Retailers retain the edge in the developing IoT market... for now

30 June 2022

Wasabi Technologies announced the opening of a new data center in Singapore on 6 June, 2022, its fourth data center in the Asia Pacific market, following Japan and Australia.

While the cloud services market is dominated by cloud titans including AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud, many small specialist cloud service providers are emerging. Rather than offering a full range of cloud services, these specialist providers focus on specific products or solutions either targeting specific industries (finance, healthcare, among others) or certain functions (for example, storage). Their revenues may be orders of magnitude lower compared to the top hyperscalers, but these specialist providers have earned a place in the overall market through their specialization and simple delivery models which reduce the time needed for customers to migrate to the platform.

Wasabi Technologies, founded in 2017, is one of these specialist cloud service providers. Focusing only on cloud storage, it earned US$275 million funding within five years. As a high-growth company, Wasabi continues to expand its global presence, and now has 13 data centers established in North America, Europe, and Asia-Pacific serving customers globally.

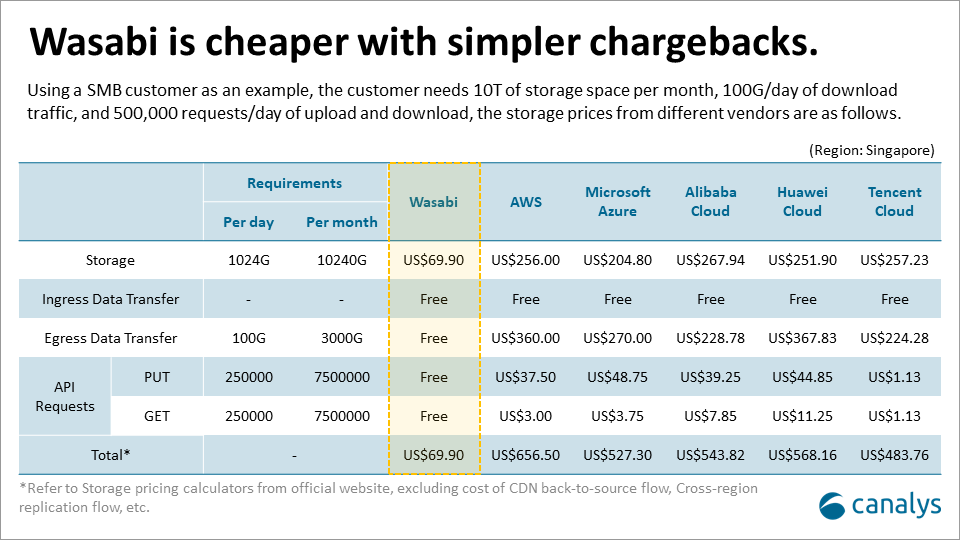

Since its inception, Wasabi has been laser-focused on the cloud storage market segment. Based on experience, it is optimizing the storage architecture of AWS' Amazon S3, to create a cheaper, higher-capacity cloud storage product. We will use an example to explain its advantages in pricing. Let's assume an SMB customer needs 10T of storage space per month, 100G/day of download traffic, and 500,000 requests/day of upload and download, the storage prices from different vendors are as follows.

Wasabi is far cheaper when compared with the cloud titans, primarily due to simpler chargebacks. It charges only for storage capacity and does not charge egress fees, fees for retrieving data in the cloud, or fees for requests for API. The secret to sustaining its pricing is the software it uses to achieve a set of in-house-created hardware and software efficiencies, which allows the product to maintain a high speed at which data is read and written while expanding the drivers’ capacity.

Wasabi has no complex product features or chargeable items, allowing salespeople to quickly understand the product and explain their sales pitches to customers. They can clearly explain what Wasabi's storage is and how it is billed. Customers with no experience or technical foundation in cloud services often spend significant time migrating to the cloud, which partly stems from the complexity of platforms. Wasabi's proposed simplicity reduces the learning curve and costs for customers, freeing up resources to focus elsewhere.

Wasabi's market expansion has always been based on qualified demand. It will expand business where it identifies opportunities. Its go-to-market strategy is partner-led, as it builds relationships with top channel partners in different regions (for example, SHI in the US and NTT in Japan) to expand through partners’ existing networks. This strategy allows it to quickly build a customer base in new markets, even when its own brand is unknown. In addition, the single product offering places it in non-competition with software companies like Veeam and MSP360, allowing it to build key technology relationships and integrate their respective offerings.

It has two current customer types. One are businesses at the early stages of cloud migration. These businesses are looking to change their storage approach but lack experience in migrating to the cloud and the technical know-how to navigate ‘full-featured’ platforms. The other type are businesses that have high data storage requirements (for example, video surveillance companies). These data-intensive businesses want to reduce the cost of storage. Wasabi services both types of customers by replacing the way companies expand their capacity through purchasing hardware storage, winning customers over with its simplicity of use and lower prices. These advantages are likely to appeal to more customer types as multi-cloud deployments gain popularity.

Asia-Pacific is a highly competitive market for cloud providers, especially over the past few years due to the rapid growth of the digital economy. Many hyperscalers, such as AWS and Alibaba Cloud, have added new data centers across the region. The opening of Wasabi's data center in Singapore follows three other openings across APAC, which once again validates the surging demand for cloud services in the region. Overall, Wasabi’s emergence will hardly change the overall market landscape in the short-term as the scale of the established Cloud titans is significant, and they play in sectors that Wasabi does not target. The potential threat to these vendors, from Wasabi's presence in the market, will take time to be broadly felt, although sometimes the toughest competitors are those that float under the radar. Furthermore, Wasabi's emphasis on the channel could offer some teaching for many cloud vendors that are predominately direct-led. The lack of a clear channel strategy affects certain cloud vendors, especially the China-headquartered ones which also have identified the rest of Asia Pacific as a growth region.

The launch of the fourth data center means Wasabi has seen the APAC market as a promising market to expand into. Its trajectory in APAC started with high-cloud readiness countries like Japan and Australia. As more customers become comfortable with their cloud deployments, they may find it more attractive to work with a full-service cloud provider to gain access to additional cloud services. Wasabi may eventually have to expand its portfolio further to compete from a feature standpoint. But for the time being, its first step though is to cement the Wasabi brand as a cloud storage provider throughout Asia-Pacific.