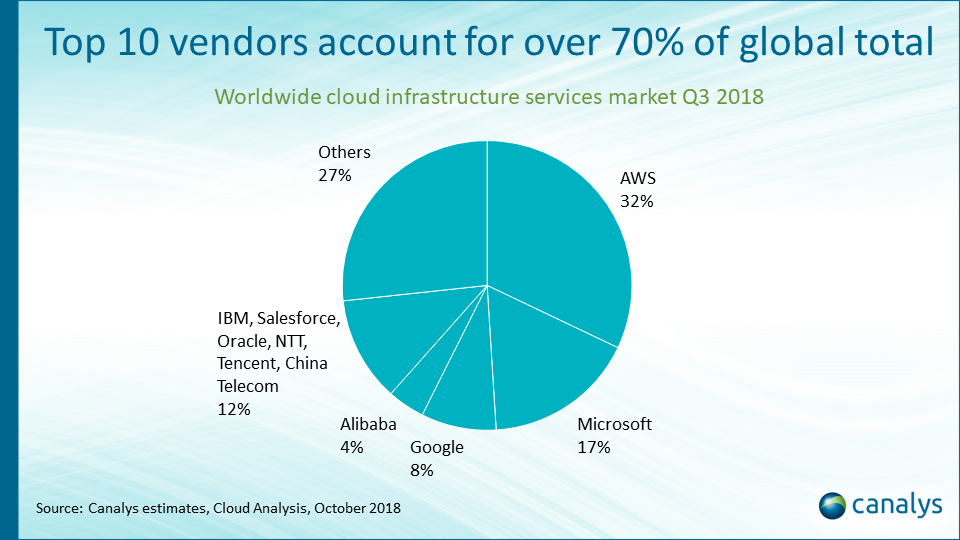

Cloud infrastructure spend climbs 46% in Q3 2018 as US-China competition intensifies

Palo Alto, Shanghai, Singapore and Reading (UK) – Friday, October 26 2018

The worldwide cloud infrastructure services market grew 46% to US$21 billion in the third quarter of 2018. US-based companies represented six of the top 10 providers, with Amazon Web Services (AWS) remaining the largest. It grew 45% during the quarter to account for 32% of total spend. This is still more than Microsoft Azure (17%) and Google Cloud (8%) combined, though the gap is closing as customers opt for multi-cloud environments. Alibaba Cloud, China’s highest ranked provider, was the fourth largest, growing more than 80% to account for 4%.

Competition between US- and China-based cloud infrastructure service providers is intensifying amid escalating trade tensions between the two countries. Tariffs on US imports into China are being used to ensure bilateral engagements take place and pressure China to agree to the United States’ demands. These include opening Chinese markets to US companies, and to removing requirements for IP and technology transfer. The United States Trade Representative highlighted the cloud computing sector as a case in point in the findings of its investigation into China earlier in March. The report stated that US cloud providers were forced to sell data center assets to local Chinese partners under the China Telecommunications Regulation to continue operating in the country.

“US- and China-based cloud infrastructure service providers currently dominate their respective domestic markets, which is unlikely to change anytime soon in the current political climate,” said Canalys Research Analyst Daniel Liu. “But competition between the two groups of providers is growing in other regions, including parts of Europe, the Middle East, Africa and ASEAN, as they expand their data center regional footprints.”

The Nordics is a new battleground, with data center regions being built in Sweden by AWS and in Norway by Microsoft Azure. Alibaba Cloud announced its second region in Europe, with data centers in London, as well as a greater presence in France and Sweden. New regions are being built in Bahrain and the UAE by AWS and Microsoft to compete with Alibaba, which opened in Dubai in 2016. Huawei Cloud plans to enter South Africa, where Microsoft is currently growing its presence. Competition in the ASEAN region is also increasing, with Huawei Cloud launching in Thailand, and Google Cloud entering Indonesia following Alibaba Cloud’s move earlier in the year.

“The expansion of US- and China-based cloud infrastructure service providers is part of a wider technology arms race between the two countries, as part of efforts to increase their economic and political influence,” Liu added. “In addition to building the largest and most scalable cloud platforms, both countries are competing to be the first to roll out 5G networks and build exascale supercomputers. The winner is likely to have the best artificial intelligence, cyber-security and military technologies.”

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Matthew Ball: matthew_ball@canalys.com +44 118 984 0535

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +86 21 2225 2817

Canalys APAC (Singapore): +65 6671 9399

Jordan Mari De Leon: jordan_mari_deleon@canalys.com +65 6671 9397

Canalys Americas: +1 650 681 4488

Alex Smith: alex_smith@canalys.com +1 650 681 4486

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please complete the contact form on our web site.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Copyright © Canalys 2018. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com