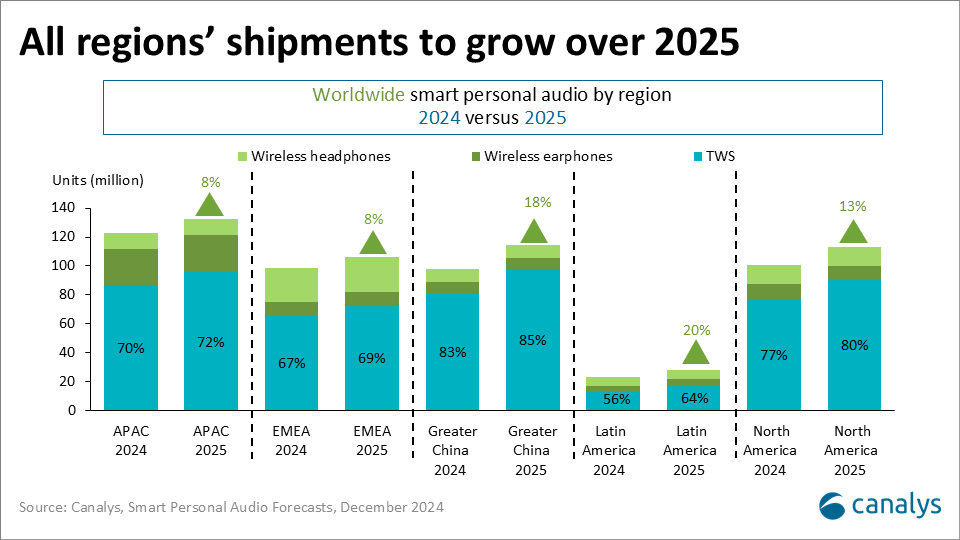

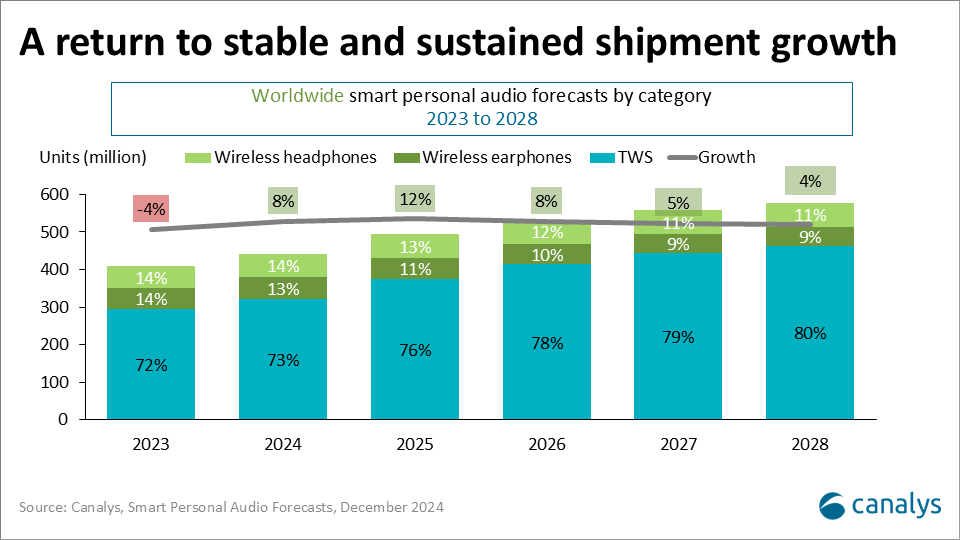

The smart personal audio market is set to grow 8% in 2025, reaching 533 million units. Key drivers include advancements in MEMS speakers, health-focused features, and improved connectivity such as Bluetooth LE and lossless Wi-Fi streaming. Growth is fueled by rising media consumption, with emerging markets including the Middle East and Latin America leading demand. To thrive, vendors must balance innovation, strong branding, and effective distribution strategies to meet evolving consumer needs.

Rising media consumption fuels demand

The surge in global media consumption is transforming smart personal audio devices into essential daily tools, driving significant growth in device shipments through 2025 and beyond, and providing vendors with a great opportunity to capitalize on the growing demand. The following statistics and insights are from Omdia’s Media and Entertainment research.

1. Music streaming growth

Music streaming, a key driver of this trend, continues to thrive. Active users are projected to increase from 793 million in 2024 to 884 million in 2025, with recorded music revenue climbing from US$40.7 billion to nearly US$47 billion over the same period. Growth in streaming is particularly strong in regions like Asia, Eastern and Central Europe, and Latin America, with Turkey leading in premium stream gains. Traditional markets including the US, UK, and Canada experienced a slight decline in market share. It’s no surprise the growth rate in more developed markets is slowing. Services rolled out in markets with higher per capita spend on recorded-music first and so the number of potential new subscribers has inevitably reduced. Conversely, less developed markets, such as those now showing the best growth rates were second in the queue for music service expansion. However, services and music companies have placed greater emphasis on boosting take up in these emerging markets. Spotify, for one, has consistently reported an over indexing of subscriber growth in these markets with promotional campaigns and discount offers proving successful.

2. Audiobooks and podcasts

Audiobooks and podcasts are witnessing a boom. Monthly podcast listeners are set to grow from 1.434 billion in 2024 to 1.550 billion in 2025, reflecting the increasing versatility of smart personal audio devices. Audiobook consumption is also on the rise, supported by Spotify’s expansion into the space and Amazon’s integration of Audible content into its Amazon Music platform.

Unlocking market growth with software, services and features

The growing reliance on smart personal audio devices and advancements in product capabilities are driving exponential market growth. This surge creates a feedback loop of innovation and rising consumer expectations, opening new opportunities for vendors to differentiate themselves and meet the demands of an ever-evolving audience.

One critical area of innovation lies in enhancing software and services. Vendors can capitalize on the increasing demand for content by introducing features that offer personalized and immersive experiences. Advanced audio customization tools, such as dynamic EQ adjustments and exclusive device-linked functionalities, can help create premium user experiences. For example, Apple’s seamless integration of lossless audio on Apple Music with AirPods and iPhones exemplifies how ecosystem-driven innovation can boost consumer appeal. Vendors could also explore automatic EQ and playback settings that adapt to the type of content being consumed, ensuring optimal audio quality across music, podcasts, and video platforms.

Strategic partnerships with streaming services, social media platforms, or audio software developers present another avenue for differentiation. These can help vendors create robust ecosystems to attract new users and encourage loyalty among existing customers.

Another significant driver of growth is the rising awareness of hearing health. As media consumption increases, so does the potential for hearing-related issues, prompting vendors to integrate protective features such as loud audio damage alerts and microphone-based amplification for users with mild to moderate hearing loss. Investing in these technologies is not just a response to consumer demand – it’s a forward-looking strategy that positions vendors as leaders in health-conscious innovation.

Capitalizing on growing demand through hardware innovation

Vendors must go beyond software enhancements and drive innovation in hardware. By introducing cutting-edge technologies, vendors can capitalize on the projected growth in device shipments and meet evolving consumer expectations.

One transformative development is the introduction of MEMS (Micro-Electro-Mechanical Systems) speakers, which promise to redefine audio performance. Companies like xMEMS are pioneering solid-state audio drivers, which it showcased at CES, that deliver superior sound quality, extended battery life, and advanced noise cancellation. While still in its early stages, this technology is expected to gain traction in late 2025, marking a significant leap forward in portable audio solutions.

Expanding use cases are further shaping the market. Features such as solar powered or touchscreen charging cases and health-focused open-ear designs are enhancing convenience and broadening functionality.

Connectivity advancements are also revolutionizing smart audio. Lossless audio streaming over Wi-Fi, enabled by platforms like Qualcomm’s S7 and S7 Pro, addresses the limitations of Bluetooth and delivers unparalleled sound quality. Meanwhile, the adoption of Bluetooth LE (Low Energy) is reducing latency and improving power efficiency, making high-end features accessible to mid-tier and even entry-level devices.

With the global smart personal audio market poised for significant growth in 2025, vendors have a unique opportunity to redefine audio experiences. To stay ahead, they must prioritize innovation, forge strategic partnerships, and deliver user-centric features that cater to rising media consumption trends and evolving consumer expectations. By embracing these strategies, vendors can not only stand out in a competitive landscape but also shape the future of personal audio.