LATAM’s short-term economic and political outlook: Argentina and Brazil

20 July 2022

Part two of the blogpost looks at the short-term economic outlook for Chile, Colombia, Mexico and Peru.

The first part of this blogpost on Latin America’s short-term economic and political outlook looked at Argentina and Brazil. This second part looks at Chile, Colombia, Mexico and Peru.

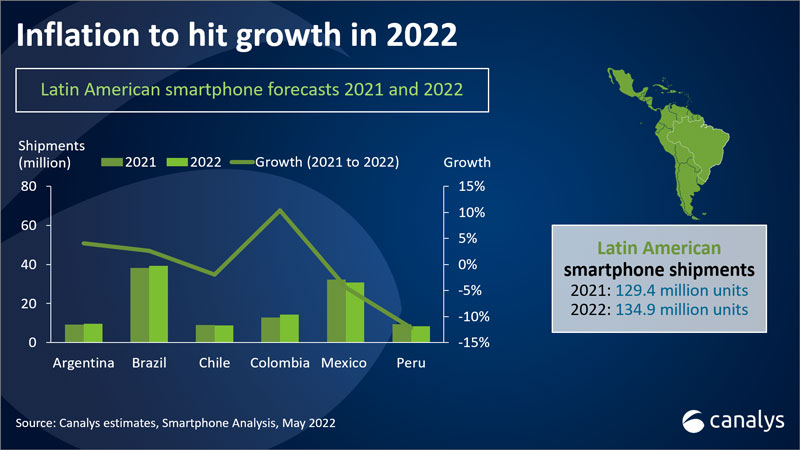

Chile: Canalys expects the Chilean smartphone market to contract by 1.95% year on year to 8.9 million units in 2022. Yearly inflation in Chile reached 12.5% in June 2022, the highest level since 1994 and the highest in the Latin American region after Argentina and Venezuela. The “Chile Apoya” economic package could fuel inflation even further. In line with growing inflation, consumer confidence suffered its biggest drop when compared with other Latin American nations.

Despite the macroeconomic uncertainty, Chile is a mature smartphone market, and its rapid 5G roll-out is helping to raise both the ASP and shipments in mid-range and higher price brackets. Its telco industry’s strength and competitiveness are boosting 5G adoption and subscriber numbers.

Colombia: Canalys expects the Colombian market to grow by 10.4% year on year to 14.2 million units in 2022. The reaction of markets and the population to the second round of presidential elections, which saw a win for the first time in Colombian history for a left-wing president, has triggered the depreciation of the Colombia peso by 11%. This will likely exacerbate further inflation in the coming months for imported goods, with expectations that the peso could depreciate up to 30% in the short term.

Despite recent uncertainty, it is expected that the Colombian economy will continue growing in the short term, even if growth will moderate when compared to 2021. Colombian GDP grew 1% in Q1 2022, with commerce the highest-growing segment (15% year on year), after artistic activities and entertainment (36%).

Regarding 5G, there are no dates in sight for 5G spectrum auctions.

Mexico: Canalys expects the Mexican market to decline by 4.5% year on year to 30.7 million units in 2022. Mexico experienced a gradual recovery from the pandemic. Its Central Bank’s conservative practices are helping to keep inflation below double-digit growth. The Mexican peso has remained stable when compared to other currencies in the region. Interest rate hikes have put the rate up to 7.75%, close to its historical high of 8.25%. This is a stress test for the Mexican economy, with unknown results.

On the other hand, high inflation in the US has also been affecting remittances going to Mexico since the start of 2022, due to the impact of US inflation on families’ disposable incomes. Inflation is also delaying the recovery of tourism in Mexico, as more than 60% of visitors come from the US.

5G plans are moving forward. Telcel is expecting to offer 5G connectivity in more than 120 cities in Mexico before the end of the year, while also growing its 4G coverage. AT&T is expecting to reach 25 cities in the same period. Even if the coverage is growing, local users are reporting a similar experience to 4G, which, along with the lack of competition in the telco market, could have an impact on 5G smartphone shipments.

Peru: Canalys expects the Peruvian market to decline by 12% year on year to 8.3 million units in 2022. After strong depreciation of the Peruvian sol, it has regained some value and stability since March 2022, thanks to the intervention of the Peruvian Central Bank over the last two years. Cumulative inflation over the latest 12 months until June 2022 was 9.32%, and the expectation is that it will slow gradually until the end of 2022.

Meanwhile, 5G deployment in Peru remains stagnant. Operators are offering 5G NSA, as new spectrum auctions for 5G bands haven’t been announced yet, which is detrimental to the user experience.

Latin American markets are constantly evolving, creating new challenges and opportunities for smartphone vendors. If you would like a more in-depth view of a specific market or opportunity, feel free to reach me here.