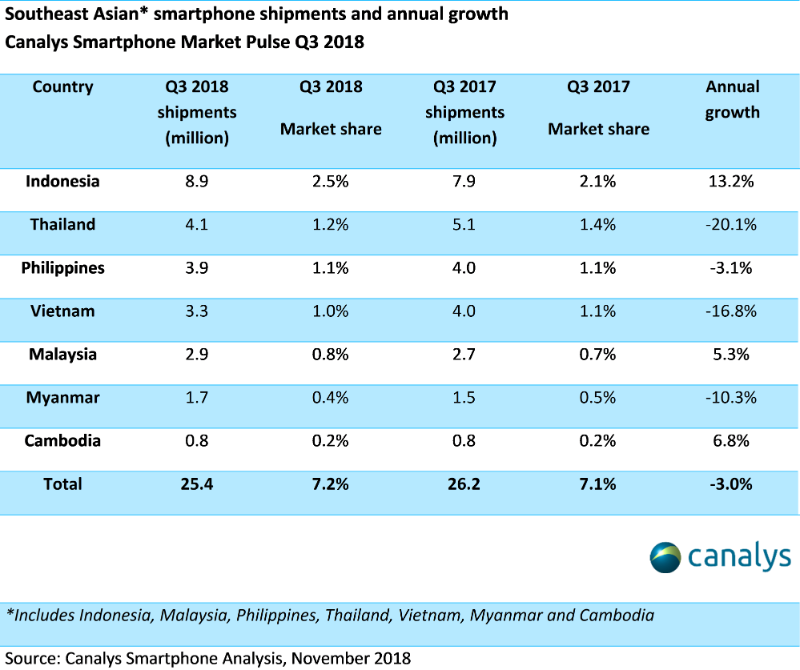

Surprising 3.0% fall for Southeast Asian smartphone market in Q3 2018

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, November 15 2018

Smartphone shipments to Southeast Asia (excluding Laos, Brunei and Timor-Leste) fell by 3.0% year on year, a surprising drop for the most important market in Asia, outside of India and China. Three of the region’s five largest markets suffered falls this quarter, as the industry faced strong headwinds and as local economies grappled with the effects of the Sino-US trade war. Vietnam and Thailand plunged 17% and 20% respectively, while Philippines dropped by 3.1%. Malaysia grew 5.3% to return closer to pre-2016 levels, while Indonesia had the biggest increase, at 13.2%, largely due to the growth of official channels and wider availability of TKDN-compliant devices. Samsung was the top vendor, shipping 5.8 million units, with Oppo second, on 4.8 million units.

“It is too early to write off Southeast Asia,” said Canalys Analyst TuanAnh Nguyen. “The rise of the Chinese vendors has set off a wave of consolidation. Multiple local and international vendors have left the market, while vendors such as Samsung have seen their shipments plummet. The temporary correction has caused a one-off decline overall, distracting from the true potential of the region. The booming population and low penetration beyond the metro cities presents a prime opportunity for smartphone vendors to continue investing in these markets.” The region accounts for nearly 8.5% of the world’s population but less than 7.5% of the smartphone market. “While 2018 is expected to end on a positive note, vendors will need to contend with a strengthening dollar and its impact on device prices. Various encouraging factors mean a bright outlook for the Southeast Asian smartphone market. Governmental digital economy initiatives, such as Thailand 4.0, Indonesia’s Palapa Ring and Vietnam’s Industry 4.0 vision, will create strong catalysts for short-term growth.”

“Oppo’s performance was most notable, as it was the only vendor that appeared in the top three in all five of the largest markets,” said Research Analyst Jin Shengtao. Its best performance was in Philippines, where it overtook local king Cherry Mobile to lead for the first time with a market share of 20%. Samsung, on the other hand, is facing massive difficulties in maintaining its leadership in the region, which has been among its brightest spots worldwide for the last two years. The global leader failed to grow in all seven markets in Q3 and suffered double-digit declines in Thailand, Philippines and Malaysia. It even failed to reach the 1 million mark in Thailand, declining 44% year on year. “Samsung is fighting hard to remain relevant,” added Jin. “It has released new devices with competitive specifications and is revamping its go-to-market strategy, giving due importance to online retailers, bringing the fight back to the Chinese vendors. This will only ensure further growth in Southeast Asia, where Oppo, Vivo, Xiaomi, Huawei/Honor and Samsung will continue to invest heavily in the years to come.”

Smartphone quarterly estimate and forecast data is taken from Canalys’ Smartphone Analysis service.

For more information, please contact:

Canalys APAC (Shanghai): +86 21 2225 2888

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Canalys APAC (Singapore): +65 6671 9399

TuanAnh Nguyen: tuananh_nguyen@canalys.com +65 6671 9384

Shengtao Jin: shengtao_jin@canalys.com +65 6657 9303

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Copyright © Canalys 2018. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com