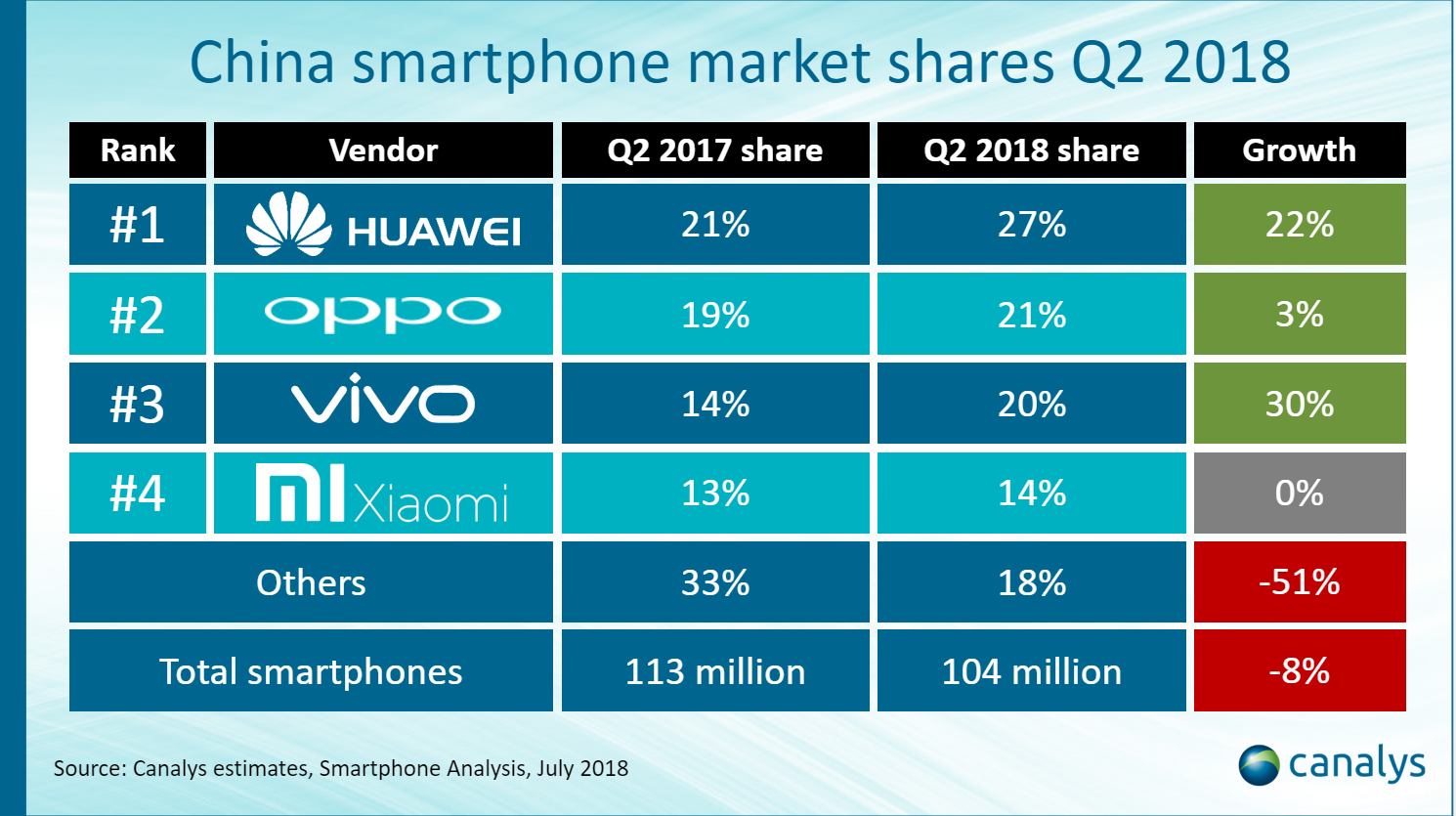

Huawei breaks record for biggest ever share in China with 27% of smartphone market in Q2

Palo Alto, Shanghai, Singapore and Reading (UK) – Wednesday, 25 July 2018

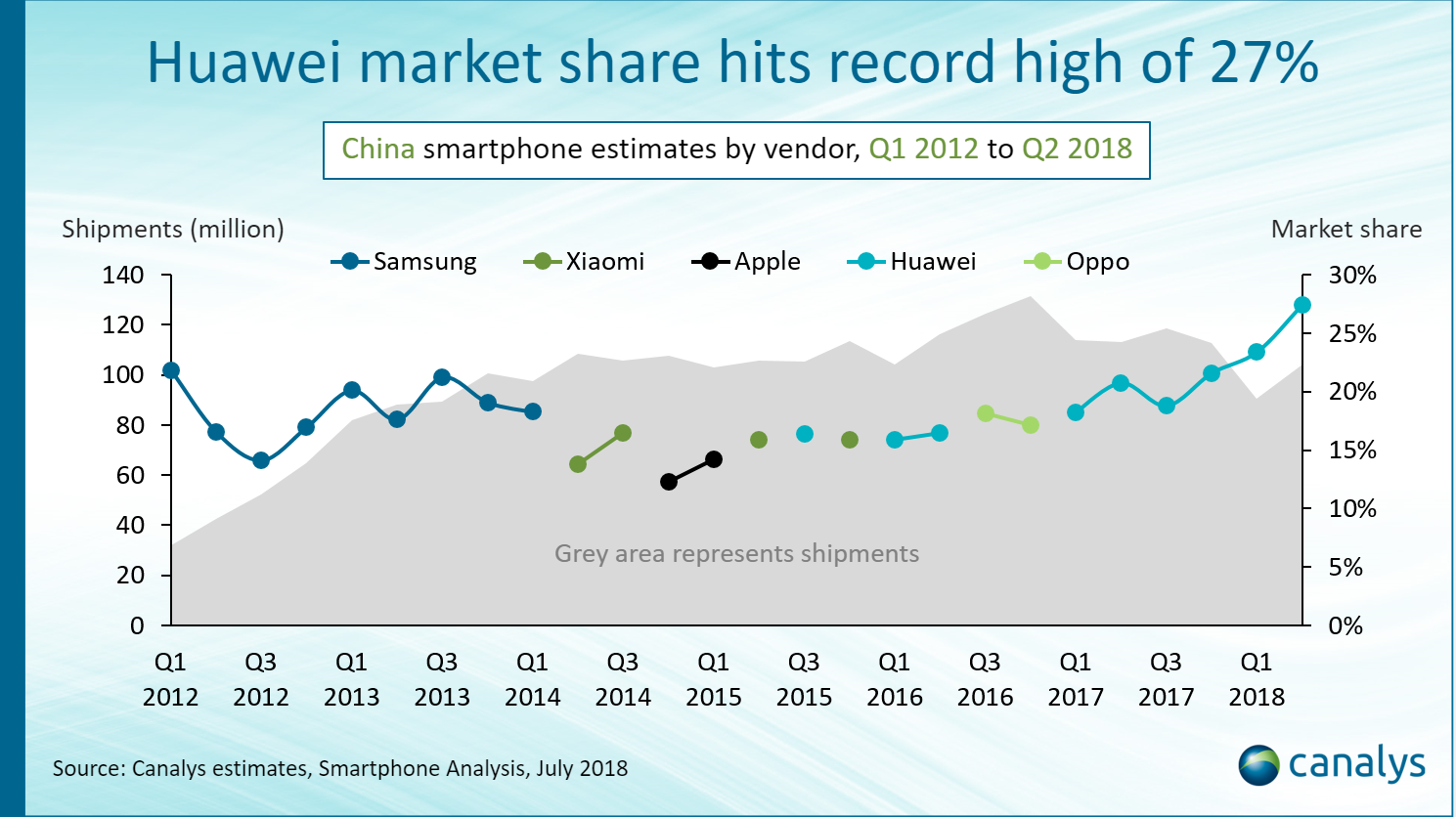

Smartphone shipments in China bounced back to above 100 million in Q2 2018, providing much needed relief to vendors and channel partners after a difficult Q1, when shipments fell by more than 20% to 91 million units. Huawei (including Honor) grew its market share to a record 27%, the biggest share for any smartphone vendor in China since Q2 2011. Huawei also broke the record for the greatest number of shipments into the channel by any vendor, at 28.5 million units. Oppo and Vivo came second and third respectively, with the latter growing by 30% to close the gap on Oppo. Xiaomi’s and Apple’s market shares fell, but they held onto their respective fourth and fifth places. The smaller vendors are finding it tough to compete, as the top five vendors now account for 90% of shipments, against 73% a year ago.

Huawei’s Honor sub-brand accounted for 55% of its shipments in Q2 2018, up from 33% a year ago. “Honor is now the largest smartphone brand in the Huawei Consumer Business Group,” said Canalys Analyst Mo Jia. “Enjoying a high level of autonomy within Huawei, Honor has been pushing to make a name for itself in the market. It has expanded successfully into the US$500+ segment with its latest flagship models and continues to erode the market share of its direct competitors in the low-cost segment, such as Xiaomi. But Honor’s independent operation and increasing strength will pose a dilemma for the other Huawei sub-brands, Mate, P and Nova, which risk losing resources to Honor in the common goal to meet Huawei’s global target of 200 million smartphone sold in 2018.” Huawei’s self-branded smartphones accounted for 45% of total sell-in to China, with about half of those being Nova models.

The Chinese market has shown signs of improvement as the rate of decline eased from 22% in Q1 2018 to 8% this quarter. But the situation is not likely to improve soon. “The market is expected to decline in the following quarters as well, mainly owing to harsh declines in shipments from smaller vendors that are unable to sustain volumes and are therefore finding it difficult to justify further investment in the market,” added Jia. “At the same time, the larger vendors face a high degree of uncertainty over the current trade situation with the US, which is adversely affecting the Chinese Yuan. Increasing prices and maintaining market share in the face of a stronger US dollar might be easy for a brand such as Huawei, but will be difficult for Xiaomi, Oppo and Vivo.”

Smartphone quarterly estimate and forecast data is taken from Canalys’ Smartphone Analysis service.

For more information, please contact:

Canalys APAC (Shanghai): +86 21 2225 2888

Mo Jia: mo_jia@canalys.com +86 21 2225 2812

Hattie He: hattie_he@canalys.com +86 21 2225 2814

Canalys APAC (Singapore): +65 6671 9399

Rushabh Doshi: rushabh_doshi@canalys.com +65 6671 9387

TuanAnh Nguyen: tuananh_nguyen@canalys.com +65 6671 9384

Canalys EMEA: +44 118 984 0520

Ben Stanton: ben_stanton@canalys.com +44 118 984 0525

Canalys Americas: +1 650 681 4488

Vincent Thielke: vincent_thielke@canalys.com +1 650 656 9016

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).