Canalys recognizes 2022’s cybersecurity channel leaders

14 November 2022

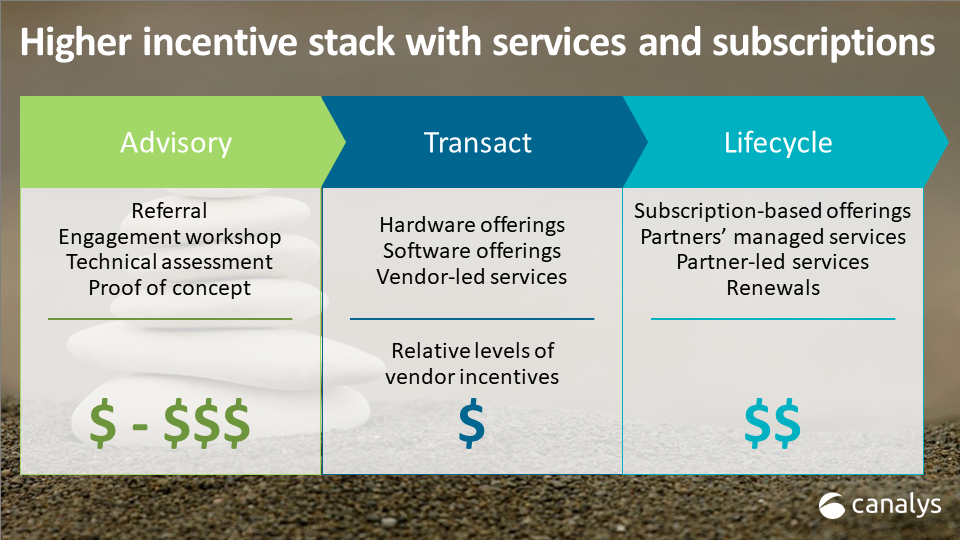

Vendors are evolving their partner incentives for subscriptions and services, and these incentives will add to the existing arsenals that partners receive today, rather than replace them. Rewarding “influence” with financial benefits can be fraught with challenges for vendors but this is not stopping them from increasingly introducing rewards for influence, as influence and referral roles become more important.

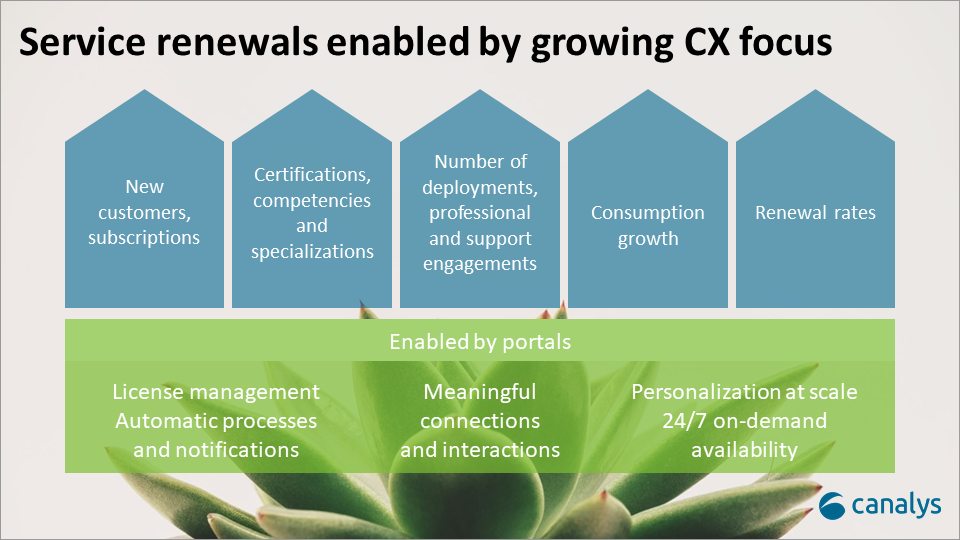

Vendors everywhere are expanding the number of channel routes to market, and the unified partner program model has now become an industry standard for both hardware and software vendors. Vendors are evolving them to satisfy the needs of next-generation partnerships, which are no longer characterized by just transactional upfront sales but opportunities to deliver value across the entire customer lifecycle. They are embracing new routes to market and partnership models: cloud marketplaces, digital and ecommerce platforms, agencies, ISVs, MSPs, and cloud and SaaS distributors. And as they pivot more heavily toward services and solutions, some are also reimagining their value propositions for their partner competencies and specializations to better reflect partner skills.

When it comes to subscription-based incentives, most vendors are redesigning their incentive models to reward partners beyond the initial sale, as partners become critical to driving activation, adoption, usage and renewal. This includes non-transactional activities, such as brokering meetings, technical assessments, customer workshops and even deal registrations for deals closed by them but fulfilled by other partners. Cisco, Microsoft and VMware are among those vendors redesigning their incentives for the customer lifecycle journey, and more vendors are following suit. Land-adopt-expand-renewal incentives are evolving and Canalys is studying what is on the market today.

Alongside reseller rebates, other subscriptions and services incentives available on the market today include:

Another benefit pushed to the forefront by the growing importance of services, SaaS and subscriptions is co-selling. Co-selling effectively means strengthening the pre-sales motion by incentivizing a vendor’s own sales teams to sell a partner’s solution or service or incentivizing other partners to do this. For many vendors, it remains underdeveloped, partly because of the complexity of processes involved and the need to change sales behavior. Vendors have typically focused on facilitating the ease and accuracy of such matches so far, whether that is co-selling with the vendor or partners. P2P co-sell incentives, depending on the nature of the co-selling, can help keep customers within vendors’ own channel ecosystems while expanding the customer reach of their partners.

Examples of co-selling incentives available today include:

Partner incentives for subscriptions and services are challenging to implement because vendors must consider the roles that partners play as well as their level of expertise or commitment to the vendor. Other factors, such as channel-centricity, ease of business, service availability, customer leads and pricing assurance, are vital for many vendors to establish greater trust and credibility first. Subscriptions, if the consumer space is any guide, can cost customers more than just pricing once they become reliant on their products. On the other hand, they are helpful for businesses seeking to reduce their regular cash outflow. Subscriptions and services delivery necessitate an ecosystem of mechanisms and channel partners. Vendors are investing in their partner compensation schemes and those new incentives will add to, rather than replace, the existing arsenal partners can earn when they sell. Incentives are not the only thing needed to drive partners’ change in behavior toward subscriptions and services, but they are certainly a vital one.

For more insights, Canalys clients can read the full report “Partner incentives evolve with subscriptions and services”.