Global PC market share (inc. tablets) Q2 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 29 July 2021

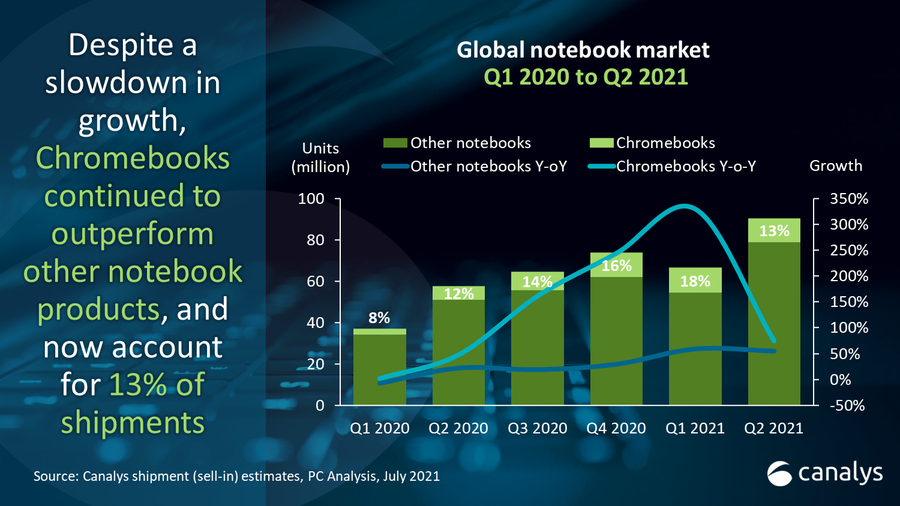

Chromebook growth hits 75% in Q2 2021 worldwide, outperforming other PC market categories

The latest data from Canalys shows the worldwide PC market (including tablets) posted yet another quarter of annual growth, with shipments up 10% to 121.7 million units. Chromebooks continued to outperform the rest of the industry product categories, posting 75% annual growth and a shipment volume of 11.9 million units. Tablet shipment growth has begun to stabilize, with an increase in Q2 of just 4% year-on-year to 39.1 million units.

Chromebook vendors have doubled down on investments in the product category and most have continued to see strong returns in terms of growth. HP maintained pole position with shipments of 4.3 million units and growth of 116% in Q2. Lenovo took second place with 2.6 million units shipped increasing shipments by 82% from a year ago. Acer secured a top-three position with growth of 83.0% propelling it above 1.8 million units in shipments. Dell and Samsung made up the remainder of the top five, with the former being the only leading vendor to suffer a shipment decline.

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2021 |

Q2 2021 |

Q2 2020 |

Q2 2020 |

Annual |

|

HP |

4,320 |

36.4% |

2,003 |

29.5% |

115.7% |

|

Lenovo |

2,560 |

21.6% |

1,410 |

20.8% |

81.5% |

|

Acer |

1,861 |

15.7% |

1,017 |

15.0% |

83.0% |

|

Dell |

1,112 |

9.4% |

1,217 |

17.9% |

-8.7% |

|

Samsung |

1,093 |

9.2% |

257 |

6.3% |

324.4% |

|

Others |

914 |

7.7% |

883 |

13.0% |

3.6% |

|

Total |

11,859 |

100.0% |

6,787 |

100.0% |

74.7% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), July 2021 |

|||||

“The success of Chromebooks is proving to be remarkably resilient,” said Brian Lynch, Research Analyst at Canalys. “Their growth streak has extended well beyond the height of the pandemic as they have cemented a healthy position across all end-user segments in the industry. Even as key markets like North America and Western Europe have seen schools begin to open up, shipments remain elevated as governments and education ecosystems plan for long-term integration of Chromebooks within digital learning processes. With Chrome’s hold over the education space relatively secure, Google is set to bet big on the commercial segment this year. We expect to see a strong focus on attracting small businesses with updated services, such as the new ‘Individual’ subscription tier for Google Workspace and promotions on CloudReady licenses to repurpose old PCs for deployment alongside existing Chromebook fleets. However, with Apple eyeing to expand its M1 success into the commercial space and Microsoft launching Windows 11 later this year, the PC OS race is set to be the most hotly contested it has been in a long time.”

In the tablet space, Q2 brought mixed fortunes in terms of growth, but all vendors continued to enjoy elevated shipment levels compared to pre-pandemic times. Apple maintained its leadership position in the rankings with 14.2 million iPads shipped for a relatively flat performance. Samsung was a big winner in terms of market share growth as it increased shipments 13.8% to post 8 million units shipped. Lenovo enjoyed the highest growth out of the top five at 78%, shipping 4.7 million units. Amazon and Huawei made up the remainder of the leaders.

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2021 |

Q2 2021 |

Q2 2020 |

Q2 2020 |

Annual |

|

Apple |

14,185 |

36.3% |

14,249 |

38.0% |

-0.5% |

|

Samsung |

7,996 |

20.5% |

7,024 |

18.7% |

13.8% |

|

Lenovo |

4,688 |

12.0% |

2,642 |

7.0% |

77.5% |

|

Amazon |

3,118 |

8.0% |

3,164 |

8.4% |

-1.5% |

|

Huawei |

2,305 |

5.9% |

5,006 |

13.4% |

-54.0% |

|

Others |

6,791 |

17.4% |

5,393 |

14.4% |

25.9% |

|

Total |

39,081 |

100.0% |

37,479 |

100.0% |

4.3% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), July 2021 |

|||||

“The tablet market has truly put to rest all predictions of a slow demise,” said Canalys Research Analyst Himani Mukka. “We have now seen a fifth consecutive quarter of year-on-year growth and the industry has many reasons to be optimistic for the future. Even as consumer demand for tablets undergoes an inevitable slowdown in the coming quarters, there are exciting developments to be seen in commercial deployments. Canalys expects to see stronger integration between the tablet and PC, allowing for smoother workflow transitions between multiple devices, which is especially attractive to those operating under hybrid and on-the-go workstyles. This will certainly be the case for iPads and Macs, but the introduction of Windows 11 on cloud, and its usage on devices that can run Android bodes well for tablet vendors, users and developers beyond the Apple ecosystem.”

In the total PC market (including desktops, notebooks and tablets), Lenovo reigned supreme once again, with remarkable growth of 23% propelling it to 24.7 million units shipped. Apple remained in second place with modest growth of 5% for total shipments of 20.6 million units. HP saw the lowest growth out of the top vendors, with shipments of 18.6 million units, up just 2.7% from a year ago. Dell and Samsung made up the remainder of an unchanged top five from Q1.

|

Worldwide PC (including tablet) shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2021 |

Q2 2021 |

Q2 2020 |

Q2 2020 |

Annual |

|

Lenovo |

24,676 |

19.7% |

20,075 |

18.1% |

22.9% |

|

Apple |

20,597 |

18.1% |

19,600 |

16.7% |

5.1% |

|

HP |

18,618 |

15.8% |

18,136 |

14.7% |

2.7% |

|

Dell |

14,034 |

10.7% |

12,067 |

13.2% |

16.3% |

|

Samsung |

9,638 |

8.% |

7,628 |

6.8% |

26.4% |

|

Others |

34,127 |

27.8% |

32,955 |

30.5% |

3.6% |

|

Total |

121,689 |

100.0% |

110,461 |

100.0% |

10.2% |

|

Note: percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), July 2021 |

|||||

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

For more information, please contact:

Canalys Singapore

Himani Mukka: himani_mukka@canalys.com +65 8223 4730

Canalys USA

Brian Lynch: brian_lynch@canalys.com +1 503 927 5489

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.