Canalys: New energy vehicle sales in the US fall 18% as the total car market stays flat in Q3 2019

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 11 November 2019

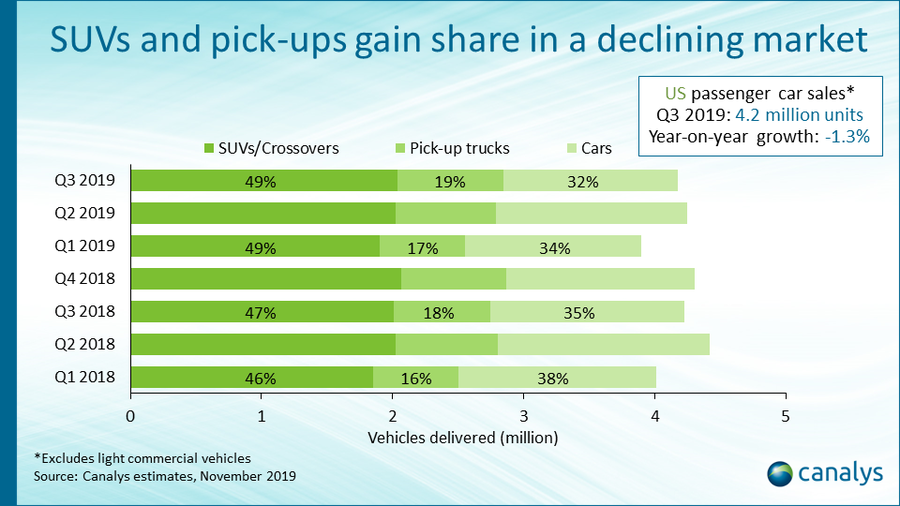

According to the latest research from Canalys, 4.2 million passenger cars were delivered to customers in the US in Q3 2019, a slight year-on-year decrease of 1.3%. During the first three quarters of 2019, deliveries were down 2.7% compared with the same period in 2018. New energy vehicles declined by 18.0%.

Canalys tracks the sales performance of the entire car market. This includes over 300 vehicle models from 40 car brands. As Chief Analyst for automotive at Canalys, Chris Jones explains, “Despite a strong economy and low unemployment, overall demand for new cars continues to be weak in the US. There are too many brands and too many models for a declining passenger car market. Car-makers must reset their market opportunity expectations and streamline and refresh their vehicle line-ups, retiring unprofitable models.”

“Urbanization continues as more young people move to cities for employment. On-demand urban mobility solutions, such as ride hailing, and car, bike and scooter sharing, offer many affordable, flexible ways to get around cities without the expense of owning an under-utilized car,” said Jones.

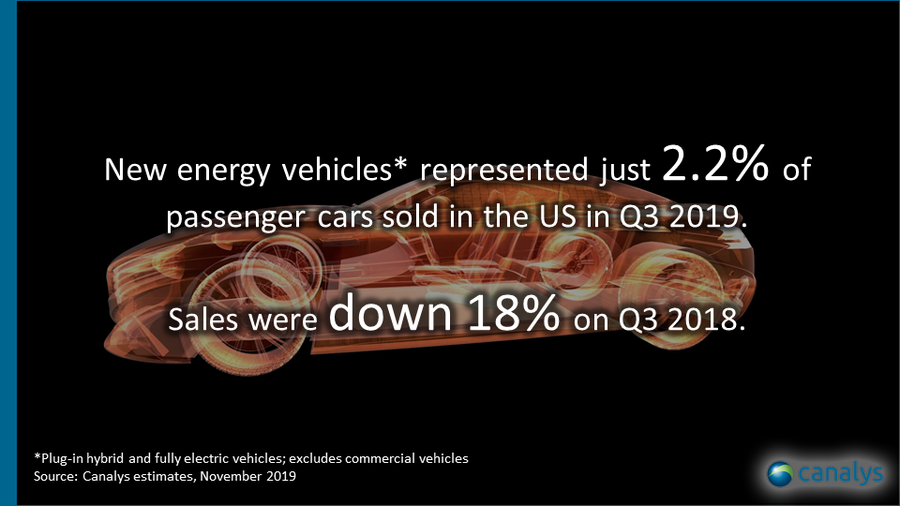

The big disappointment is the continued low sales of new energy vehicles (NEVs) in the US. Only 90,000 NEVs (plug-in hybrid, full electric and fuel cell vehicles) were delivered in Q3 2019, down 18% from Q3 2018, according to Canalys estimates. NEVs represented just 2.2% of total passenger car deliveries in the US in Q3 2019. In comparison, sales of non-commercial small and medium-sized pick-up trucks, SUVs and crossovers all grew in Q3 2019, while sales of other passenger cars declined by 10% compared with last year.

Tesla sold more NEVs than all the competition combined, to command a market share of 60%, but even its sales were down more than 20% year on year.

“There is a severe lack of vehicle choice when it comes to NEVs in the US. Deliveries of the market-leading Tesla Model 3 have peaked, but there is nothing new from the competition to challenge it. This needs to change in order to grow the EV charging network, spur demand for zero emission vehicles and, as a result, improve air quality in US cities,” said Jones.

Each quarter Canalys produces a comprehensive intelligent vehicle sales database showing the advanced driver assistance, connectivity, convenience and safety features in new cars.

For more information, please contact:

Canalys China

Johnny Xie: johnny_xie@canalys.com +86 159 2128 2961

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Canalys Singapore

Jermaine Tan: jermaine_tan@canalys.com +65 9798 6301

Canalys UK

Sandy Fitzpatrick: sandy_fitzpatrick@canalys.com +44 7887 725868

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

China: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China

India: 43 Residency Road, Bengaluru, Karnataka 560025, India

Singapore: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535

UK: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK

USA: 319 SW Washington #1175, Portland, OR 97204 USA

email: contact@canalys.com | web: www.canalys.com