Expert Hubs 2021: fighting threats with cybersecurity

9 November 2021

The response of Samsung's Foldable release seems to have met expectations within the electronic giant thus far and it expects shipments in this category to grow continuously – several times more than its previous year – as it said in the recent Q3 earnings’ call. Concurrently, symptoms of key conversion drivers are starting to emerge.

Back up one quarter to 27 August 2021 when Samsung unveiled its third generation flagship Fold smartphones – the Z fold 3 and Z flip 3 – which replaced the Note series lineup that, for the last five years, have usually been released in Q3. Such consolidation of Samsung's flagship lineup this year aligned well with current global supply chain issues and chip shortages plaguing the industry. In a nutshell, the 3 series’ improvements over the previous generations largely come from durability (a questionable trade-off considering the price value), front-end usability and a launch price lowered by US$200.

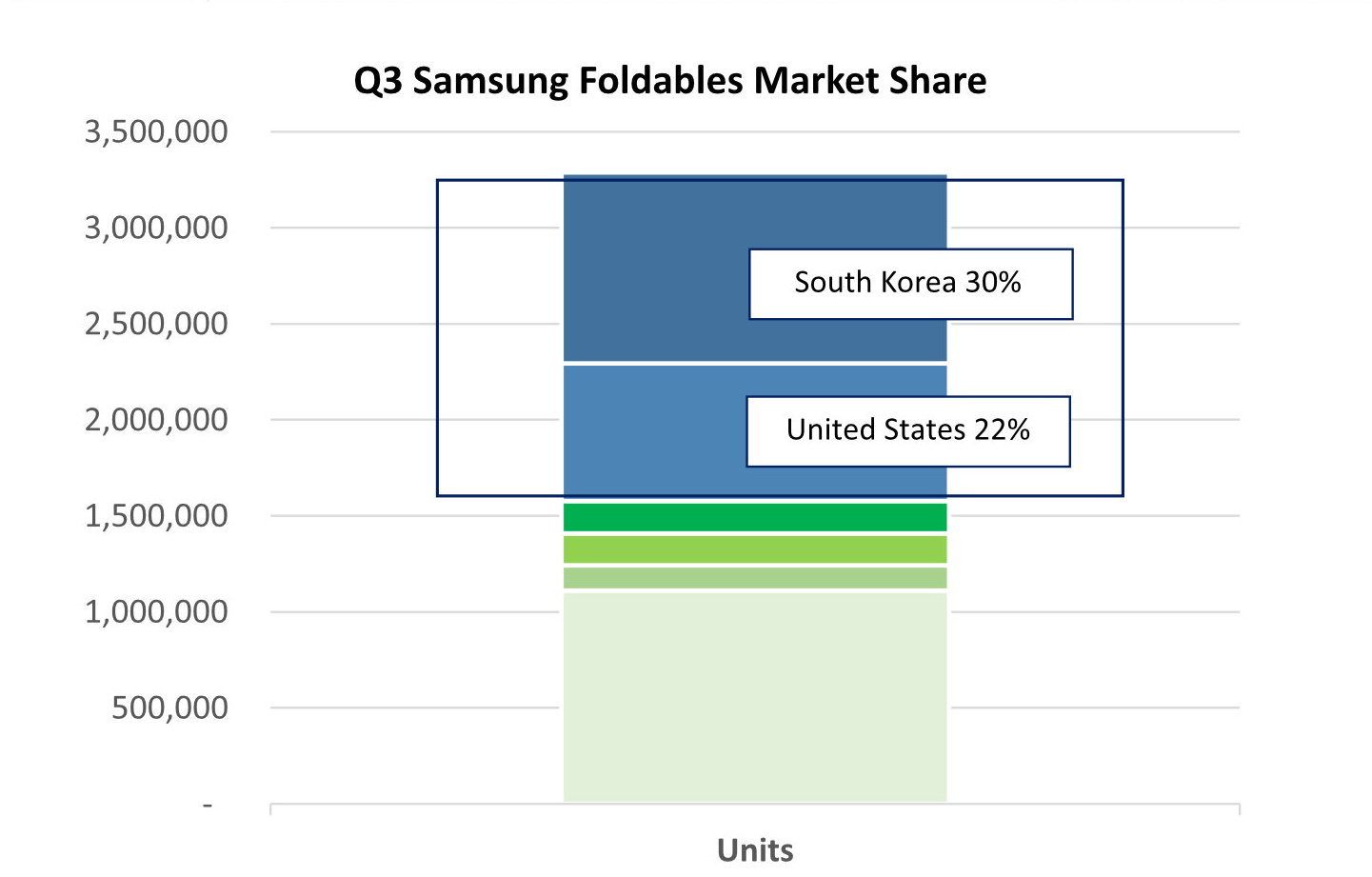

The response to the Foldables release seems to have met expectations within the electronic giant thus far, at around 3.3 million units this quarter based on Canalys data – highly concentrated in South Korea and the United States, at 30% and 22% respectively. This complimented its penetration efforts in these two specific markets, but drew adoption concerns for the remaining countries – UK, Mainland China and Germany have shares around 5% each and the remaining 48 countries have an average of 0.7% each.

Going forward, Samsung expects the overall shipments in this category to grow continuously – several times more than the previous year – as it said in the recent Q3 earnings’ call. Canalys estimates the shipment will reach eight million units in H2 2021.

The Z fold 3 offers an enhanced user experience with a higher refresh rate screen and S-Pen compatibility. Thanks to the Qualcomm Snapdragon 888 processor, released in 2021, the foldable's guts are upgraded with more power. However, while everything looks perfect on paper, something feels amiss – so much power packed into an unoptimized folding form factor throttles the performance and holds back the SoC by overheating. Other functional issues raised by users include battery drain, and S-Pen not cooperating at times which ultimately hurts the user experience. Fixes have to come from further optimization; and Samsung has the opportunity to optimize software with its vertically integrated hardware supply.

But Samsung wants to have a more-integrated and powerful device (that also yields efficient power consumption as seen in the previous Exynos variant in premium phones) to differentiate itself from competitors. It has invested heavily into proprietary chipsets over several years and in the graphical performance space, Samsung and AMD announced a multi-year strategic partnership to produce mobile, ultra-low powered, high-performance GPUs for Samsung products. This was supposed to open doors to more optimization in the entertainment departments, mainly in mobile games. However, that was in 2019 and two years on we have yet to see significant progress away from the competition in these departments.

Competitors are starting to catch on as well. Other than Huawei's and Motorola's foldables, Oppo's recent "Find N", released exclusively to the Chinese market, has a more mature, and refined introductory design when compared to the first few movers. As time continues to tick, Samsung foldables remain confined within the growing fields they are in, with much potential laying beneath and beyond.