Scaling partner programs for young and emerging vendors

Young and emerging vendors looking to expand their business through channel partners take on a brave and uphill task. They courageously venture into new unchartered territories, embarking on a mission to build a partner program that must generate enough returns on investment to grow with the channel and convince top management to further invest in the channel. Persuading top management is a breeze when they are advocates of a channel-centric model, but far more challenging when they lack an understanding of how the channel works and have a history of relying on direct sales. Established incumbents, over the years, have created what most define as the industry standard in channel engagement and distinguishing from these standards requires a proposition that balances familiarity with being able to shine and adds a dash of brilliance and innovation.

With their lean organizational model, young and emerging vendors have an advantage when it comes to developing close relationships with partners and customers. They tend to have better commercial flexibility, are more responsive to issues, and partner suggestions are more likely to be readily accepted. They are also eager to deliver, and keen to have partners that will vouch for them. A young partner program's strongest advantage often lies in its ability to provide highly personalized support and benefits.

No partner, whether new or existing, is interested in jumping through hoops of fire when working with their vendors. For young and emerging vendors, simplicity becomes even more critical, and should always be front and center of things. They may want to start low-touch partnership models such as affiliates and referrals, and gradually grow commitment with partners from there. The first partners in a program have a special place within a vendor. For their commitment, they get the privilege of having their opinions heard most in building a partner program's foundation.

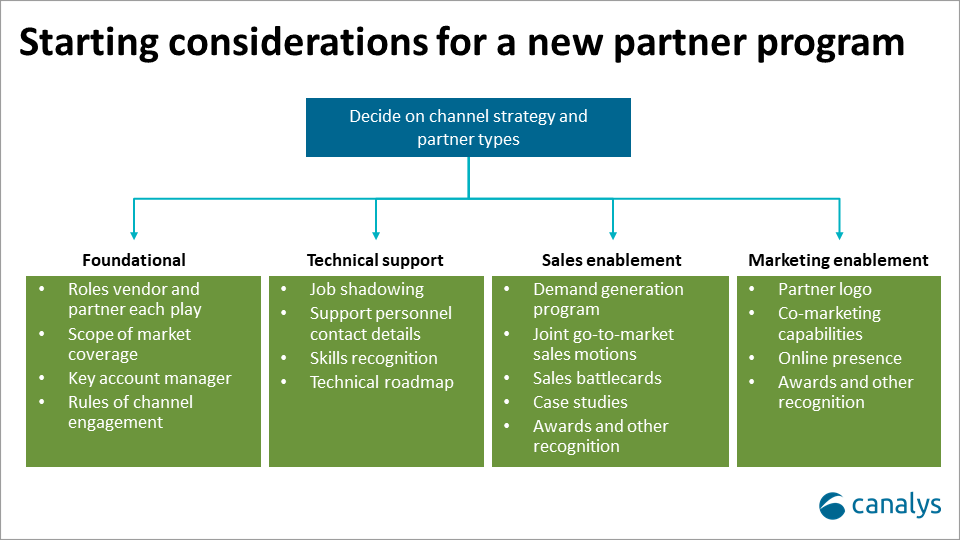

Building relationships with channel partners fundamentally comes down to the following:

Young and emerging vendors should also consider the value of their partner ecosystems to drive customer leads to each other. The more complementary the strengths, the more valuable the partner ecosystem becomes. Complementary strengths could come in the form of vertical-related skills or geographic expansion, where the partners do not directly compete and are happy to work alongside each other. Often, partner account managers will act as the intermediary, making introductions across their ecosystem.

As vendors scale with a greater number of partners, most consider adding tiers to their partner programs. Greater sales support and channel engagement automation also become popular investment priorities given their need to maximize existing resources and returns. Automating the right things allows partner account managers to focus more on expanding business with partners rather than managing the mundane (yet important) things needed to close sales. The addition of a lead generation program will also help ensure partners have a regular sales funnel to engage with, benefiting those partners that may have had an initial spike of activity followed by a dormant period.

When channel conflict happens, there are a few ways of handling it: 1) jointly work with the partner on the customer account, 2) agree on the roles the vendor and partner will play in the deal 3) credit everything to the direct sales or channel partner. Depending on the vendor's channel strategy – whether they hunt and pass 100% of leads to partners or have their direct and channel work in parallel – the strategy can vary. Breakdown in partnerships can happen in a multitude of ways, but inevitably boil down to a handful of factors: lack of communication, lack of understanding of other parties' perspective, lack of agreement on the common goal, lack of role clarity, lack of power to effect necessary changes, and internal pressures to reach quarterly targets.

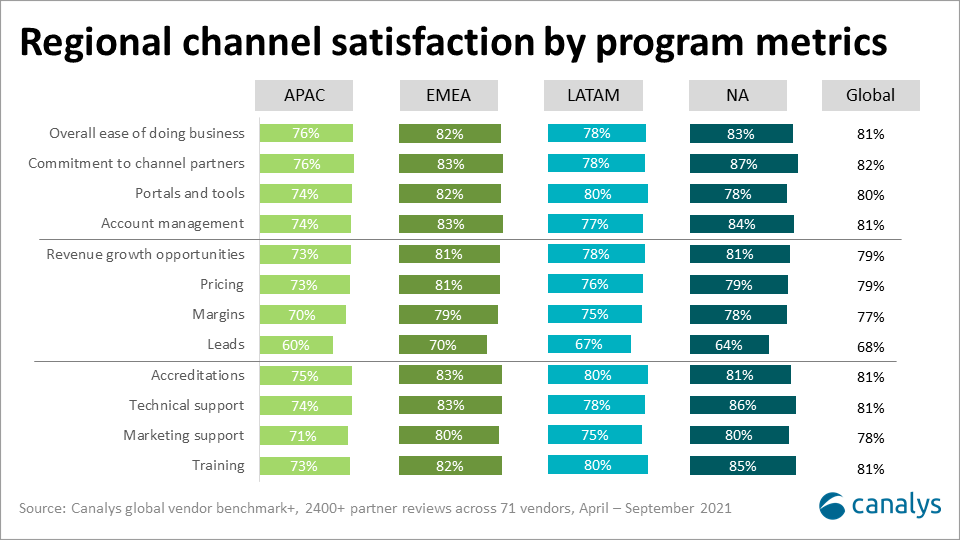

New markets can come in the form of new geographic territories. Vendors must reassess their existing program strategy when entering new markets. For example, SPIFF reward programs tend to work better in Asia Pacific and Latin America, while the Master Agent model is successful in the United States. But both these types of ‘programs’ have limited traction in EMEA. Many partners also prefer to work with marketing agencies that can speak the local language and understand local market dynamics. Partner marketing efforts in Vietnam and Japan, for example, have much higher response rates when delivered in local languages. Regardless of the vendors’ business nature, partners will prefer working with teams that understand them, are readily available for support and can resolve their issues efficiently.

Below are brief summaries on channel differences by geographies:

Leaders of a young and emerging vendor are a very special breed; they work on a blank canvas and deserve respect. With the right personality and aptitude for adventure, these young leaders can succeed. They are versatile in unexpected situations, quick learners, have business acumen and are drivers of sales, and able to dive right into the core of issues. While they need to double as a hands-on leader, they must also step back and have a broad vision in mind. Having prior work experience helps smooth the process, but that sometimes can be a luxury. Partners willing to bet on young vendors may find themselves rewarded at the end of the day.